ETFs are surpassing mutual funds as the standard building blocks of stock and bond portfolios. Here’s a closer look at the latest updates to the Charles Schwab commission-free ETF list. While the commercials often focus on quantity instead of quality, I will do the opposite. Here are the factors that I think are important:

ETFs are surpassing mutual funds as the standard building blocks of stock and bond portfolios. Here’s a closer look at the latest updates to the Charles Schwab commission-free ETF list. While the commercials often focus on quantity instead of quality, I will do the opposite. Here are the factors that I think are important:

- Total Assets. This is a measure of popularity and reputation. A more popular ETF will have a smaller bid/ask spread and won’t have to liquidate in a bear market. A more reputably ETF manager will have lower index tracking error. However, ETF size isn’t everything.

- Index/Asset Class. What index does it track? Does that index cover an asset class that I want to include??

- Cost. What is the expense ratio? Low costs are important.

Schwab Commission-Free ETF full list. This Schwab ETF OneSource page includes a full list of their 503 commission-free ETFs.

Brief history of changes. In early February 2019, Schwab announced that it would increase the number of commission-free ETFs on their list to 503 as of March 1st, 2019, including no early redemption fees (no minimum holding period). Here is the list of 246 added ETFs, including 90 iShares ETFs.

Schwab’s ETF OneSource started in February 2013 with 103 commission-free ETFs including many in-house ETFs. Schwab has become very competitive with Vanguard and iShares by developing their own brand of low-cost, index ETFs. Outside providers now include: Aberdeen Standard Investments, ALPS Advisors, DWS Group, Direxion, Global X ETFs, IndexIQ, Invesco, iShares ETFs, John Hancock Investments, J.P. Morgan Asset Management, OppenheimerFunds, PIMCO, State Street Global Advisors SPDR® ETFs, USCF, WisdomTree and Charles Schwab Investment Management.

In March 2017, Schwab dropped their standard stock commission to $4.95 per trade + $0.65 per options contract. In addition, expenses for the Schwab market cap-weighted index mutual funds were lowered to match their Schwab ETF equivalents. Schwab Index mutual funds now have no investment minimum.

Largest ETFs on Schwab Commission-Free ETF list. Here are the top 20 most popular ETFs on their list, sorted by largest total assets. Also listed are the asset class and expense ratios.

| ETF Name (Ticker) | Asset Class | Expense Ratio |

| iShares Core U.S. Aggregate Bond ETF (AGG) | US Total Bond | 0.05% |

| iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) | US Corporate Bonds | 0.15% |

| iShares Edge MSCI Min Vol USA ETF (USMV) | US Low Volatility | 0.15% |

| iShares TIPS Bond ETF (TIP) | US Inflation-Protected Bond | 0.19% |

| iShares 1-3 Year Treasury Bond ETF (SHY) | Short-Term Treasury Bond | 0.15% |

| iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB) | Emerging Markets Bond | 0.39% |

| Schwab International Equity ETF (SCHF) | International Developed | 0.06% |

| iShares MBS ETF (MBB) | US Mortage-Backed Bonds | 0.09% |

| iShares MSCI Japan ETF (EWJ) | International Country Stock | 0.47% |

| iShares iBoxx $ High Yield Corporate Bond ETF (HYG) | US High-Yield Corporate Bond | 0.49% |

| Invesco S&P 500® Equal Weight ETF (RSP) | US Large-Capk | 0.20% |

| Schwab U.S. Large-Cap ETF (SCHX) | US Large Cap Blend | 0.03% |

| Schwab U.S. Broad Market ETF (SCHB) | US Total Stock | 0.03% |

| iShares 7-10 Year Treasury Bond ETF (IEF) | Interm-Term Treasury Bond | 0.15% |

| iShares National AMT-Free Muni Bond ETF (MUB) | Municipal Bond | 0.07% |

| iShares 20+ Year Treasury Bond ETF (TLT) | Long-Term Treasury Bond | 0.15% |

| iShares Edge MSCI Min Vol EAFE ETF (EFAV) | International Developed Stock | 0.20% |

| iShares Short-Term Corporate Bond ETF (IGSB) | US Short-Term Corporate Bond | 0.06% |

| Invesco S&P 500® Low Volatility ETF (SPLV) | US Large-Cap Stock | 0.25% |

| iShares Edge MSCI USA Quality Factor ETF (QUAL) | US Large-Cap Stock | 0.15% |

Lowest Expense Ratio ETFs on Schwab Commission-Free ETF list. Here are the top 20 cheapest ETFs on their list, sorted by lowest expense ratio.

| ETF Name (Ticker) | Asset Class | Expense Ratio |

| Schwab U.S. Broad Market ETF (SCHB) | US Total Stock | 0.03% |

| Schwab U.S. Large-Cap ETF (SCHX) | US Large Cap Blend | 0.03% |

| SPDR Portfolio Large Cap ETF (SPLG) | US Large Cap Blend | 0.03% |

| SPDR Portfolio Total Stock Market ETF (SPTM) | US Total Stock | 0.03% |

| SPDR Portfolio Developed World ex-US ETF (SPDW) | International Developed Stock | 0.04% |

| Schwab U.S. Aggregate Bond ETF (SCHZ) | International Developed Large Cap Blend | 0.04% |

