New increased offer (up to 100k total). The Frontier Airlines World Mastercard is a niche co-branded card from Barclays, but if you do fly on Frontier regularly, it actually offers some good perks on a relative basis. Many strict, barebones airlines are starting to trickle back some perks to win back customers and Frontier is no exception. For Frontier, it appears that this credit card is a major gateway to these little wins like actually getting to bring on a carry-on or not having to pay a fee to redeem your miles. (I’ve never flown Frontier before, but I’m assuming they must be cheap for you to put up with this stuff!)

- The standard offer is for 50,000 bonus miles plus a $100 flight voucher after spending $500 on purchases and paying the annual fee in full, both within the first 90 days of account opening.

- Right now, if you visit this page, you can see how to get an extra 50,000 bonus miles if you are the primary cardmember of a cobranded credit card with another US Domestic Airline, complete verification, and complete an additional application form. You must also spend $3,000 within 180 days of account opening to earn the additional 50,000 miles. That would give you a total of 100,000 Frontier miles. Looks like you must apply by January 31, 2025.

Here are the other highlights of the card :

- Two Free Checked Bags for primary cardmember. Must purchase flight at FlyFrontier.com using this card. Includes ski/golf bag.

- Elite Gold Status. Get it upfront for 90 days with account opening and first purchase with your card within the first 90 days of account opening. To keep it, you must spend $3,000 within the first 90 days of account opening. Status will be good for 12 months from the day the account was opened.

- Pooling of miles between friends and family members is allowed with this card.

- Zone 2 Priority Boarding for primary cardmember.

- Award Redemption Fee Waiver

- 5X miles on eligible purchases at flyfrontier.com.

- 3X miles on eligible restaurant purchases.

- 1X miles on all other purchases.

- 1 Elite Status Point for every $1 spent on purchases.

- $100 Frontier Airlines Flight Voucher after your Account anniversary when you have spent $2,500 or more in Net Purchases on your Card Account during your cardmembership year (each 12-month period through and including your Card Account anniversary date).

- $0 annual fee for the first year, then $99.

Elite Gold Status gets you the following benefits:

- Free carry-on bag for yourself

- No change/cancel fees* (+7 days from departure)

- Preferred Seat Assignment at Booking

- Premium Seating at Check-in (based on availability)

- Priority Customer Care (both live phone and online chat)

- Priority Boarding: Zone 1 for you, Zone for 2 everyone in your booking.

- Family Pooling

Redeeming Frontier miles. They advertise that 50,000 miles can be redeem for “up to 2 round-trip award tickets”, which is technically true but that is for their most limited “value” awards. They also have “standard” awards and “last seat” awards (available to elites only). You will also be subject to taxes and fees starting a $5.60 per one-way. Here is their award chart:

The good news is that this card does give you an easy pathway toward Elite Gold status for the first year and that lets you nab any unsold seat on the plane. But that also means that 50,000 miles might only be worth a single roundtrip award ticket.

You also avoid the award redemption fee with this credit card. Otherwise, they charge an award redemption fee of between $15 and $75 for all award tickets departing within 180 days of booking.

I’ve seen outside valuations place the value of a Frontier mile at about 1.1 cent each. After pricing out some Frontier flights, that sounds about right, although it will definitely vary based on your route. The cheaper, shorter flights are easier to find a “saver” award, while their most convenient, longer routes you should expect to use the “standard” or “last seat” awards. I’d also only agree with this valuation if I had this credit card to ease the hassles.

Two free checked bags are a new feature that was announced 8/15/24 (hat tip to DoC). Here is the fine print:

Tickets must be purchased from FlyFrontier.com or the Frontier Airlines mobile app

· There is no limit to how many times you can use this benefit

· Free checked bag benefit includes golf and ski equipment

· Primary cardmembers must use their FRONTIER Airlines World Mastercard at booking to unlock the free checked bag benefit

Due to the limited footprint of Frontier, I’m not sure if I will add this to my Top 10 Best Credit Card Bonus Offers.

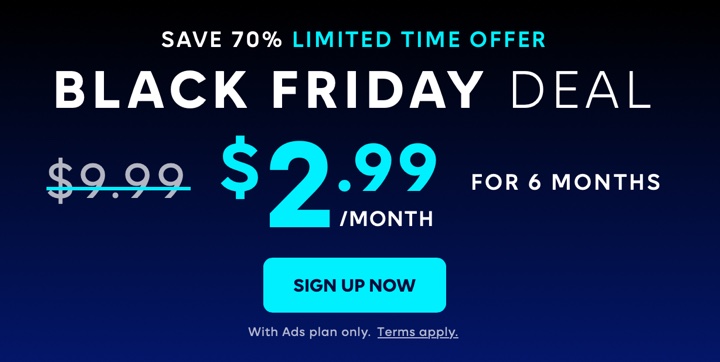

Check offer link again to see if eligible for this new round. If you have a Discover card with cash back rewards, you can redeem them to buy eligible items at Amazon.com. The redemption rate is $1 in Cash Back Bonus = $1 to spend at Amazon, which is the same rate as their statement credit redemptions. Check if you have a targeted promotion and activate for an additional discount for redeeming a single penny’s worth of points. (To see the link, you may need to visit

Check offer link again to see if eligible for this new round. If you have a Discover card with cash back rewards, you can redeem them to buy eligible items at Amazon.com. The redemption rate is $1 in Cash Back Bonus = $1 to spend at Amazon, which is the same rate as their statement credit redemptions. Check if you have a targeted promotion and activate for an additional discount for redeeming a single penny’s worth of points. (To see the link, you may need to visit

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)