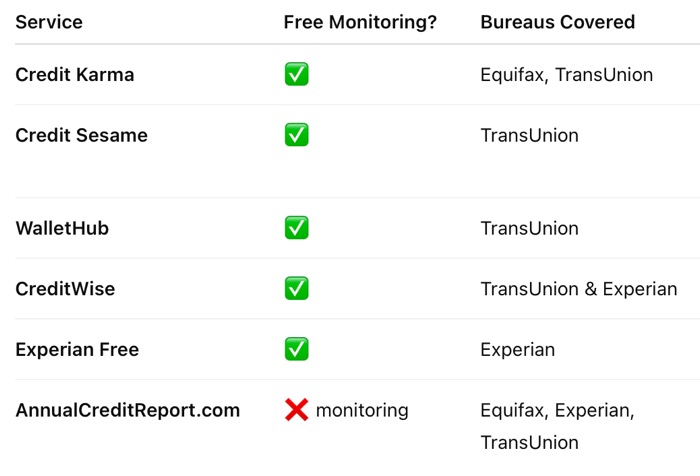

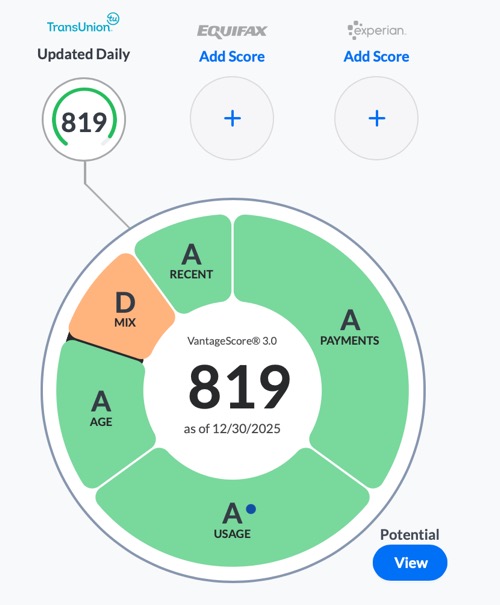

Updated. Happy New Year! 🎉 🥳 In terms of keeping my finances in order, what I’ve been finding most useful recently are credit monitoring alerts. The last time I applied for a credit card, I received multiple e-mails within minutes alerting me that someone had checked my credit report. I’m also told if a new account is added. This makes me feel more comfortable knowing that I’ll be alerted quickly if someone does try to steal my identity. The following third-party services listed below provide you a free credit score (of various algorithms) and/or free continuous credit monitoring from select credit bureaus.

- Free credit score (VantageScore 3.0) from both Transunion and Equifax.

- Free credit monitoring from both Transunion and Equifax. Via e-mail alerts or app notification. Will let you know about things like a new credit check or a new account added.

- Limited identity theft monitoring. Credit Karma uses your email address to search and notify you if they are listed in public data breaches.

- Free credit score (VantageScore 3.0) from Transunion. Daily credit score updates and weekly credit report profile updates.

- Free credit monitoring from Transunion. Via e-mail alert. Will let you know about things like a new credit check or a new account added.

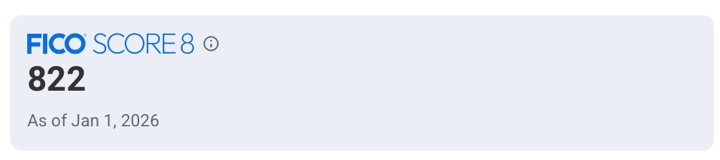

- Free credit score (FICO 8) from Experian. Daily credit score updates and daily credit report profile, refreshed upon login.

- Free credit monitoring from Experian. Free e-mail alerts.

- Warning that Experian will regularly try to upsell you to a paid membership tier. Simply click “No, keep my membership” to stay on the free tier. I’ve been on it for years.

- Improve your credit score by adding utility payments. Experian Boost is a free option that can potentially improve your Experian-based credit score by adding on-time utility and phone bill payments.

