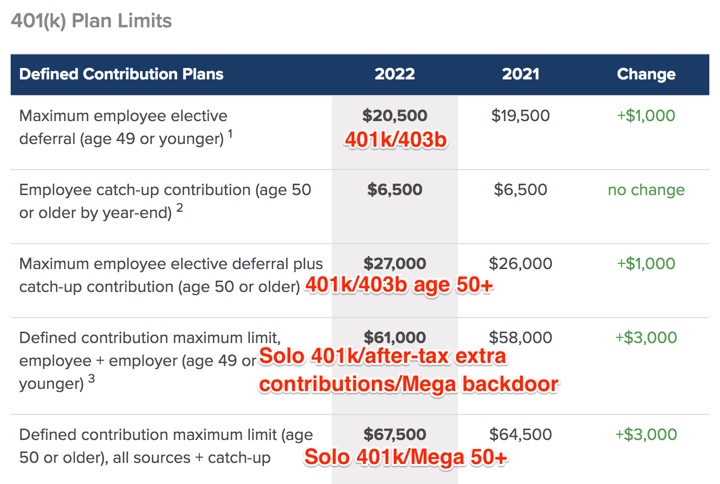

The beginning of the year is a good time to check on the new annual contribution limits to the various available retirement accounts. Our income has been quite variable these last few years, so I regularly adjust the paycheck deferral percentages based on expected income for the year. This SHRM article has a nice summary of 2022 vs. 2021 numbers for most employer-based accounts.

The beginning of the year is a good time to check on the new annual contribution limits to the various available retirement accounts. Our income has been quite variable these last few years, so I regularly adjust the paycheck deferral percentages based on expected income for the year. This SHRM article has a nice summary of 2022 vs. 2021 numbers for most employer-based accounts.

401k/403b Employer-Sponsored Accounts.

For example, I would break down the applicable limit down to monthly and bi-weekly amounts:

- $20,500 annual limit = $1,708 per monthly paycheck.

- $20,500 annual limit = $788 per bi-weekly paycheck.

If you are contributing to a pre-tax account instead of a Roth, you could also use a paycheck calculator to find the detailed impact to your take-home pay.

The higher numbers are for those folks that have the ability to contribute extra money into their 401k accounts on an after-tax basis (and potentially perform an in-service Roth rollover), or those self-employed persons with SEP IRAs or Self-Employed 401k plans.

The investment options in 401k plans have also improved on average steadily over the years with lower fees and costs, allowing your money to compound even faster.

Traditional/Roth IRAs. The annual contribution limits is unchanged from last year, $6,000 with an additional $1,000 allowed for those age 50+.

- $6,000 annual limit = $500 per monthly paycheck.

- $6,000 annual limit = $231 per bi-weekly paycheck.

Most brokerage accounts (Vanguard, Fidelity, M1 Finance) will allow you to set up automatic investments on a weekly, biweekly, or monthly basis. As long as you have enough money in your linked checking account, the broker will transfer the cash over and then invest it on a recurring basis. You may even be able to sync it to take out money the very same or next day as when your paycheck hits.

Health Savings Accounts are often treated as the equivalent of a “Healthcare IRA” due the potential triple tax benefits (tax-deduction on contributions, tax-deferred growth for decades, and tax-free withdrawals towards qualified healthcare expenses). This assumes that you have a high-deductible health insurance plan, you can cover your current healthcare expenses out-of-pocket, you can still afford to contribute to the HSA.

Even though I’ve been parroting the “standard personal finance advice” to raise that contribution percentage and save as much as you can in your 401k for years and years, it still holds true. There is some true mind trickery when the money never touches your bank account. The easiest way for me not to eat potato chips is not the have them in the house. (My nemesis is that Costco mega-sized bag of Himalayan Salt Kettle Chips…) The easiest way to make sure you don’t spend the money that you want to invest, is to never have it touch your bank account.

