This is becoming a recurring theme around here, but I came across an interesting tidbit in this ProPublica article on how your brain plays tricks on you. Emphasis mine:

This is becoming a recurring theme around here, but I came across an interesting tidbit in this ProPublica article on how your brain plays tricks on you. Emphasis mine:

Fidelity did a study of all their accounts to see what types of investors performed the best. They found that the best investors were the people who had either forgotten they had an account in the first place — or were dead! In other words, most investors succeed in doing the exact opposite of what they set out to do with their money (presumably, make more of it).

In other words, the best investment performance came from doing nothing. That means no buying what looks obviously good, no selling what looks obviously bad, no “taking profits”, no “taking money off the table”.

If doing nothing is best, then you should probably invest in something that encourages inactivity. That’s exactly what a Target Date Fund (TDF) does, manage your asset allocation in an emotionless manner as you age. Auto-pilot.

This Morningstar article appears to confirm this idea: Target-Date Funds: Good Behavior Leads to Better Results. Emphasis mine:

Investor returns, a dollar-weighted return that takes into account cash inflows and outflows to estimate the returns that investors actually experience, gives clues to how target-date investors have fared according to these concerns. The news is good. Whereas most other broad categories show the effects of poor timing–investors tend to buy high and sell low–target-date investors largely avoid that fate.

Investors of target-date funds tend to invest part of every paycheck into employer plans like 401(k)s, and are either (1) lazy and put there by default, which suggests future laziness, or (2) actively chose to be invested in an auto-pilot fund, which suggests they accept that inactivity on their part is a good idea. (I should admit that I did neither and use the self-directed brokerage option… but only to buy TIPS. Honest!)

There is nothing wrong with focusing on your savings rate and using the auto-pilot!

In a Quora question

In a Quora question

I like the idea of living off dividend and interest income. Who doesn’t? The problem is that you can’t just buy stocks with the absolute highest dividend yields and junk bonds with the highest interest rates without giving up something in return. There are many bad investments lurking out there for desperate retirees looking only at income. My goal is to generate reliable portfolio income by not reaching too far for yield.

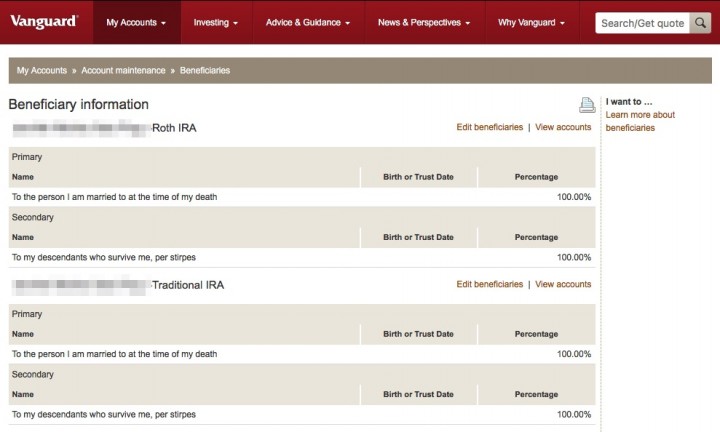

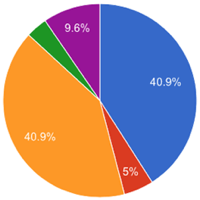

I like the idea of living off dividend and interest income. Who doesn’t? The problem is that you can’t just buy stocks with the absolute highest dividend yields and junk bonds with the highest interest rates without giving up something in return. There are many bad investments lurking out there for desperate retirees looking only at income. My goal is to generate reliable portfolio income by not reaching too far for yield. It has been a while, so here is a 2016 First Quarter update on my investment portfolio holdings. This includes tax-deferred accounts like 401ks, IRAs, and taxable brokerage holdings, but excludes things like our primary home and cash reserves (emergency fund). The purpose of this portfolio is to create enough income to cover household expenses.

It has been a while, so here is a 2016 First Quarter update on my investment portfolio holdings. This includes tax-deferred accounts like 401ks, IRAs, and taxable brokerage holdings, but excludes things like our primary home and cash reserves (emergency fund). The purpose of this portfolio is to create enough income to cover household expenses.

Reading

Reading

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)