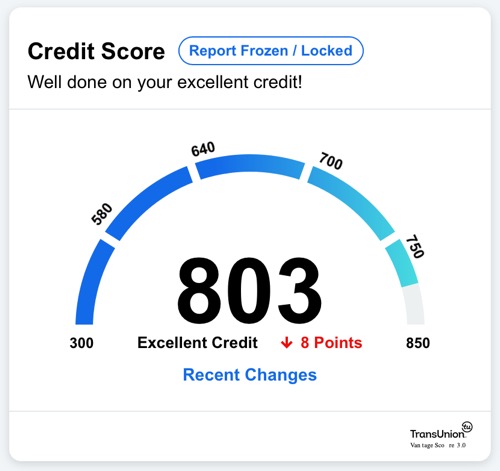

- Free credit score (VantageScore 3.0) from Transunion. Daily credit score updates and free daily full credit reports.

- Free credit monitoring from Transunion. Via e-mail alert. Will let you know about things like a new credit check or a new account added.

- Free credit score (FICO 8) from Transunion. You do not need to be a Capital One customer to sign up.

- Free credit monitoring from both Transunion and Experian.

None of the services above require a trial or credit card number to sign up for their free tiers. They may ask for the last 4 digits of your SSN for verification. These are all ad-supported (they will pitch you stuff) and usually have a paid upgrade option (but you can stay on the free tier forever).

The government requires the credit bureaus to provide you a free credit report at least once every 12 months (now actually weekly since the pandemic). However, the site will not provide you credit scores or pro-active alerts if anything changes on those reports.

Note that some of the scores above are not FICO scores because Fair Isaac might charge more money in licensing fees. If you really want a FICO number, nearly every major credit card issuer now includes a monthly FICO score with their cards: Chase, Citi, Bank of America, Discover, Barclaycard, and American Express.

Bottom line. Used in combination, I use the services above to keep track of changes to my credit reports across all three credit bureaus for free. None of them require my credit card number, and they quickly alert me to things like new accounts, new credit check inquiries, and high credit line usage. I just ignore the generic ads and upsells.

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)

From what I can tell Credit Sesame upped their free identity theft insurance coverage to $1M. Given that I get bombarded with emails from all sorts of companies (eh hem, Discover) trying to sell me identity theft monitoring and insurance this doesn’t seem like a completely trivial benefit to opt yourself in to.

A lot of people aren’t aware that there are different versions of FICO scores depending on what you’re trying to do. Scores from mortgage lenders can differ a lot from scores from auto lenders, for example. And these free services don’t even offer FICO scores (except Experian, which only gives you FICO 8). I still use Credit Karma, but the more I compare it against my actual FICO scores the less faith I have in it. Some of my FICO scores are currently 50-60 points off from the Vantage score that Credit Karma uses. I hate paying for things, but I’ve finally started just paying for my FICO score when I need one.

I’ve got all of the above plus the free services from Discover, Mastercard ID Protection Online, and Capital One Credit Wise. I’ve also got Aura Identity Guard which I seem to get perpetual free renewals because of ongoing data breaches.

Aura seems to be the best and notifies me every time there is a soft pull, hard pull or even a background check, etc. Mastercard is a close second and Capital One a close third. Between the seven free service I typically get 2-3 notifications as well as Aura. I don’t think there has been a time where I’ve only gotten the Aura notification and none of the others.

Jonathan, do you still freeze your credit? It was on my to-do list for the new year but seeing this post made me wonder if even necessary with all the free monitoring available.

That’s a good question. To be honest, I do prefer to keep my reports frozen, but sometimes I forget to unfreeze them and it’s a hassle when opening a new account, and sometimes I forget to freeze them again when I unfreeze a specific one. I usually set them to thaw for only a week. But having credit monitoring is an added layer of protection if I forget, and it still tells me useful things like exceeding a certain percentage of credit limit, when an inquiry is going to fall off my report for being too old, etc.