The Vanguard Target Retirement Funds are one of the largest “set-and-forget” mutual funds that own a mix of stocks and bonds that automatically adjust over time based on your targeted retirement year, with combined assets across the institutional and retail classes of over $600 billion.

The Vanguard Target Retirement Funds are one of the largest “set-and-forget” mutual funds that own a mix of stocks and bonds that automatically adjust over time based on your targeted retirement year, with combined assets across the institutional and retail classes of over $600 billion.

2021 is finally in the books! Most of my portfolio is in low-cost index funds across various asset classes, which I purposefully ignore most of the time as I believe the proper time horizon is at least several years long. However, I do check in once a year. Per Morningstar, here are the annual returns for select asset classes as benchmarked by popular ETFs after market close 12/31/21.

2021 is finally in the books! Most of my portfolio is in low-cost index funds across various asset classes, which I purposefully ignore most of the time as I believe the proper time horizon is at least several years long. However, I do check in once a year. Per Morningstar, here are the annual returns for select asset classes as benchmarked by popular ETFs after market close 12/31/21.

In order to use Fidelity’s

In order to use Fidelity’s

A few readers asked about “fully paid lending programs” offered by some brokerage firms. The premise is very intriguing: You lend out the stock shares you own and earn interest, all while keeping full “economic” ownership. You still get any upside or downside, you can still sell at any time, and your loans are backed by 100%+ collateral at a custodial bank. The broker finds borrowers, collects interest, and splits it with you (usually 50/50). Is this zero-effort free money? These programs can go by various names:

A few readers asked about “fully paid lending programs” offered by some brokerage firms. The premise is very intriguing: You lend out the stock shares you own and earn interest, all while keeping full “economic” ownership. You still get any upside or downside, you can still sell at any time, and your loans are backed by 100%+ collateral at a custodial bank. The broker finds borrowers, collects interest, and splits it with you (usually 50/50). Is this zero-effort free money? These programs can go by various names:

One of my newer interests is better understanding individual businesses and how they work. Accounting is the “language of business” used to write annual reports, 10-Ks, 10-Qs, income statements, and so on. I was afraid a textbook would be too boring, so I am auditing the online Coursera course

One of my newer interests is better understanding individual businesses and how they work. Accounting is the “language of business” used to write annual reports, 10-Ks, 10-Qs, income statements, and so on. I was afraid a textbook would be too boring, so I am auditing the online Coursera course  Financial freedom seekers usually have a Number – the value at which their investments can support their spending indefinitely. This is directly linked to “safe withdrawal rates”. For example a 4% safe withdrawal rate is a 25x multiplier – meaning $30,000 in spending needs not covered by Social Security, annuities, or pensions would require 25 x $30,000 = $750,000. Morningstar recently released a 59-page research paper called

Financial freedom seekers usually have a Number – the value at which their investments can support their spending indefinitely. This is directly linked to “safe withdrawal rates”. For example a 4% safe withdrawal rate is a 25x multiplier – meaning $30,000 in spending needs not covered by Social Security, annuities, or pensions would require 25 x $30,000 = $750,000. Morningstar recently released a 59-page research paper called

Some investors like to break down their portfolio into several different asset and sub-asset classes. One long-standing example of the “slice-and-dice” is the “

Some investors like to break down their portfolio into several different asset and sub-asset classes. One long-standing example of the “slice-and-dice” is the “ Savings I Bonds are a unique, low-risk investment backed by the US Treasury that pay out a variable interest rate linked to inflation. With a holding period from 12 months to 30 years, you could own them as an alternative to bank certificates of deposit (they are liquid after 12 months) or bonds in your portfolio.

Savings I Bonds are a unique, low-risk investment backed by the US Treasury that pay out a variable interest rate linked to inflation. With a holding period from 12 months to 30 years, you could own them as an alternative to bank certificates of deposit (they are liquid after 12 months) or bonds in your portfolio.  The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)