The hard problem of retirement planning continues to be how to turn a pile of assets (like in a 401k plan) into the maximum reliable income stream for decades without running out of money. Historically, companies that pay a high-yet-reliable dividend have been referred to as “widow and orphan” stocks. The academic paper Why Dividends Matter by Paul Schultz explores the underpinnings of this practice, including the “implicit contract” between the company and shareholders that “you can consume at the level of the dividend for the foreseeable future without fear of running out of money.” The debate about investing based on dividends will not be resolved by this paper, but here are a few quotes:

It is not necessary to think that a practice of consuming only from dividends is a result of limited rationality, biases, or mental accounting. When firms establish a quarterly dividend, they implicitly tell investors that they can consume at the level of the dividend for the foreseeable future. So, investors who want to smooth consumption can do so by consuming dividends.

As a whole, the investors in this survey are far more concerned about the danger of depleting assets by selling stock, than by spending dividends. This is why investors like dividends. They allow to investors to smooth consumption by indicating how much they can consume without depleting assets.

Now that we have many ways to backtest historical stocks returns, the popular counter-argument is that we have other ways to decide how much is “safe” to withdraw, and that amount is often more that the current dividend yield available. We can simply some stock shares as needed if the dividend is not enough. Which is the better way to decide how much is safe to withdraw?

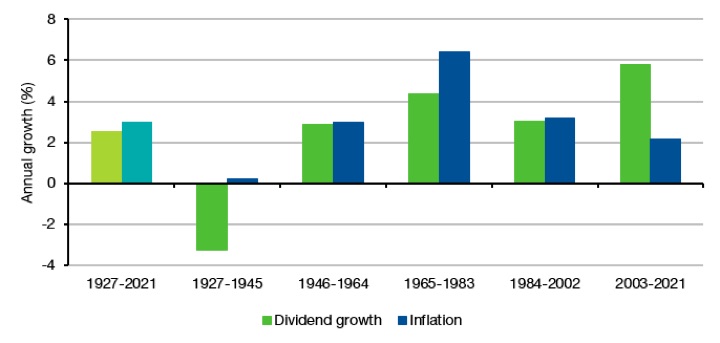

Historically, do dividend payouts keep up with inflation? This would seem to be important if investors are only spending the dividends every year. Otherwise, they would eventually need to sell shares of stock anyway. Table I of the paper “Changes in Dividends and Inflation” covers this using CRSP data for all US stocks. Hat tip to Klement on Investing, who converted Table I into a nice visual chart:

Over the past nearly 100 years, the dividend growth rate has mostly matched inflation. Dividend growth did fall behind inflation during the period of 1970s high inflation. In turn, dividends have grown much faster than (historically low) inflation in the last 20 years.

Here’s another chart from Hartford Funds which separates the portion of S&P 500 total market returns into share price appreciation and dividends.

I would note that these charts cover the broad US stock market, not just a subset of high-dividend stocks nor international stocks. I certainly don’t think we can get away with buying only the highest dividend-yielding stocks and calling it a day. However, I do believe that dividend payouts are is a useful data point to consider, amongst many others. I tend to pay attention to the dividend yield on the S&P 500 and also certain indexes like those tracked by the Vanguard Value Index Fund ETF. I also expect the dividends on both to grow more or less with inflation over the long run.

Even Vanguard’s founder Jack Bogle had the following to say (source):

But you ought to think about all sources of your retirement income. Having said that, when you own an equity portfolio, don’t get into it for market reasons, get into it for income reasons. Oversimplifying, what you want to do when you retire is walk out to the mailbox on Social Security day and on dividend payment day for the funds—assuming they’re the same day—and make sure you have two envelopes out there. One is your fund dividend and the other is your Social Security check. The Social Security will keep up with inflation year after year, and dividends are likely to increase year after year. They have been going up. Every once in a while there is an interruption, such as the Great Depression of the early 1930s. And many bank stocks eliminated their dividends in 2008, so there was obviously a drop. But it has long since recovered, and then some.

