Are your kids curious about the banking system? Are you? Law professor Mehrsa Baradaran wrote A Kids Book About Banking and it is currently available free via download in either PDF or EPub format. Physical copies (not free) are available on Amazon. Found via Axios.

Are your kids curious about the banking system? Are you? Law professor Mehrsa Baradaran wrote A Kids Book About Banking and it is currently available free via download in either PDF or EPub format. Physical copies (not free) are available on Amazon. Found via Axios.

Silicon Valley Bank (SVB) collapsed overnight and we found ourselves wishing we knew more about how banks worked… so, we made a book!

When you think of a bank, what comes to mind? A building? A safe, filled with gold? What if we told you banks weren’t any of these things? And (get ready for this)…most money isn’t even kept in the bank! Banking is a system that allows money to move from one place to another, creating opportunities and growth. And banks only work with a shared belief in the magic of money.

It’s a good way to start a conversation, but be warned, it might be kind of scary to YOU as an adult to be reminded that all your bank deposits, the result of possibly decades of hard work, are just a bunch of 1s and 0s on a computer database somewhere. There is no gold in a vault. There are just banks taking your money and creating even more money via fractional-reserve banking. But it all collapses if we don’t collectively trust the system, or “believe in magic”. Every time I read about this system, I reconsider buying a plot of land nearby that I can see and walk on.

I tried reading it to my youngest kid, but she preferred talking vegetables and listening to The Cool Bean for the 87th time instead. I think she’s still in the trading strange metal coins for candy phase of learning about money.

