Many people want to take advantage of the tax benefits of 529 college savings accounts, but don’t want to deal with the volatility of stocks or bonds. Perhaps the beneficiary will need the funds soon, or you want the security of FDIC insurance. Many students are now adults saving for their own educations in a few years. In this case, consider the Virginia CollegeWealth 529 Savings Account and its following features:

Many people want to take advantage of the tax benefits of 529 college savings accounts, but don’t want to deal with the volatility of stocks or bonds. Perhaps the beneficiary will need the funds soon, or you want the security of FDIC insurance. Many students are now adults saving for their own educations in a few years. In this case, consider the Virginia CollegeWealth 529 Savings Account and its following features:

- FDIC-insured through partner banks

- $25 minimum to open

- No annual fee

- No monthly maintenance fees

- No state residency requirements

- Up to a $4,000 state tax deduction for Virginia taxpayers

- High interest rates of up to 2.25% APY

Deposit details. The FDIC insurance coverage is $250,000 per account owner, per bank. All Virginia College Savings Plan 529 Accounts have a maximum aggregate contribution limit per beneficiary of $350,000.

Will the interest rate stay high? It is important to note that this is a savings account and not a certificate of deposit (CD), so the interest rate is subject to change at any time. If you are willing to commit to a 5-year CD, the Ohio CollegeAdvantage 529 has 5- to 12-year CDs paying 2% APY right now.

However, looking through old documents indicates that the interest rates that you see today for BB&T Bank have been the same at least as far back as June 30, 2011 (source, also checked in 2012 and 2013). That means BB&T’s rates have been the same for nearly four years during a period of historically low interest rates. I think that should provide some measure of confidence that the rates won’t drop dramatically the day after you open the account.

For Union Bank, rates have been slightly higher in the past (2.5% APY in 2011, 2.3% APY in 2012). Not a huge drop over time but interesting that Union Bank used to be higher but now BB&T is higher. I’m assuming you can also switch internally between these two banks. You can also roll over your assets into another 529 plan in the future, if you wish.

Partner banks and current rates (as of March 4th, 2015)

Union Bank & Trust

- Balances of $1 to $9,999: 1.75% APY

- Balances of $10,000 or more: 2% APY

- Balances of $1 to $9,999: 2% APY

- Balances of $10,000 to $24,999: 2% APY

- Balances of $25,000 or more: 2.25% APY

Best high-yield savings account, period? In a weird twist, you can put money in a 529 and take an unqualified withdrawal where you’ll be subject to income taxes and an additional 10% penalty on any earnings . But you’d have to pay income tax on interest from a normal savings account anyway. That means you could treat this account like a regular taxable savings account and get an effective rate of 1.8%+ APY even after any penalties. That is nearly a full percentage point higher than my current Ally Bank high-yield savings. I don’t know how many people have actually taken advantage of this “loophole” option, but it is interesting. One possible drawback is that it can take longer (possible weeks) to withdraw money from a 529 than from a traditional bank account.

Let’s take a step back and focus on some actionable tips to simplify and automate your savings. Think of it as knocking out your New Year’s Resolution in just 10 minutes or less.

Let’s take a step back and focus on some actionable tips to simplify and automate your savings. Think of it as knocking out your New Year’s Resolution in just 10 minutes or less.

Our family keeps a full year of expenses put aside in cash reserves; it provides us with financial stability with the additional side benefits of lower stress and less concern about stock market gyrations. Emergency funds can actually have a

Our family keeps a full year of expenses put aside in cash reserves; it provides us with financial stability with the additional side benefits of lower stress and less concern about stock market gyrations. Emergency funds can actually have a

Capital One 360 is running their annual Financial Independence Day promotion, with what is traditionally the best bonus of the year for their 360 Savings and 360 Checking accounts. (Formerly known as ING Direct.) These online bank accounts offer no monthly fees and no minimum balance requirements, all with a decent interest rate. As a result, the savings account makes a great “online piggy bank” where you can make free transfers from your existing checking accounts from any bank into the 360 Savings account on a regular basis. Promo details:

Capital One 360 is running their annual Financial Independence Day promotion, with what is traditionally the best bonus of the year for their 360 Savings and 360 Checking accounts. (Formerly known as ING Direct.) These online bank accounts offer no monthly fees and no minimum balance requirements, all with a decent interest rate. As a result, the savings account makes a great “online piggy bank” where you can make free transfers from your existing checking accounts from any bank into the 360 Savings account on a regular basis. Promo details: Updated. If you open multiple bank accounts in order to take advantage of higher interest rates or sign-up bonuses, you may be concerned about any potential consequences from all that activity. In my experience, there are two main factors to be aware of when you open a bank account:

Updated. If you open multiple bank accounts in order to take advantage of higher interest rates or sign-up bonuses, you may be concerned about any potential consequences from all that activity. In my experience, there are two main factors to be aware of when you open a bank account: Our family keeps a full year of expenses put aside in cash reserves; it provides us with financial stability with the additional side benefits of lower stress and less concern about stock market gyrations. Emergency funds can actually have a

Our family keeps a full year of expenses put aside in cash reserves; it provides us with financial stability with the additional side benefits of lower stress and less concern about stock market gyrations. Emergency funds can actually have a

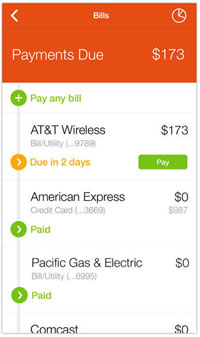

A few readers e-mailed me to let me know that bill management website Manilla.com announced that they will be shutting down. Surprising, as they were just mentioned in Money magazine last month!

A few readers e-mailed me to let me know that bill management website Manilla.com announced that they will be shutting down. Surprising, as they were just mentioned in Money magazine last month! The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)