Total Wireless is an Verizon MVNO that while not the overall cheapest, can be the best value to remain the Verizon network if you don’t require unlimited data. $25/month gets you unlimited talk, text, and 1GB data. $35/month gets you 5 GB. Right now, if you visit their website and look at the bottom right, you should see a form to submit your email for a unique 25% off coupon code (max discount of $100) when you buy both a phone and a plan card. This can result in some very cheap prices on select new and used phones including the iPhone SE, iPhone 8+, and other Android phones.

Total Wireless is an Verizon MVNO that while not the overall cheapest, can be the best value to remain the Verizon network if you don’t require unlimited data. $25/month gets you unlimited talk, text, and 1GB data. $35/month gets you 5 GB. Right now, if you visit their website and look at the bottom right, you should see a form to submit your email for a unique 25% off coupon code (max discount of $100) when you buy both a phone and a plan card. This can result in some very cheap prices on select new and used phones including the iPhone SE, iPhone 8+, and other Android phones.

New iPhone SE 64GB and $25 plan card for $287.49 total:

New iPhone 8+ 128GB and $25 plan card for $250 total:

I personally would lean toward the iPhone SE 2020 with fast internals, or maybe the iPhone 8+ if you want the bigger screen. Shipping should be free as well.

Alternatively, you can try the promo code FALL15 for 15% off a phone + plan purchase.

Visible is another Verizon MVNO where if you are willing to do some legwork and maintain a “Party”, you can get unlimited data for $25 a month. If you need that much data yet, one option would be to use these discounted phone prices and stay on Total for 12 months, at which point they will allow you to unlock your phone to use on any carrier, and then you can move to Visible.

If you are an Amazon Prime member, check if you are targeted for a free 30-day trial to Audible Premium Plus which will include

If you are an Amazon Prime member, check if you are targeted for a free 30-day trial to Audible Premium Plus which will include

Here’s my monthly roundup of the best interest rates on cash for September 2020, roughly sorted from shortest to longest maturities. I track these rates because I keep 12 months of expenses as a cash cushion and also invest in longer-term CDs (often at lesser-known credit unions) when they yield more than bonds. Check out my

Here’s my monthly roundup of the best interest rates on cash for September 2020, roughly sorted from shortest to longest maturities. I track these rates because I keep 12 months of expenses as a cash cushion and also invest in longer-term CDs (often at lesser-known credit unions) when they yield more than bonds. Check out my  Mortgage rates have hit another all-time low, with some 30-year fixed rate mortgages below 3% and 15-year fixed below 2.5%. I know that many folks have already refinanced successfully, but these lower rates may offer even more homeowners the ability to lower their payments and/or pay off their home sooner. Importantly, Fannie Mae and Freddie Mac announced an additional 0.5% fee on refinances that was supposed to start on 9/1, but that was just

Mortgage rates have hit another all-time low, with some 30-year fixed rate mortgages below 3% and 15-year fixed below 2.5%. I know that many folks have already refinanced successfully, but these lower rates may offer even more homeowners the ability to lower their payments and/or pay off their home sooner. Importantly, Fannie Mae and Freddie Mac announced an additional 0.5% fee on refinances that was supposed to start on 9/1, but that was just

