Here’s my monthly roundup of the best interest rates on cash as of March 2022, roughly sorted from shortest to longest maturities. I look for lesser-known opportunities available to individuals while still keeping your principal FDIC-insured or equivalent. I use this information for both my cash reserves and as possible bond substitutes. Check out my Ultimate Rate-Chaser Calculator to see how much extra interest you’d earn by moving money between accounts. Rates listed are available to everyone nationwide. Rates checked as of 3/7/2022.

Here’s my monthly roundup of the best interest rates on cash as of March 2022, roughly sorted from shortest to longest maturities. I look for lesser-known opportunities available to individuals while still keeping your principal FDIC-insured or equivalent. I use this information for both my cash reserves and as possible bond substitutes. Check out my Ultimate Rate-Chaser Calculator to see how much extra interest you’d earn by moving money between accounts. Rates listed are available to everyone nationwide. Rates checked as of 3/7/2022.

Significant changes since last month: Pretty quiet. 7.12% Savings I Bonds still available if you haven’t done it yet. Treasury rates around the 1 and 2 year terms are rising, as with CD rates overall. In general, there still doesn’t seem to be much upside to locking in any length of CD at somewhere around 1% APY when there are so many short-term options nearly as good (or better). I like keeping my options open while waiting to see how much rates rise in 2022.

Fintech accounts

Available only to individual investors, fintech companies often pay higher-than-market rates in order to achieve fast short-term growth (often using venture capital). “Fintech” is usually a software layer on top of a partner bank’s FDIC insurance.

- 4% APY on $2,000/$6,000. Current offers 4% APY on up to $2,000 on each of their “savings pods”. Free users get 1 savings pod, while premium users get 3 savings pods. Potential promos include $50 bonus and “Premium free for life”. Please see my Current app review for details.

- 3% APY on up to $100,000, but requires direct deposit and credit card spend. HM Bradley pay 3% APY if you open both a checking and credit card with them, and maintain $1,500 in total direct deposit each month and make $100 in credit card purchases each month. Please see my updated HM Bradley review for details.

- 3% APY on 10% of direct deposits + 1% APY on $25,000. One Finance lets you earn 3% APY on “auto-save” deposits (up to 10% of your direct deposit, up to $1,000 per month). Separately, they also pay 1% APY on up to another $25,000 with direct deposit. New customer $50 bonus via referral. See my One Finance review.

- 3% APY on up to $15,000, requires direct deposit and credit card transactions. Porte requires a one-time direct deposit of $1,000+ to open a savings account. Porte then requires $3,000 in direct deposits and 15 debit card purchases per quarter (average $1,000 direct deposit and 5 debit purchases per month) to receive 3% APY on up to $15,000. New customer bonus via referral. See my Porte review.

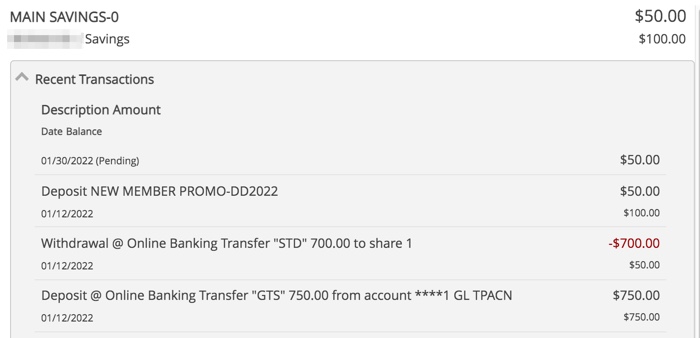

- 1.20% APY on up to $50,000. You must maintain a $500 direct deposit each month for this balance cap, otherwise you’ll still earn 1.20% on up to $5,000. They also pay 4% on USDC stablecoin, but I avoid this as it is not FDIC-insured (and you can get higher rates elsewhere if you did want to hold USDC.) New customer $50 bonus via referral. See my OnJuno review.

- 1.00% APY on up to $50,000 per account. SoFi is now offering 1% APY on the first $50k each of their checking, savings, and Vault accounts ($150k total possible). You must maintain a direct deposit each month of any amount. Convenient if you already have a relationship with them. $25 new Sofi Money account bonus. See my roundup of current SoFi bonuses.

High-yield savings accounts

Since the huge megabanks pay essentially no interest, I think every should have a separate, no-fee online savings account to accompany your existing checking account. The interest rates on savings accounts can drop at any time, so I list the top rates as well as competitive rates from banks with a history of competitive rates. Some banks will bait you with a temporary top rate and then lower the rates in the hopes that you are too lazy to leave.

- T-Mobile Money is still at 1.00% APY with no minimum balance requirements. The main focus is on the 4% APY on your first $3,000 of balances as a qualifying T-mobile customer plus other hoops, but the lesser-known fact is that the 1% APY is available for everyone. Thanks to the readers who helped me understand this. Unfortunately, some readers have reported their applications being denied.

- AdelFi (formerly ECCU) is offering new members 1.01% APY on up to $25,000 when you bundle a High-Yield Money Market Account & Basic Checking. (Existing members can get 0.75% APY.) To join this credit union, you must attest to their statement of faith.

