Pentagon Federal Credit Union is now offering 2.02% APY rate on it’s 3, 4, 5, and 7-year CDs (they call it a Money Market Certificate). The minimum opening deposit is $1,000. Early withdrawal penalties are as follows:

- For terms from 6 months to 4 years, you will lose the last 180 days of interest. If you haven’t earned 180 days of interest yet, you lose all the interest and get back only your opening amount.

- For terms of 5 years or longer, you will lose the last 365 days of interest. If you haven’t earned 365 days of interest yet, you lose all the interest and get back only your opening amount.

As a credit union, you must meet their eligibility requirements to join. Basically all members of the military and their immediate families are welcome, as well as many other military-related groups. Otherwise, simply become a member of the organization Voices for America’s Troops. Membership costs $15/yr, and you don’t need to renew to remain a PenFed member. “Voices for America’s Troops advocates for a strong national defense, including sustaining and improving quality of life programs for America’s troops, their families and survivors.”

(I ran a search through the blog archives and found a post about PenFed offering 6.25% APY 3-year CDs back in late 2006. I wonder how long until we see rates like that again?)

Ally Bank

Ally Bank

Update: Citibank has a

Update: Citibank has a  Capital One Consumer Bank has their annual Financial Independence Day promotion which boosts the usual bonus for their Consumer Bank Savings and 360 Checking accounts. (Artist formerly known as ING Direct.) Offers good until Wednesday, July 3rd 11:59PM ET.

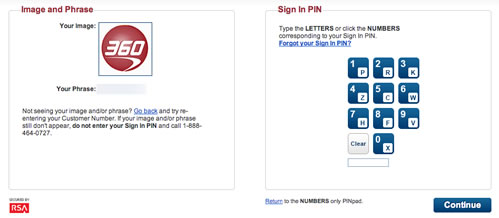

Capital One Consumer Bank has their annual Financial Independence Day promotion which boosts the usual bonus for their Consumer Bank Savings and 360 Checking accounts. (Artist formerly known as ING Direct.) Offers good until Wednesday, July 3rd 11:59PM ET.

New inflation numbers for March 2013 were just announced, so it’s time for the usual semi-annual update and rate predictions.

New inflation numbers for March 2013 were just announced, so it’s time for the usual semi-annual update and rate predictions.  Our family keeps a full year of expenses put aside in cash reserves; it provides us with financial stability with the additional side benefits of lower stress and less concern about stock market gyrations. Emergency funds can actually have a

Our family keeps a full year of expenses put aside in cash reserves; it provides us with financial stability with the additional side benefits of lower stress and less concern about stock market gyrations. Emergency funds can actually have a  If you have a Citi credit card or a Citibank account from our partner Citi, with the ThankYou points rewards system, you have a wide array of options to redeem your points at

If you have a Citi credit card or a Citibank account from our partner Citi, with the ThankYou points rewards system, you have a wide array of options to redeem your points at  Capital One bought ING Direct USA back in early 2012, and has finally completed their transition and re-branding. Their new savings account product is called Capital One Consumer Bank Savings. Since I’ve had an account with them for over a decade (September 2001, as they remind me every time I log in), here’s an updated review of my 2nd oldest bank account meant for both new and existing customers.

Capital One bought ING Direct USA back in early 2012, and has finally completed their transition and re-branding. Their new savings account product is called Capital One Consumer Bank Savings. Since I’ve had an account with them for over a decade (September 2001, as they remind me every time I log in), here’s an updated review of my 2nd oldest bank account meant for both new and existing customers.

If you have a dormant FNBO Direct account, you may be interested to know that they are offering a promotional rate of 1.35% APY beginning July 1, 2012 on all the money above what your balance was on June 29th, 2012. (Only available to existing FNBO Direct customers as of June 29, 2012.) Even better, the rate is guaranteed until December 31, 2012, making it better than 6-month CDs from other banks. All rates above have expired and FNBO is now offering a standard rate of 0.85% APY.

If you have a dormant FNBO Direct account, you may be interested to know that they are offering a promotional rate of 1.35% APY beginning July 1, 2012 on all the money above what your balance was on June 29th, 2012. (Only available to existing FNBO Direct customers as of June 29, 2012.) Even better, the rate is guaranteed until December 31, 2012, making it better than 6-month CDs from other banks. All rates above have expired and FNBO is now offering a standard rate of 0.85% APY. The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)