Walmart is rolling out a membership program

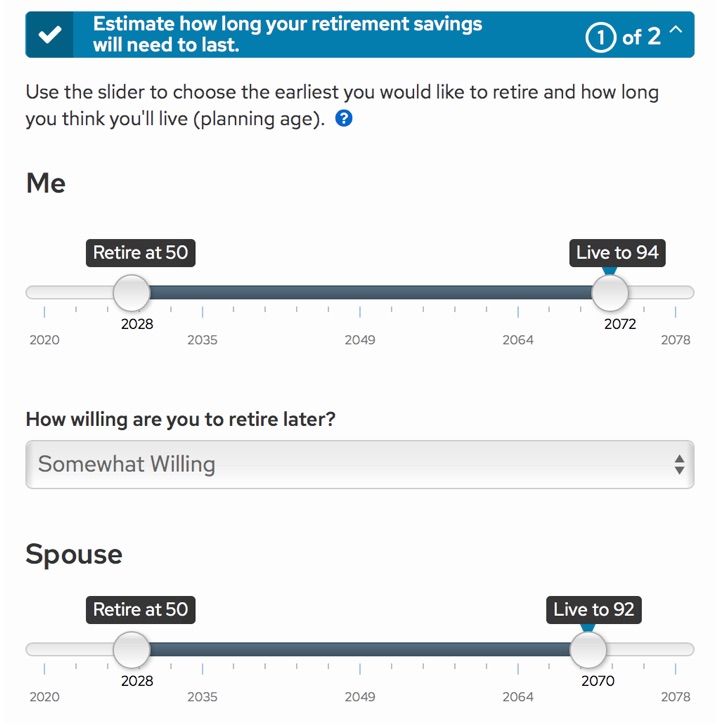

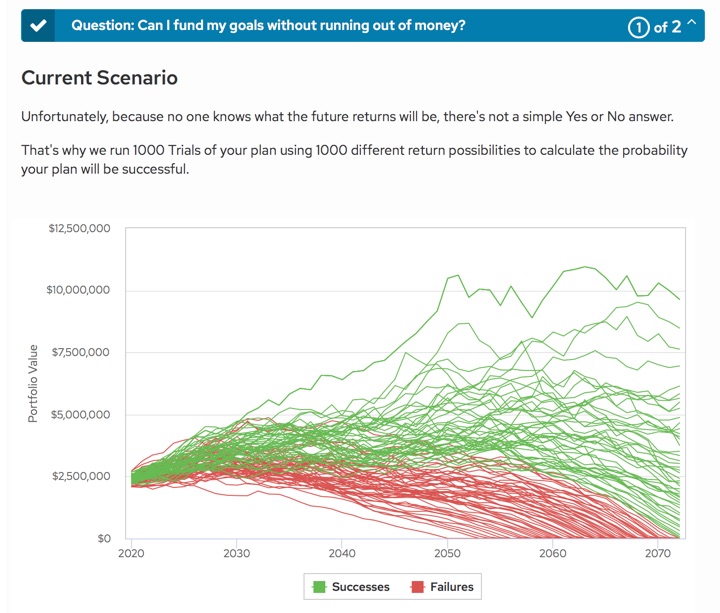

Walmart is rolling out a membership program  Schwab has rolled out a new digital financial planning tool called

Schwab has rolled out a new digital financial planning tool called

Interest rates on liquid savings accounts keep dropping, making bank bonuses more attractive on a relative basis. Opening new accounts are more hassle, so I usually want at least double the interest rates I could get by doing nothing. This

Interest rates on liquid savings accounts keep dropping, making bank bonuses more attractive on a relative basis. Opening new accounts are more hassle, so I usually want at least double the interest rates I could get by doing nothing. This  Financial institutions increasingly want all of your money under one roof. Brokerage firms and robo-advisors are adding savings accounts and debit cards. Banks want to let you trade stocks. If you have built up some sizeable assets, you can make extra money when they decide to pay you to move over your assets. Try them out, see if you like them, and move again if you need to.

Financial institutions increasingly want all of your money under one roof. Brokerage firms and robo-advisors are adding savings accounts and debit cards. Banks want to let you trade stocks. If you have built up some sizeable assets, you can make extra money when they decide to pay you to move over your assets. Try them out, see if you like them, and move again if you need to.

The CFA Institute Research Foundation publishes some short finance ebooks on Amazon Kindle that qualify as continuing education credits for Chartered Financial Analysts (CFAs), a type of investment professional certification.

The CFA Institute Research Foundation publishes some short finance ebooks on Amazon Kindle that qualify as continuing education credits for Chartered Financial Analysts (CFAs), a type of investment professional certification.  The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)