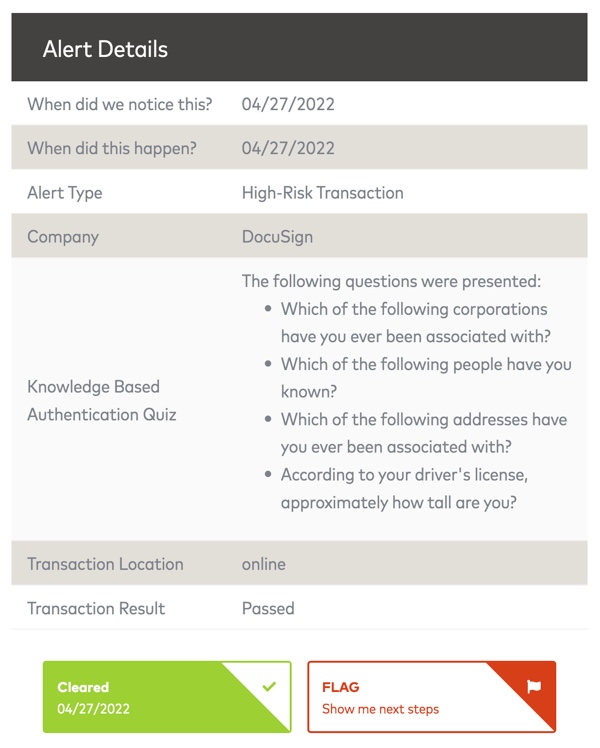

Update April 2022: Just a quick update that this has been a useful, additional free identity theft protection service. Today, I electronically signed some “power of attorney”-type papers through Docusign and they had me answer some identity verification questions like “which address have you been associated with?” that pulled from my credit reports and driver’s license data. Immediately, I got the following alert from Mastercard Identity Protection that even included the exact questions asked:

Previously, this service has also alerted me that my personal information like name/email have been found in data breaches from random websites like autoexpresscars.com and drivesure.com. These are all events that did not trigger any alerts from my other credit bureau-based monitoring services. Therefore, I feel signing up for this additional free service rounds them out. Services like Docusign are useful but open you up to potentially more severe cases of fraud.

Original post:

Data breaches are scary fact of life these days. If you have a Mastercard, did you know that they offer a Mastercard ID Theft Protection service to cardholders for free? If you activate it, Mastercard has paid on your behalf for a private-label identity theft protection service provided by Generali Global Assistance, Inc. (GGA). The same way that Safeway doesn’t actually make their generic version of Cheerios, Mastercard has outsourced this service. Thanks to reader Bill P for the tip.

Data breaches are scary fact of life these days. If you have a Mastercard, did you know that they offer a Mastercard ID Theft Protection service to cardholders for free? If you activate it, Mastercard has paid on your behalf for a private-label identity theft protection service provided by Generali Global Assistance, Inc. (GGA). The same way that Safeway doesn’t actually make their generic version of Cheerios, Mastercard has outsourced this service. Thanks to reader Bill P for the tip.

Services are provided by Generali Global Assistance, Inc. (GGA), one of the largest providers of private-label identity protection services in the United States. GGA has handled thousands of identity-related cases and has protected millions of customers since it began offering the service in 2003. GGA’s in-house identity theft resolution specialists are certified identity theft risk management specialists – CITRMS® certification by the Institute of Consumer Financial Education (ICFE) and FCRA-certification (Fair Credit Reporting Act by the Consumer Data Industry Association).

You’ll receive an alert if there’s a change to your TransUnion credit report (e.g., new inquiries, new accounts, updated personal information by creditors). That’s nice, but I already get more comprehensive coverage from all three bureaus than this from my combination of Credit Sesame, Credit Karma, and FreeCreditScore.

The difference that caught my eye was their emphasis on full-service, human help if you do become a victim of identity theft. Emphasis mine:

This program is designed to help protect you from identity theft and provide full-service, hands-on assistance in the event of an incident. Studies have shown that the largest cost to victims of identity theft is lost time and stress associated with figuring out how to restore their identity, including replacing cards and documents while communicating with creditors to dispute fraudulent activity. In the event of an incident, we will assign you with a personal case manager to help you resolve issues, saving you countless hours and reducing the stress associated with identity theft.

