This post provides updated information and instructions regarding the free FICO score that is available to Citibank credit card holders.

This post provides updated information and instructions regarding the free FICO score that is available to Citibank credit card holders.

Background. While their plans were announced in late 2014, Citi started offering free FICO scores to select cardholders in January 2015.

FICO Score details.

- FICO Score version: FICO® Bankcard Score 8 model. This is an industry-specific model tailored to credit card decisioning, with a range of 250 to 900. (The “classic” FICO range is 300-850.) This is one of the many FICO flavors. Score version is taken directly from Citi website and press release.

- Credit bureau: Equifax

- Update frequency: Monthly

- Limitations: Available to all “Citi-branded consumer credit cardmembers”. Reports are that the following cards are eligible:

- Citi® Double Cash Card (I have this and got my free score)

- Citi® / AAdvantage® Platinum Select® Mastercard® and Citi® / AAdvantage® Executive World Elite™ MasterCard (co-branded American Airlines)

- Citi® Dividend Platinum Select® Visa® Card

- Citi® Thank You Cards

- Citi Simplicity® Card

- Citi Forward® Card

- Citi Prestige® Card

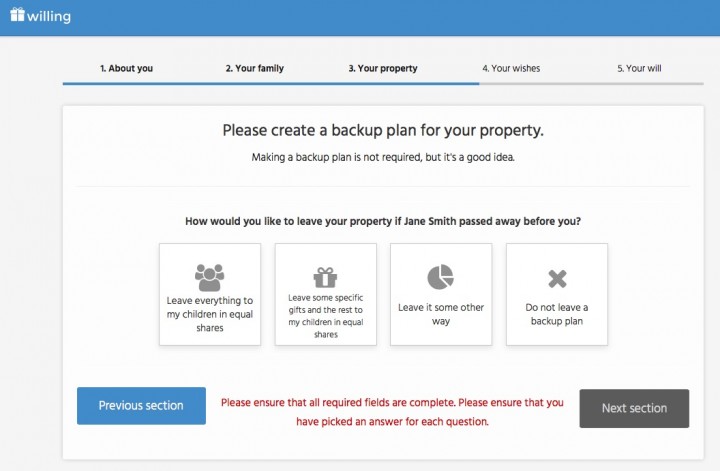

How to find the score. You can find the free FICO score on your online account access. According to a January 2015 press release, you can also request them to mail it to you. After logging in, look for either the “View your FICO Score” link or click on the “Card Benefits” tab. See screenshot below (click to enlarge):

Here are some example screenshots of what information is provided. Here is the latest score, a score meter, and the top two factors impacting your score:

They also provide a score history:

Here is a visual of the score range to help understand what each range means to lenders:

Fine print:

Your FICO® Score is calculated based on data from Equifax using the FICO® Bankcard Score 8 model and may be different from other credit scores. FICO® Scores are intended for and delivered only to the Primary cardmember and only if a FICO® Score is available. Disclosure of this score is not available for all Citi products and Citi may discontinue displaying the score at our discretion.

This post provides updated information and instructions regarding the free FICO score that is available to Discover credit card holders.

This post provides updated information and instructions regarding the free FICO score that is available to Discover credit card holders.

If you have an Android smartphone or tablet, Amazon just released

If you have an Android smartphone or tablet, Amazon just released  Expedia.com has revamped their in-house loyalty rewards program. Citi and Expedia have partnered on a new set of co-branded credit cards.

Expedia.com has revamped their in-house loyalty rewards program. Citi and Expedia have partnered on a new set of co-branded credit cards.  High-deductible health plans are still growing in popularity. While these can be a great way to save on your monthly premiums, it also means that when you do have to visit the emergency room, you get to tackle nearly the entire bill instead of a small co-pay. The problem is that most medical bills cannot be understood by mere mortals. Likely, the doctors and nurses themselves have no clue how that $6,344 bill for a broken arm got generated.

High-deductible health plans are still growing in popularity. While these can be a great way to save on your monthly premiums, it also means that when you do have to visit the emergency room, you get to tackle nearly the entire bill instead of a small co-pay. The problem is that most medical bills cannot be understood by mere mortals. Likely, the doctors and nurses themselves have no clue how that $6,344 bill for a broken arm got generated.

Our family keeps a year’s worth of expenses (not income) put aside in cash reserves; it provides financial insurance with the side benefits of lower stress and less concern about stock market gyrations. In my opinion, emergency funds can actually have a

Our family keeps a year’s worth of expenses (not income) put aside in cash reserves; it provides financial insurance with the side benefits of lower stress and less concern about stock market gyrations. In my opinion, emergency funds can actually have a  Many online retailers offer a “Low Price Guarantee”, which doesn’t mean they actually have the lowest prices but only that they will match a lower price if you find it and ask for your money within a certain time window. Sometimes they’ll match certain competitors, and sometimes they’ll only match themselves.

Many online retailers offer a “Low Price Guarantee”, which doesn’t mean they actually have the lowest prices but only that they will match a lower price if you find it and ask for your money within a certain time window. Sometimes they’ll match certain competitors, and sometimes they’ll only match themselves.

Back in 2014, Google bought Word Lens, a neat app that translated a few languages in real time using your smartphone’s camera. The live translation feature has been integrated into the Google Translate app (

Back in 2014, Google bought Word Lens, a neat app that translated a few languages in real time using your smartphone’s camera. The live translation feature has been integrated into the Google Translate app (

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)