- There are several other established high-yield savings accounts at closer to 0.50% APY. Marcus by Goldman Sachs is on that list, and if you open a new account with a Marcus referral link (that’s mine), they will give you and the referrer a 1.00% APY for your first 3 months (a 0.50% boost). You can then extend this by referring others.

Short-term guaranteed rates (1 year and under)

A common question is what to do with a big pile of cash that you’re waiting to deploy shortly (plan to buy a house soon, just sold your house, just sold your business, legal settlement, inheritance). My usual advice is to keep things simple and take your time. If not a savings account, then put it in a flexible short-term CD under the FDIC limits until you have a plan.

- No Penalty CDs offer a fixed interest rate that can never go down, but you can still take out your money (once) without any fees if you want to use it elsewhere. CFG Bank has a 13-month No Penalty CD at 0.70% APY with a $500 minimum deposit. Ally Bank has a 11-month No Penalty CD at 0.50% APY for all balance tiers. Marcus has a 13-month No Penalty CD at 0.65% APY with a $500 minimum deposit. You may wish to open multiple CDs in smaller increments for more flexibility.

- Comenity Direct has a 1-year CD at 1.00% APY ($1,500 min). Early withdrawal penalty is 180 days of interest.

Money market mutual funds + Ultra-short bond ETFs

Many brokerage firms that pay out very little interest on their default cash sweep funds (and keep the difference for themselves). Unfortunately, money market fund rates are very low across the board right now. Ultra-short bond funds are another possible alternative, but they are NOT FDIC-insured and may experience short-term losses at times. These numbers are just for reference, not a recommendation.

- The default sweep option is the Vanguard Federal Money Market Fund which has an SEC yield of 0.01%.

- Vanguard Ultra-Short-Term Bond Fund currently pays 0.97% SEC yield ($3,000 min) and 1.07% SEC Yield ($50,000 min). The average duration is ~1 year, so your principal may vary a little bit.

- The PIMCO Enhanced Short Maturity Active Bond ETF (MINT) has a 0.85% SEC yield and the iShares Short Maturity Bond ETF (NEAR) has a 0.86% SEC yield while holding a portfolio of investment-grade bonds with an average duration of ~6 months.

Treasury Bills and Ultra-short Treasury ETFs

Another option is to buy individual Treasury bills which come in a variety of maturities from 4-weeks to 52-weeks. You can also invest in ETFs that hold a rotating basket of short-term Treasury Bills for you, while charging a small management fee for doing so. T-bill interest is exempt from state and local income taxes. Right now, this section isn’t very interesting as T-Bills are yielding close to zero!

- You can build your own T-Bill ladder at TreasuryDirect.gov or via a brokerage account with a bond desk like Vanguard and Fidelity. Here are the current Treasury Bill rates. As of 3/7/2022, a new 4-week T-Bill had the equivalent of 0.17% annualized interest and a 52-week T-Bill had the equivalent of 1.05% annualized interest.

- The Goldman Sachs Access Treasury 0-1 Year ETF (GBIL) has a 0.05% SEC yield and the SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL) has a -0.05% (!) SEC yield. GBIL appears to have a slightly longer average maturity than BIL.

US Savings Bonds

Series I Savings Bonds offer rates that are linked to inflation and backed by the US government. You must hold them for at least a year. If you redeem them within 5 years there is a penalty of the last 3 months of interest. The annual purchase limit for electronic I bonds is $10,000 per Social Security Number, available online at TreasuryDirect.gov. You can also buy an additional $5,000 in paper I bonds using your tax refund with IRS Form 8888.

- “I Bonds” bought between November 2021 and April 2022 will earn a 7.12% rate for the first six months. The rate of the subsequent 6-month period will be based on inflation again. More on Savings Bonds here.

- In mid-April 2022, the CPI will be announced and you will have a short period where you will have a very close estimate of the rate for the next 12 months. I will have another post up at that time.

- See below about EE Bonds as a potential long-term bond alternative.

Prepaid Cards with Attached Savings Accounts

A small subset of prepaid debit cards have an “attached” FDIC-insured savings account with exceptionally high interest rates. The negatives are that balances are severely capped, and there are many fees that you must be careful to avoid (lest they eat up your interest). There is a long list of previous offers that have already disappeared with little notice. I don’t personally recommend nor use any of these anymore, as I feel the work required and risk of messing up exceeds any small potential benefit.

- Mango Money pays 6% APY on up to $2,500, if you manage to jump through several hoops. Requirements include $1,500+ in “signature” purchases and a minimum balance of $25.00 at the end of the month.

Rewards checking accounts

These unique checking accounts pay above-average interest rates, but with unique risks. You have to jump through certain hoops which usually involve 10+ debit card purchases each cycle, a certain number of ACH/direct deposits, and/or a certain number of logins per month. If you make a mistake (or they judge that you did) you risk earning zero interest for that month. Some folks don’t mind the extra work and attention required, while others would rather not bother. Rates can also drop suddenly, leaving a “bait-and-switch” feeling.