Their package of services includes: identity theft affidavit assistance and submission, creditor notification, dispute and follow-up, 3-bureau fraud alert placement, inform police/legal authorities, placement of credit freeze and opt-out services provided by certified identity theft resolution specialists.

These could be hollow claims, but hopefully they are truly helpful in taking care of these things on your behalf. If you have a Mastercard, it may be another worthwhile service to add to your defenses.

Nothing like a

Nothing like a  There are many apps in the “reloadable debit card for kids” category, where parents can transfer money into their account and kids can spend it. However, I have been looking for a better app that can illustrate the power of compound interest and deferred gratification.

There are many apps in the “reloadable debit card for kids” category, where parents can transfer money into their account and kids can spend it. However, I have been looking for a better app that can illustrate the power of compound interest and deferred gratification.

I had to double-check the date when I received the press release for this product to make sure it wasn’t April 1st. 🤯

I had to double-check the date when I received the press release for this product to make sure it wasn’t April 1st. 🤯  Wells Fargo has a $1,500 bonus offer if you open a new business checking account in a physical branch with a

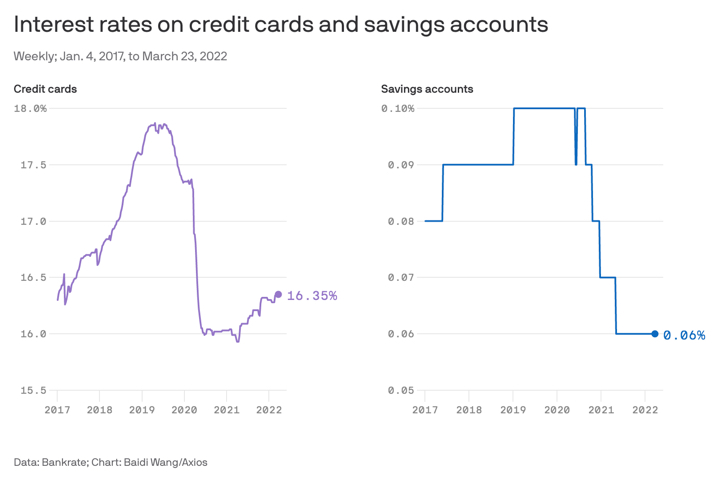

Wells Fargo has a $1,500 bonus offer if you open a new business checking account in a physical branch with a  Here’s my monthly roundup of the best interest rates on cash as of April 2022, roughly sorted from shortest to longest maturities (useful for both cash reserves and as possible bond substitutes). I look for lesser-known opportunities available to individuals while still maintaining FDIC insurance or equivalent. Check out my

Here’s my monthly roundup of the best interest rates on cash as of April 2022, roughly sorted from shortest to longest maturities (useful for both cash reserves and as possible bond substitutes). I look for lesser-known opportunities available to individuals while still maintaining FDIC insurance or equivalent. Check out my

After a delay of two years, my family finally used up our flight credits and stash of hotel points to travel internationally to Vancouver and Whistler, British Columbia for some snow-filled fun. I was a bit worried about how well my “budget” cellular service

After a delay of two years, my family finally used up our flight credits and stash of hotel points to travel internationally to Vancouver and Whistler, British Columbia for some snow-filled fun. I was a bit worried about how well my “budget” cellular service

Many online banking, stock trading, crypto, and fintech apps use the Plaid service to provide easy funding via your existing bank accounts. The price of this convenience is that you are providing some very sensitive data to a small, private company. They have your bank login information and can see all your transaction data. (Visa was in an agreement to acquire Plaid for over $5 billion, but it was cancelled to due

Many online banking, stock trading, crypto, and fintech apps use the Plaid service to provide easy funding via your existing bank accounts. The price of this convenience is that you are providing some very sensitive data to a small, private company. They have your bank login information and can see all your transaction data. (Visa was in an agreement to acquire Plaid for over $5 billion, but it was cancelled to due  The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)