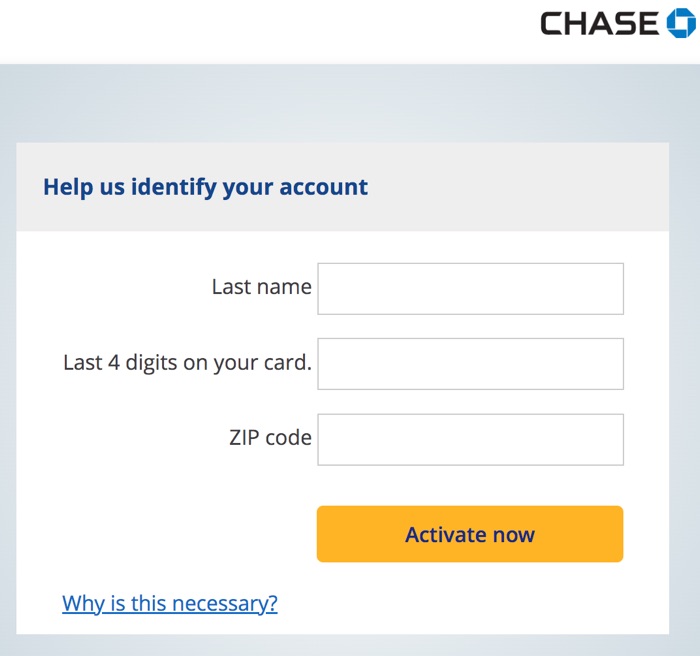

New quarter, new offers. A quick 2026 Q1 reminder that you can discover targeted offers for your Chase-issued credit card at Chase.com/mybonus. This includes both their in-house cards like Sapphire or Freedom Flex and their co-branded cards like United, IHG, Hyatt, Southwest, Amazon, etc. For some reason, these are often offers that they don’t tell you about otherwise by email or snail mail.

You might get 5X points or 5% cash back on up to $1,000 spent on Gas Stations, Groceries, and Restaurants:

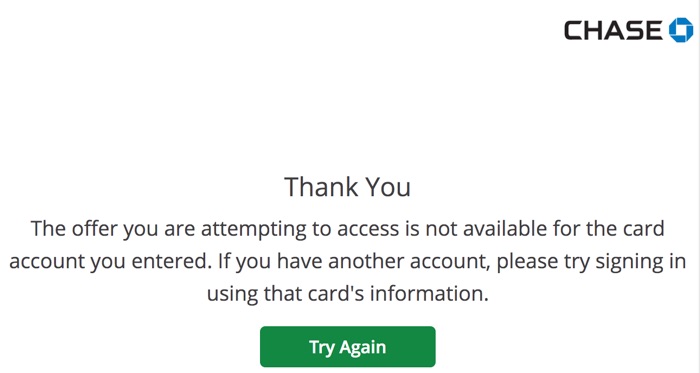

You may also simply get a message that your card can’t be found or that you weren’t targeted:

The updated

The updated

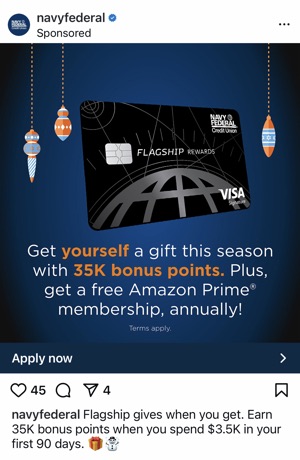

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

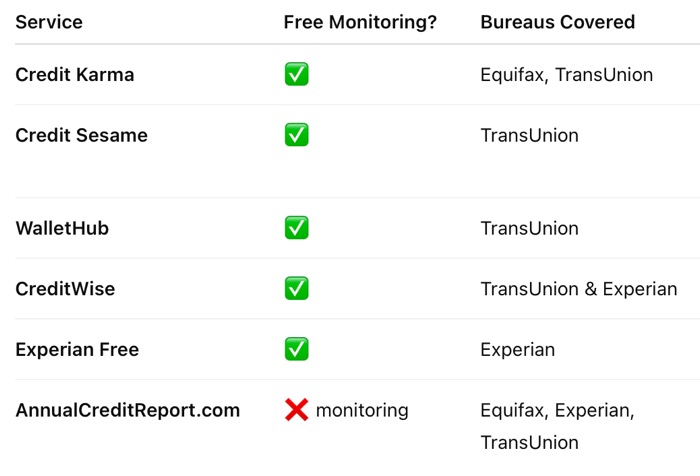

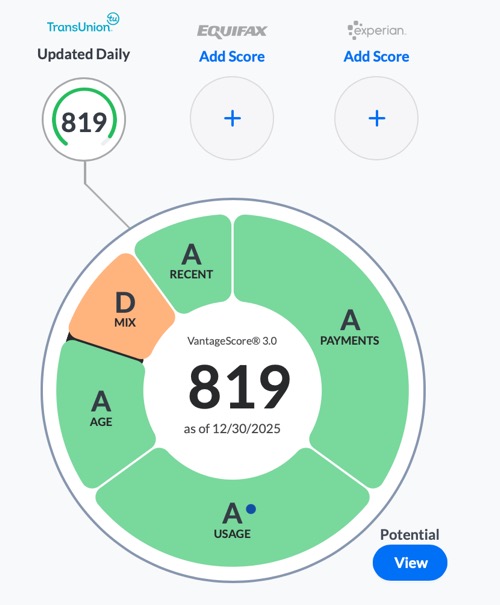

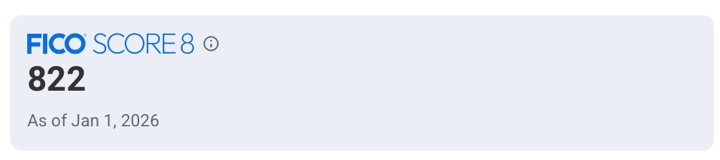

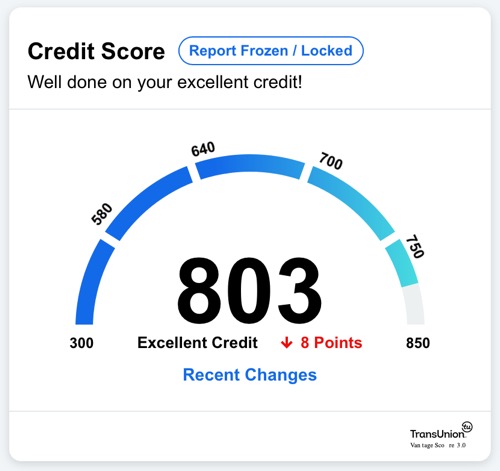

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)