- Lafayette Federal Credit Union is offering 2.02% APY on balances up to $25,000 with a $500 minimum monthly direct deposit to their checking account. No debit transaction requirement. They are also offering new members a $100 bonus with certain requirements. Anyone can join this credit union via partner organization ($10 one-time fee).

- Quontic Bank is offering 1.01% APY on balances up to $150,000. May be useful for those with high balances. You need to make 10 debit card point of sale transactions of $10 or more per statement cycle required to earn this rate.

- The Bank of Denver pays 2.00% APY on up to $10,000 if you make 12 debit card purchases of $5+ each, receive only online statements, and make at least 1 ACH credit or debit transaction per statement cycle. If you meet those qualifications, you can also link a Kasasa savings account that pays 1.00% APY on up to $25k. Thanks to reader Bill for the updated info.

- Presidential Bank pays 2.25% APY on balances between $500 and up to $25,000, if you maintain a $500+ direct deposit and at least 7 electronic withdrawals per month (ATM, POS, ACH and Billpay counts).

- Evansville Teachers Federal Credit Union pays 3.30% APY on up to $20,000. You’ll need at least 15 debit transactions and other requirements every month.

- Lake Michigan Credit Union pays 3.00% APY on up to $15,000. You’ll need at least 10 debit transactions and other requirements every month.

- Find a locally-restricted rewards checking account at DepositAccounts.

Certificates of deposit (greater than 1 year)

CDs offer higher rates, but come with an early withdrawal penalty. By finding a bank CD with a reasonable early withdrawal penalty, you can enjoy higher rates but maintain access in a true emergency. Alternatively, consider building a CD ladder of different maturity lengths (ex. 1/2/3/4/5-years) such that you have access to part of the ladder each year, but your blended interest rate is higher than a savings account. When one CD matures, use that money to buy another 5-year CD to keep the ladder going. Some CDs also offer “add-ons” where you can deposit more funds if rates drop.

- NASA Federal Credit Union has a special 49-month Share Certificate at 1.70% APY ($10,000 min of new funds). Early withdrawal penalty is 1 year of interest. They also have a 15-month special at 1.05% APY and 9-month at 0.80% APY.

Anyone can join this credit union by joining the National Space Society (free). However, NASA FCU will perform a hard credit check as part of new member application. - KS StateBank has a 5-year CD at 1.90% APY ($500 min). Early withdrawal penalty is 18 months of interest.

- You can buy certificates of deposit via the bond desks of Vanguard and Fidelity. You may need an account to see the rates. These “brokered CDs” offer FDIC insurance and easy laddering, but they don’t come with predictable early withdrawal penalties. Right now, I see a 5-year CD at 2.00% APY. Be wary of higher rates from callable CDs listed by Fidelity.

Longer-term Instruments

I’d use these with caution due to increased interest rate risk, but I still track them to see the rest of the current yield curve.

- Willing to lock up your money for 10 years? You can buy long-term certificates of deposit via the bond desks of Vanguard and Fidelity. These “brokered CDs” offer FDIC insurance, but they don’t come with predictable early withdrawal penalties. You might find something that pays more than your other brokerage cash and Treasury options. Right now, I see a 10-year CD at 2.40% APY vs. 1.77% for a 10-year Treasury. Watch out for higher rates from callable CDs from Fidelity.

- How about two decades? Series EE Savings Bonds are not indexed to inflation, but they have a unique guarantee that the value will double in value in 20 years, which equals a guaranteed return of 3.5% a year. However, if you don’t hold for that long, you’ll be stuck with the normal rate which is quite low (currently 0.10%). I view this as a huge early withdrawal penalty. But if holding for 20 years isn’t an issue, it can also serve as a hedge against prolonged deflation during that time. Purchase limit is $10,000 each calendar year for each Social Security Number. As of 3/7/2022, the 20-year Treasury Bond rate was 2.29%.

All rates were checked as of 3/7/2022.

WeBull 12 Free Fractional Stocks Offer

WeBull 12 Free Fractional Stocks Offer SoFi Invest Free $25 in Stock Offer

SoFi Invest Free $25 in Stock Offer TradeUP Free Stocks Offer

TradeUP Free Stocks Offer Public Free Stock Offer

Public Free Stock Offer Robinhood Free Stock Offer

Robinhood Free Stock Offer Did you know that there exists a tuition-free, accredited, online university where you can obtain an Bachelor’s degree in Computers Science, MBA, or Masters in Education for a tiny fraction of the cost of traditional universities? The

Did you know that there exists a tuition-free, accredited, online university where you can obtain an Bachelor’s degree in Computers Science, MBA, or Masters in Education for a tiny fraction of the cost of traditional universities? The

Amazon Prime has announced the following price increases (note that some links will show up if you are viewing this via e-mail newsletter, please read online):

Amazon Prime has announced the following price increases (note that some links will show up if you are viewing this via e-mail newsletter, please read online):

Lafayette Federal Credit Union (LFCU) has a respectable history of offering competitively-priced banking products. I recently joined and here is a quick review of their current promotions and the application process. Highlights:

Lafayette Federal Credit Union (LFCU) has a respectable history of offering competitively-priced banking products. I recently joined and here is a quick review of their current promotions and the application process. Highlights:

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)