Nothing like a 10% yield with no principal risk to attract more attention to a quiet little investment option. The WSJ has a new article What Are I Bonds? Everything You Need to Know to Earn Nearly 10% Interest as a follow-up to The Safe Investment That Will Soon Yield Almost 10% (paywall?). No groundbreaking discoveries, but you might find something useful as they are admittedly more complicated than a traditional bank savings account. Here’s an interesting stat of how TreasuryDirect is selling several billions of dollars more than in previous years:

Nothing like a 10% yield with no principal risk to attract more attention to a quiet little investment option. The WSJ has a new article What Are I Bonds? Everything You Need to Know to Earn Nearly 10% Interest as a follow-up to The Safe Investment That Will Soon Yield Almost 10% (paywall?). No groundbreaking discoveries, but you might find something useful as they are admittedly more complicated than a traditional bank savings account. Here’s an interesting stat of how TreasuryDirect is selling several billions of dollars more than in previous years:

Americans snatched up nearly $11 billion in I Bonds, which are inflation-adjusted U.S. savings bonds, over the past six months, compared with around $1.2 billion during the same period in 2020 and 2021, according to Treasury Department records. That figure will likely rise even higher on an expected jump in rates next month.

Another common question is to buy this week in April or wait until May. Here is another perspective:

I Bonds will be subject to at least one rate change in a 12-month period. Elliot Pepper, a financial planner in Baltimore, doesn’t know what the next rate after 9.6% will be. So, he’ll try to mitigate the risk that it will be lower than 7.12% by taking half of his annual limit and “locking in” the combined 7.12% and 9.6% and then buying the remaining $5,000 in late October, when he has more visibility about the next rate.

If the rate then is lower than 7.12%, Mr. Pepper said he would have been better off investing his $10,000 maximum before May. If the rate is higher than 7.12%, he would have been better off buying the bonds after May, he said.

My view remains that historically, a 7.12% inflation rate is much higher than average. So if you take a step back, your options are:

7.12% for 6 months + 9.62% for 6 months + ??? for 6 months

Or:

9.62% for 6 months + ??? for 6 months + ???? for 6 months

I’d rather lock in the 7.12% over an unknown number. However, if the new rate in October does end up being even higher, I will still eventually get that future ??? rate as a long-term holder of I bonds (it’ll just be shifted six months later). Finally, you get to start earning the interest a month earlier if bought in April. As I had the cash available in other low-interest vehicles, I saw no reason to wait. I’ve already maxed out for 2022 and 2021 (and 2020 and 2019…)

There are many apps in the “reloadable debit card for kids” category, where parents can transfer money into their account and kids can spend it. However, I have been looking for a better app that can illustrate the power of compound interest and deferred gratification.

There are many apps in the “reloadable debit card for kids” category, where parents can transfer money into their account and kids can spend it. However, I have been looking for a better app that can illustrate the power of compound interest and deferred gratification.

Wells Fargo has a $1,500 bonus offer if you open a new business checking account in a physical branch with a

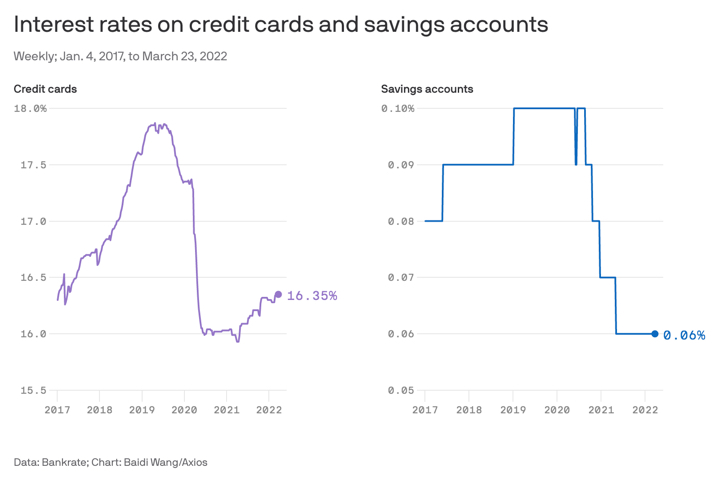

Wells Fargo has a $1,500 bonus offer if you open a new business checking account in a physical branch with a  Here’s my monthly roundup of the best interest rates on cash as of April 2022, roughly sorted from shortest to longest maturities (useful for both cash reserves and as possible bond substitutes). I look for lesser-known opportunities available to individuals while still maintaining FDIC insurance or equivalent. Check out my

Here’s my monthly roundup of the best interest rates on cash as of April 2022, roughly sorted from shortest to longest maturities (useful for both cash reserves and as possible bond substitutes). I look for lesser-known opportunities available to individuals while still maintaining FDIC insurance or equivalent. Check out my

Many online banking, stock trading, crypto, and fintech apps use the Plaid service to provide easy funding via your existing bank accounts. The price of this convenience is that you are providing some very sensitive data to a small, private company. They have your bank login information and can see all your transaction data. (Visa was in an agreement to acquire Plaid for over $5 billion, but it was cancelled to due

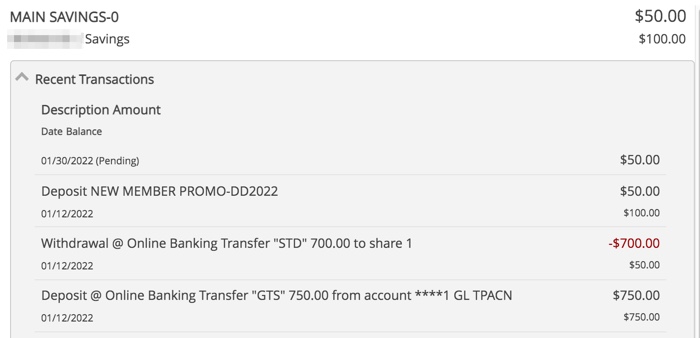

Many online banking, stock trading, crypto, and fintech apps use the Plaid service to provide easy funding via your existing bank accounts. The price of this convenience is that you are providing some very sensitive data to a small, private company. They have your bank login information and can see all your transaction data. (Visa was in an agreement to acquire Plaid for over $5 billion, but it was cancelled to due  Lafayette Federal Credit Union (LFCU) has a respectable history of offering competitively-priced banking products. I recently joined and here is a quick review of their current promotions and the application process. Highlights:

Lafayette Federal Credit Union (LFCU) has a respectable history of offering competitively-priced banking products. I recently joined and here is a quick review of their current promotions and the application process. Highlights:

2021 end-of-year update. I have an informal goal each year of earning the equivalent of the maximum annual IRA contribution limit of $6,000 using the profits from various promotions alone. If you had put $6,000 into your IRA every year for the last 10 years (2011-2020) and invested in a simple Target Date retirement fund, you would have turned

2021 end-of-year update. I have an informal goal each year of earning the equivalent of the maximum annual IRA contribution limit of $6,000 using the profits from various promotions alone. If you had put $6,000 into your IRA every year for the last 10 years (2011-2020) and invested in a simple Target Date retirement fund, you would have turned  The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)