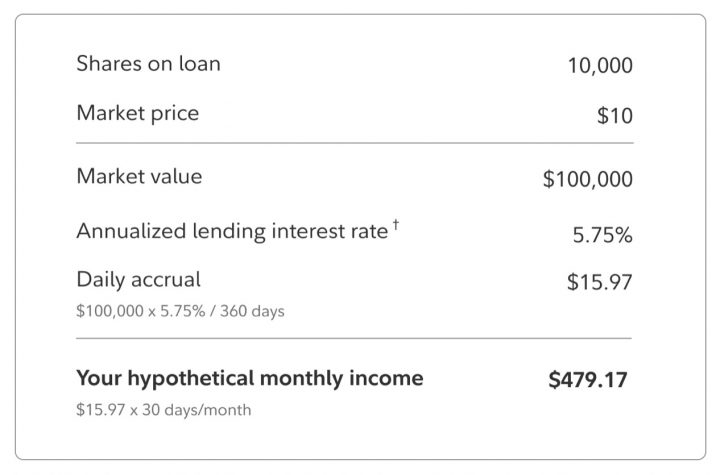

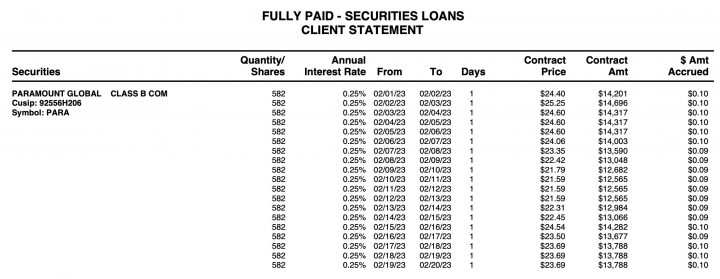

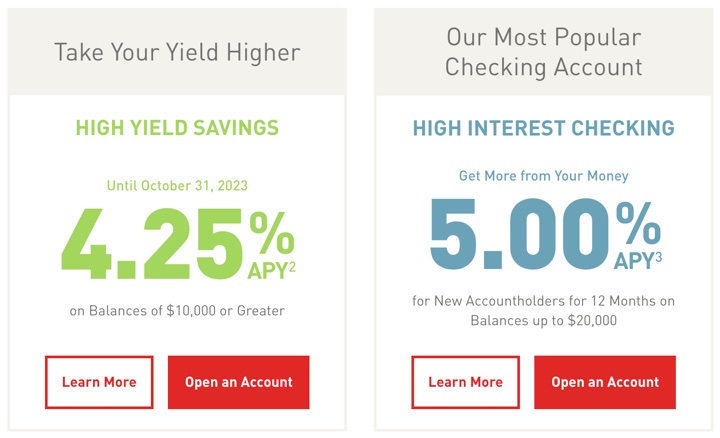

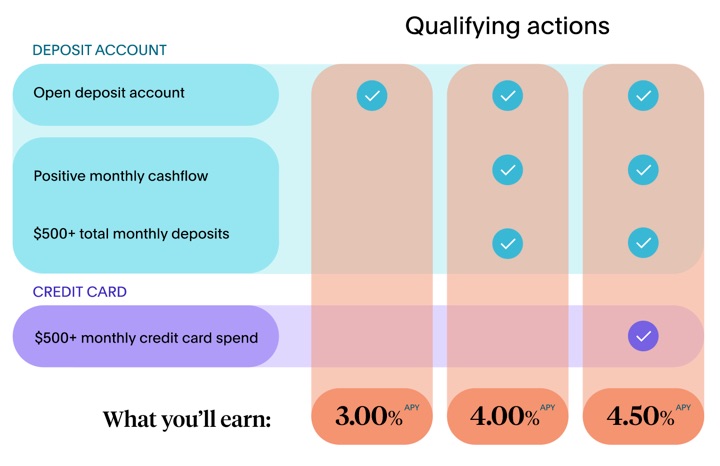

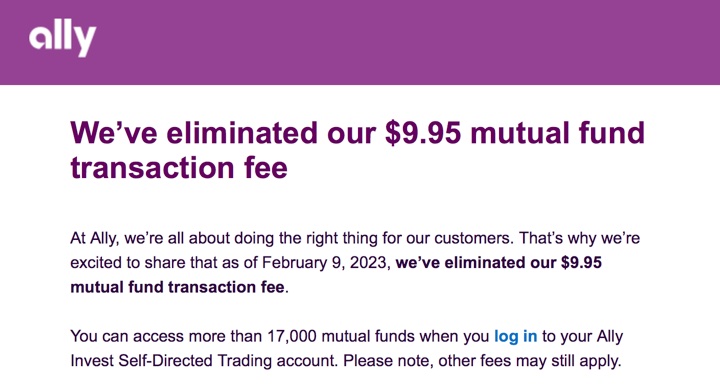

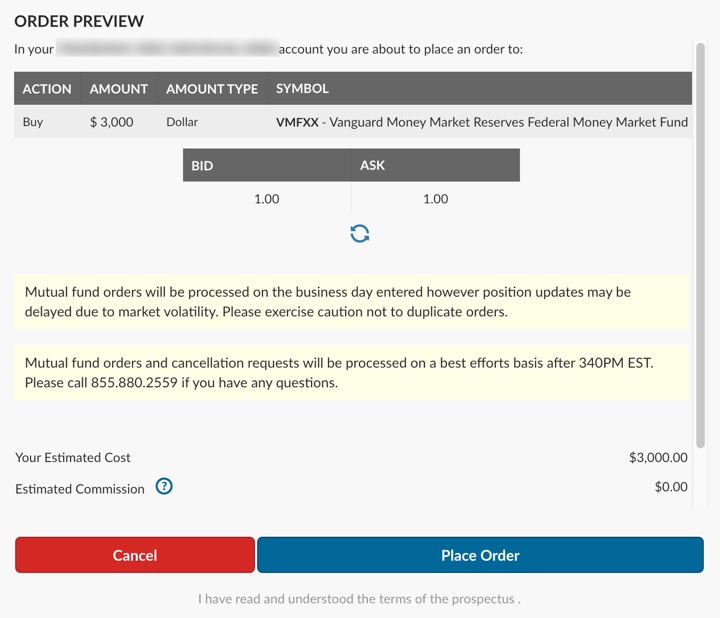

Here’s my monthly roundup of the best interest rates on cash as of March 2023, roughly sorted from shortest to longest maturities. We all need some safe assets for cash reserves or portfolio stability, and there are often lesser-known opportunities available to individual investors. Check out my

Here’s my monthly roundup of the best interest rates on cash as of March 2023, roughly sorted from shortest to longest maturities. We all need some safe assets for cash reserves or portfolio stability, and there are often lesser-known opportunities available to individual investors. Check out my

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)