Update: Tiicker has added a few new Perks for Real Good Foods, the most direct one being a $100 Amazon gift card for holding 50 shares of RGF with no minimum holding period. There are also other bigger perks for holding a lot more shares for at least a week. The bid/ask spread was about 10 cents, so it cost about $5 to buy/sell 50 shares quickly. You can get this even if you already got the previous $50 gift card from owning RGF (now expired). Limited quantities.

Original post:

TiiCKER is a new app that helps promote certain brands and companies by encouraging people to become shareholders and investors. (They say “ii” stands for individual investor.) In the past, Wrigley used to give out free packs of gum to shareholders, Dial used to give out soap coupons, Colgate-Palmolive gave out discounts on toothpaste, and so on. Shareholder perks are still somewhat popular in Japan, from baseball tickets to bags of rice. Found via DoC. Here are the perks currently available:

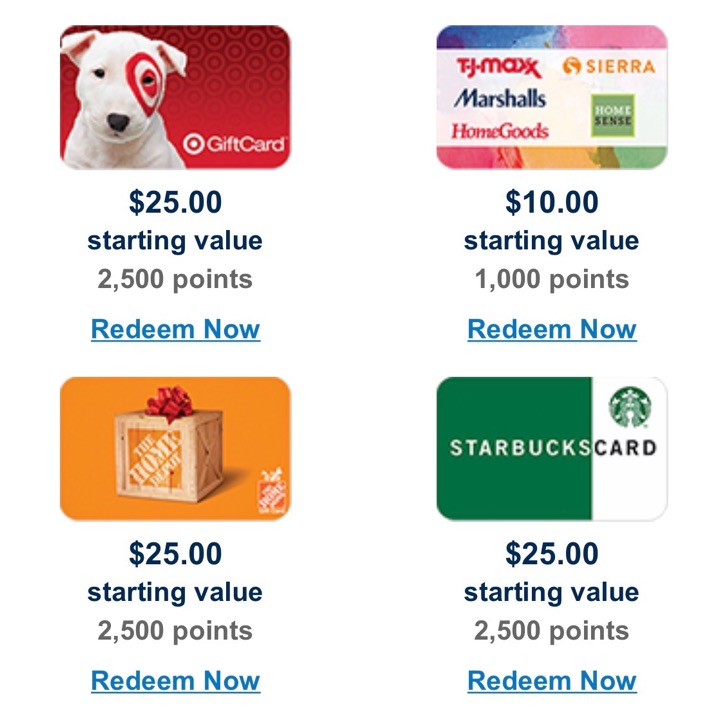

- Link a brokerage with $100 worth of ANY stocks held inside, get $11 Amazon gift card or Visa virtual prepaid debit card.

- (EXPIRED?) Link a brokerage with $50 worth of Amazon (AMZN) stock held inside (partial shares allowed), get $10 Amazon gift card or Visa virtual prepaid debit card.

- (EXPIRED) Link a brokerage with $50 worth of Real Good Foods (RGF) held inside, get $50 Instacart gift card. Limited quantities.

- (There are other perks available, please see Tiicker site for current list.)

Sometimes they require a minimum holding period, but the perks above currently do not. A few screenshots of an expired perk:

In order to prove your ownership, you must link your existing brokerage account via the Plaid service. Plaid says it does not save nor share your username and passwords with anyone, and with many brokerages, you now log in directly on your brokerage website for authentication.

I can report that I was able to sign-up, link my account via Plaid, and grab the first two bonuses in under 5 minutes. Since this is not a brokerage account, no SSN was required. Gift card redemption was instant and easy. You may need to refresh or unlink/relink your brokerage account after buying the shares for it to recognize a new purchase, or possibly wait up to 24 hours. In many cases, the perk is quite valuable compared the cost of buying and selling the shares, although this can get tricky when the holding period is longer. In addition, I have noticed this “RealGood” brand at Whole Foods and may try it now, so hey, this marketing may actually work…

Tiicker has a referral program, although the reward is vague: “Spread the word and help others discover investor perks. Refer 5 friends and receive a free TiiCKER perk!” If you wish, you can use my my referral link. Thanks if you do.

Capital One 360 has a new special

Capital One 360 has a new special

Primis Bank is relatively unknown, but is sure to gather some new deposits with their

Primis Bank is relatively unknown, but is sure to gather some new deposits with their

While updating my posts on

While updating my posts on

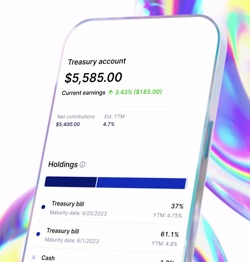

Investing app Public just announced a

Investing app Public just announced a  As inflation spiked, so did interest in purchasing inflation-linked

As inflation spiked, so did interest in purchasing inflation-linked  Here’s my monthly roundup of the best interest rates on cash as of January 2023, roughly sorted from shortest to longest maturities. We all need some safe assets for cash reserves or portfolio stability, and there are often lesser-known opportunities available to individual investors. Check out my

Here’s my monthly roundup of the best interest rates on cash as of January 2023, roughly sorted from shortest to longest maturities. We all need some safe assets for cash reserves or portfolio stability, and there are often lesser-known opportunities available to individual investors. Check out my

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)