Fixed for 2026. I initially wrote this calculator in 2007. Hey, at least you know it wasn’t AI! Some of you may be wondering how well your specific portfolio performed last year (or over any specific period of time). Let’s say you started the year with $10,000 and put in another $5,000 through 10 different deposits spaced throughout the year, and ended up with $16,000. What was your rate of return? Your main goal is simply to separate the effect of new deposits (or withdrawals) and your actual return from investments.

Figuring out your exact personal rate of return requires you to know the exact dates of all your deposits and withdrawals, along with a financial calculator or spreadsheet program with an IRR function (example here). However, for a quick and simple estimate of your returns, try this calculator instead:

Instructions

- Get your initial balance. This is probably from your brokerage statements. Try January of last year.

- Tally up any deposits or withdrawals. For example, let’s say you know you put $3,000 in your Roth IRA and also 5% of your $40,000 salary into a 401(k). That would be $3,000 + $2,000 = $5,000. That’s it, you don’t need to worry about looking up the specific dates and amounts.

- Get your final balance. Your December statement is probably available already.

- Find the time elapsed (in years) between your initial and final balances.

- Hit Calculate. An estimate of your annualized return is instantly given.

How Accurate Is This Estimate?

The calculator assumes that the inflows and outflows are spread evenly around the middle of the year. I originally saw this method in the book The Four Pillars of Investing (review). However, unless the deposits and withdrawals are very large as compared to the initial balance, the estimates are actually pretty good.

For example, let’s say that you start with $100,000 on 1/1/2025, and end up with $120,000 on 1/1/2026. If you had net deposits of $10,000 during the year, the calculator above would estimate your return at 9.52%. If the $10,000 was actually deposited all at once on one of these specific days, you would get the following exact returns:

| Deposit Date | Exact Return |

| 1/1/2025 (very first day) | 9.1% |

| 6/04/2025 (middle of the year) | 9.5% |

| 1/1/2026 (very last day) | 10% |

| Estimate | 9.5% |

Also check out the rest of my Tools and Calculators.

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

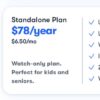

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)