Update 2021: I just renewed with Mint Mobile again. I’m still happy with the service, including the new faster 5G speeds and increased data limits (added automatically without raising the price). I now pay $20/month for 10 GB 5G/LTE data (up from 8 GB). I also consolidated all the important info from my previous Mint Mobile posts into the full review below.

Full review:

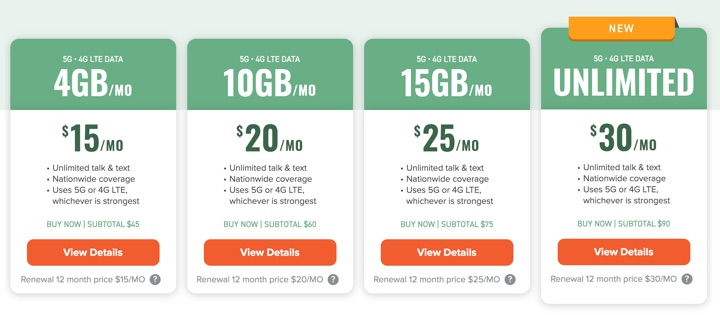

Mint Mobile is a prepaid cellular MVNO which runs on the T-Mobile network. They offer very competitive pricing on 5G/LTE data plans, as long as you “buy in bulk”. To switch, they will send you a SIM card to place in your existing phone. New customers can get the lowest price for the first 3 months for a lower upfront commitment. After that, you’ll need to renew for 12 months. Here are the current plan options:

- 4 GB 5G/LTE Data + Unlimited Talk/Text for $15/month

- 10 GB 5G/LTE Data + Unlimited Talk/Text for $20/month

- 15 GB 5G/LTE Data + Unlimited Talk/Text for $25/month

- Unlimited* 5G/LTE Data + Unlimited Talk/Text for $30/month (*Throttled after 35 GB)

I like that Mint Mobile acts like Vanguard in that I keep automatically getting more for my money without me having to be a new customer. $15 a month used to get me 2 GB of data, then 3 GB, and now 4 GB. $20 a month used to get me 5 GB of data, then 8 GB, and now 10 GB.

After you run out of 5G/LTE high-speed data, Mint Mobile plans still include “unlimited” slow data at 2G speeds (128kbps). This is nice to keep your messages and e-mail even if you accidentally binge-watch something on Netflix over cellular. All plans also include free international calls to Mexico and Canada.

Bring your own phone. You can bring your own unlocked GSM phone including both Android and Apple iPhones. Input your zip code first and then they will help you check your phone compatibilty. The most reliable way is to look up your IMEI number in your phone settings. Alternatively, they are offering the new iPhone SE for $15 a month, which means you can get a new phone + service for $30 a month total.

eSim now available. If have an iPhone that supports eSim (iPhone XS, iPhone XS Max, iPhone XR to the current iPhone 12 line-up), you can now switch to Mint without even waiting for a physical SIM card. Look for the eSim option during the sign-up process. Android support is supposed to come mid-2021, but unfortunately there are currently no plans to support the Apple Watch.

Number porting tip. Don’t forget to collect the following info from your existing carrier before starting the transfer process: Account number, Account PIN/password, and zip code on bill. Other than that, I was able to swap SIM cards and activate everything in under 10 minutes.

Upgrade to a higher data plan later and only pay the difference. During the pandemic, I found myself eating through a lot more cellular data. After I bumped into my data cap (3 GB at the time for $15/month) for the second time, I contacted Mint to upgrade to their next tier (8 GB at the time for $20/month). They allowed me to upgrade to the higher data plan for the rest of my 12-month term by only paying for the future difference. I did not have to retroactively pay to upgrade the entire term, or even renew for a new term.

What’s the catch? Any drawbacks? I did not experience any “catch”. Otherwise, I wouldn’t have kept renewing with Mint for three years in a row. If I’m being picky, here are potential drawbacks:

- As with all MVNOs, you don’t get the roaming that you get when you pay full price from the Big 3 carriers of Verizon, AT&T, or T-Mobile. However, I never noticed any ongoing issues with cell coverage. The only time that I remember lacking service was during a large public event (remember those?) – a music concert in a stadium.

- As with any time you switch carriers, the porting process can sometimes be a hassle. You’ll need to call your existing carrier and get a secret passphrase, which might involve a phone call and some hold time. Mint tries to do everything online, but does have a phone number and human reps if needed.