Bet on the dividends, and not on the market price. You’ve got those two envelopes and that’s your retirement. If you have a pension plan (one that is not likely to go bankrupt—and a lot of them are likely to) that is a third envelope. You want to be concerned about whether you have enough income to pay utility bills, pay for your food, pay your rent or your mortgage, whatever it might be, every month. You want income to help you pay those bills. And in the retirement stage, that’s what investing should be about—regular checks from dividends and/or from Social Security and/or from a pension account.

One of the concerns about contributing to 529 plan for college savings is that you won’t end up using all the money and end up being hit with additional taxes (at ordinary income rates) and penalties on an non-qualified withdrawal. The funds potentially would have been better off simply invested in a taxable brokerage account (and long-term capital gains rates).

One of the concerns about contributing to 529 plan for college savings is that you won’t end up using all the money and end up being hit with additional taxes (at ordinary income rates) and penalties on an non-qualified withdrawal. The funds potentially would have been better off simply invested in a taxable brokerage account (and long-term capital gains rates).  Savings I Bonds are a unique, low-risk investment backed by the US Treasury that pay out a variable interest rate linked to inflation. With a holding period from 12 months to 30 years, you could own them as an alternative to bank certificates of deposit (they are liquid after 12 months) or bonds in your portfolio.

Savings I Bonds are a unique, low-risk investment backed by the US Treasury that pay out a variable interest rate linked to inflation. With a holding period from 12 months to 30 years, you could own them as an alternative to bank certificates of deposit (they are liquid after 12 months) or bonds in your portfolio.  Here’s my 2023 Q1 income update for my

Here’s my 2023 Q1 income update for my

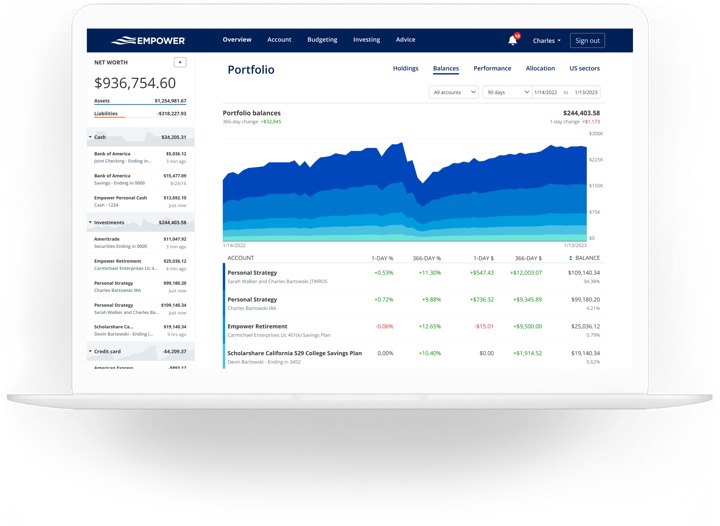

Here’s my quarterly update on my current investment holdings as of the end of 2022, including our 401k/403b/IRAs and taxable brokerage accounts but excluding real estate and side portfolio of self-directed investments. Following the concept of

Here’s my quarterly update on my current investment holdings as of the end of 2022, including our 401k/403b/IRAs and taxable brokerage accounts but excluding real estate and side portfolio of self-directed investments. Following the concept of

The beginning of the year is also a good time to check on the new annual contribution limits for retirement and benefit accounts, many of which are indexed to inflation. Our income has been quite variable these last few years, so I regularly adjust our paycheck deferral percentages based on expected income for the year. I still try to max things out if I can, or at least stay on pace to do so. This

The beginning of the year is also a good time to check on the new annual contribution limits for retirement and benefit accounts, many of which are indexed to inflation. Our income has been quite variable these last few years, so I regularly adjust our paycheck deferral percentages based on expected income for the year. I still try to max things out if I can, or at least stay on pace to do so. This

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)