The card_name is a premium travel rewards card with a flat 2 Miles per dollar on all purchases. 75,000 miles can be redeemed as a $750 credit towards any travel purchase made with the card (any airline website, any hotel website, AirBNB stays, Uber rides, no blackout dates). Here are the highlights:

- 75,000 Miles once you spend $4,000 on purchases within the first 3 months of account opening – that’s equal to $750 in travel.

- 2x miles on every purchase, every day.

- 5x miles on hotels, vacation rentals and rental cars booked through Capital One Travel. They offer a Price Match Guarantee.

- Up to a $120 credit for Global Entry or TSA PreCheck®.

- Enjoy two complimentary visits per year to Capital One Lounges or to 100+ Plaza Premium Lounges through the Partner Lounge Network. This perk is valid through December 31, 2024.

- Use your miles to get reimbursed for any travel purchase-or redeem by booking a trip through Capital One Travel.

- Transfer your miles to your choice of 15+ travel loyalty programs

- Miles won’t expire for the life of the account and there’s no limit to how many you can earn.

- $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection.

- No foreign transaction fees.

- $95 annual fee.

Note the following about existing or previous cardholders:

Existing or previous cardmembers are not eligible for this product if they have received a new cardmember bonus for this product in the past 48 months.

(Capital One’s “ultra-premium” card is the Capital One Venture X Rewards Credit Card, which has more perks including Priority Pass airport lounge access and a $300 annual travel credit through Capital One Travel, but also a higher $395 annual fee. This Venture card is more directly competitive with the Chase Sapphire Preferred, while the Venture X competes more directly with the Chase Sapphire Reserve.)

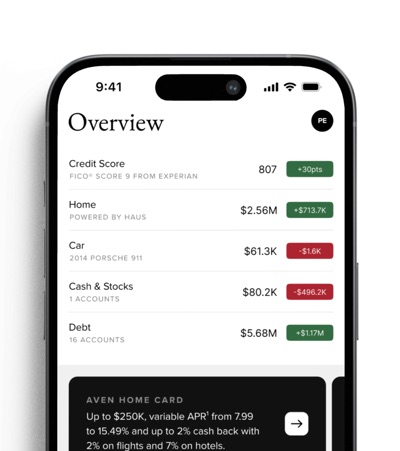

Redemption details. Capital One “miles” can be redeemed directly for a cash statement credit on a 1 mile = $0.01 basis when offsetting any travel purchase made on the card within the past 90 days. In other words, 50,000 miles = $500 toward travel. That means you can fly on any airline or stay at any hotel, pay with this card, and then “erase” that purchase using your miles balance later. This even includes AirBnB vacation rentals, car rentals, and Uber rides.

This means that earning 2 miles on every $1 in purchases essentially makes this a 2% back card when applied towards travel. You also have the option of booking travel through their travel portal, similar to Chase Ultimate Rewards, but you are not required to do so. You have the flexibility of booking through them or making the purchase directly through the airline, hotel, car rental counter, etc. This makes it easy to combine and spend all your Capital One miles.

Miles transfer options. Capital One now allows you to transfer your “miles” into select airline miles programs as well. Here are the airline transfer partners:

- Aeromexico

- Air France/KLM

- Air Canada Aeroplan

- Cathay Pacific Asia Miles

- Avianca Lifemiles

- British Airways Avios

- Emirates Skywards

- Etihad

- EVA

- Finnair

- Qantas

- Singapore Airlines Krisflyer

- TAP Air Portugal

- Turkish Airlines

- Virgin Red

Hotel partners

- Accor Live Limitless

- Choice Hotels

If you know how to leverage one of these international airline miles programs (my favorites are Aeroplan and Avios since you can combine family points), this can be a very valuable option. Otherwise, it’s nice to know you can always get a certain level of value by redeeming against any travel purchase.

Bottom line. The card_name earns 2x miles on every purchase, which you can either redeem against any travel purchase or transfer to one of their airline/hotel partners.

Due to the $700+ potential first-year value, I will be adding this card to my list of Top 10 Best Credit Card Bonus Offers.

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)