How’s the 5G data speed? If you have a 5G-capable phone and 5G towers around, you can get download speeds that rival or perhaps exceed your home internet connection. I did various tests with the SpeedTest app and sometimes had blazing 5G speeds (200 Mbps+), while sometimes the 5G with only one bar was slower than normal LTE (50 Mbps). Supposedly, Mint will automatically allow to connect to whichever is faster, 5G or LTE.

Can I use my phone as a WiFi hotspot? All Mint plans include free hotspot tethering up to your data allotment (5 GB hotspot on unlimited plan).

7-day money back guarantee details. It is important to note that their “7-Day Money Back Guarantee” starts at activation, not order date or ship date. So activate, and make sure the coverage works for you within those 7 days. If not, you can request a full refund online (minus shipping if any). You don’t even need to ship back your SIM card.

Bottom line. Mint Mobile works best for my needs, as I get unlimited talk, text, and 10 GB of 5G/LTE data for $20 a month. Other recs? If you want to unlimited talk and text only, you can find from Tello for only $8 a month (now a T-Mobile MVNO). If you want unlimited data on Verizon towers, look into Visible Wireless at $25 to $40 a month.

Also see:

- Unlimited Talk & Text ONLY Cell Phone Plans on Every Network – From $8/Month

- Lesser-Known Cheap DATA Cell Phone Plans on Every Network – From $15/Month

Disclosure: This post includes affiliate links. If you make a purchase through the links above, I may be compensated.

An under-the-radar loophole is now out in the open, thanks to fintech app Jiko* publishing a PR release bragging about their

An under-the-radar loophole is now out in the open, thanks to fintech app Jiko* publishing a PR release bragging about their  Here’s my monthly roundup of the best interest rates on cash as of February 2021, roughly sorted from shortest to longest maturities. I track these rates because I keep 12 months of expenses as a cash cushion and there are many lesser-known opportunities to improve your yield while still being FDIC-insured or equivalent. Check out my

Here’s my monthly roundup of the best interest rates on cash as of February 2021, roughly sorted from shortest to longest maturities. I track these rates because I keep 12 months of expenses as a cash cushion and there are many lesser-known opportunities to improve your yield while still being FDIC-insured or equivalent. Check out my  Walmart+ membership gets you the following perks:

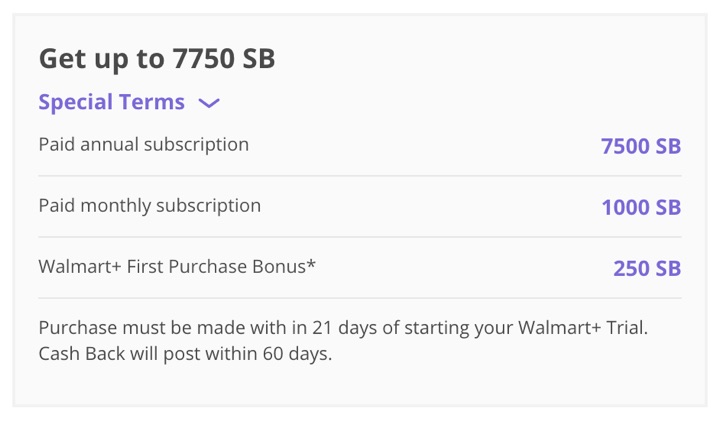

Walmart+ membership gets you the following perks:

While it seems that Robinhood and Gamestop are officially the new gambling version of a multiplayer online video game (

While it seems that Robinhood and Gamestop are officially the new gambling version of a multiplayer online video game (

Alliant Credit Union, one of the top 10 largest US credit unions by assets, has teamed up with Suze Orman to promote their new

Alliant Credit Union, one of the top 10 largest US credit unions by assets, has teamed up with Suze Orman to promote their new  I know I’m a bit late on this, but after reading several media articles, here again is my curated collection of highlights and perhaps overlooked items that might be worthy of additional research.

I know I’m a bit late on this, but after reading several media articles, here again is my curated collection of highlights and perhaps overlooked items that might be worthy of additional research.

Here’s another caffeine promo from Dunkin Donuts: Buy

Here’s another caffeine promo from Dunkin Donuts: Buy  Here’s a simple Starbucks promo that expires soon:

Here’s a simple Starbucks promo that expires soon:  The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)