| SPDR Portfolio Aggregate Bond ETF (SPAB) | US Total Bond | 0.04% |

| Schwab U.S. Large-Cap Growth ETF (SCHG) | US Large-Cap Growth | 0.04% |

| SPDR Portfolio S&P 500 Growth ETF (SPYG) | US Large-Cap Growth | 0.04% |

| Schwab U.S. Large-Cap Value ETF (SCHV) | US Large-Cap Value | 0.04% |

| SPDR Portfolio S&P 500 Value ETF (SPYV) | US Large-Cap Value | 0.04% |

| Schwab U.S. Mid-Cap ETF (SCHM) | US Mid-Cap | 0.04% |

| Schwab U.S. Small-Cap ETF (SCHA) | US Small-Cap | 0.04% |

| Schwab U.S. TIPS ETF (SCHP) | US Inflation-Protected Bond | 0.05% |

| Schwab 1000 Index ETF (SCHK) | US Large-Cap Blend | 0.05% |

| SPDR Portfolio Mid Cap ETF (SPMD) | US Mid-Cap | 0.05% |

| SPDR Portfolio Small Cap ETF (SPSM) | US Small-Cap | 0.05% |

| SPDR Bloomberg Barclays Corporate Bond ETF (CBND) | US Corporate Bond | 0.06% |

| Schwab International Equity ETF (SCHF) | International Developed | 0.06% |

| Schwab Intermediate-Term U.S. Treasury (SCHR) | US Treasury Bond | 0.06% |

Commentary. Overall, Schwab’s OneSource ETF list does include a good mix of Schwab ETFs with good management, low costs, and low bid/ask spreads. There are also a few good iShares and SPDR ETFs that could be potential ETF pairs for tax-loss harvesting. A DIY investor should find it easy create a diversified portfolio of ETFs according to their desired asset allocation, if you know what you are looking for. With 500+ ETFs, many will be short-lived duds, while still others are ETFs that track a very similar index but are much more expensive than the competition.

Here’s my monthly roundup of the best interest rates on cash for April 2019, roughly sorted from shortest to longest maturities. The big news is that we are starting to see some slight rate drops in CDs! Folks who locked in at 4% APY may end up pleased they did. Check out my

Here’s my monthly roundup of the best interest rates on cash for April 2019, roughly sorted from shortest to longest maturities. The big news is that we are starting to see some slight rate drops in CDs! Folks who locked in at 4% APY may end up pleased they did. Check out my  Each year, Barron’s releases their list of top online brokers. I like read and share it, hoping to find deeper insights into industry trends and specific broker features. However, this year their 2019 rankings article is firmly behind a paywall. That is certainly their right, but it also discourages sharing and discussion. (I am a paying subscriber to the NY Times, WSJ, and Bloomberg Businessweek, but not Barron’s.)

Each year, Barron’s releases their list of top online brokers. I like read and share it, hoping to find deeper insights into industry trends and specific broker features. However, this year their 2019 rankings article is firmly behind a paywall. That is certainly their right, but it also discourages sharing and discussion. (I am a paying subscriber to the NY Times, WSJ, and Bloomberg Businessweek, but not Barron’s.) ETFs are surpassing mutual funds as the standard building blocks of stock and bond portfolios. Therefore, I’m taking a closer look at the latest commission-free ETF lists from the major brokers. Unfortunately, the marketing often focuses on quantity instead of quality. Who cares if they offer 500+ ETFs, if I only need six good ones? Here are the factors that I think are important:

ETFs are surpassing mutual funds as the standard building blocks of stock and bond portfolios. Therefore, I’m taking a closer look at the latest commission-free ETF lists from the major brokers. Unfortunately, the marketing often focuses on quantity instead of quality. Who cares if they offer 500+ ETFs, if I only need six good ones? Here are the factors that I think are important: Update: Sprint has replaced this offer with their

Update: Sprint has replaced this offer with their  I find it interesting how Domino’s Pizza rescued themselves from oblivion by (1) improving the taste of their pizzas so they don’t remind you of cardboard and (2) fully embracing mobile (lazy) ordering. Their smartphone app lets you apply coupons easily, order quickly, and tracks your order in real-time. There have so many business articles about this turnaround that they created a website to track them all at

I find it interesting how Domino’s Pizza rescued themselves from oblivion by (1) improving the taste of their pizzas so they don’t remind you of cardboard and (2) fully embracing mobile (lazy) ordering. Their smartphone app lets you apply coupons easily, order quickly, and tracks your order in real-time. There have so many business articles about this turnaround that they created a website to track them all at

I’m never really sure what to call it, but Marcus (formerly Goldman Sachs Bank) is offering a $100 bonus if you deposit $10,000+ in new funds into their online savings account within 10 days of enrollment at this special offer page. You must enroll by 11:59pm EST on 3/18/19 and maintain the new $10,000+ deposit for 90 days. They will deposit $100 into your account within 14 days, after those 90 days (got it?). Both new and existing customers are eligible, which is nice.

I’m never really sure what to call it, but Marcus (formerly Goldman Sachs Bank) is offering a $100 bonus if you deposit $10,000+ in new funds into their online savings account within 10 days of enrollment at this special offer page. You must enroll by 11:59pm EST on 3/18/19 and maintain the new $10,000+ deposit for 90 days. They will deposit $100 into your account within 14 days, after those 90 days (got it?). Both new and existing customers are eligible, which is nice.  Updated 2019. Let’s say you are a DIY investor and doing some research on some mutual funds. You decide to learn more about the Vanguard Intermediate-Term Tax-Exempt Fund. You pull up the Morningstar quote pages (ticker

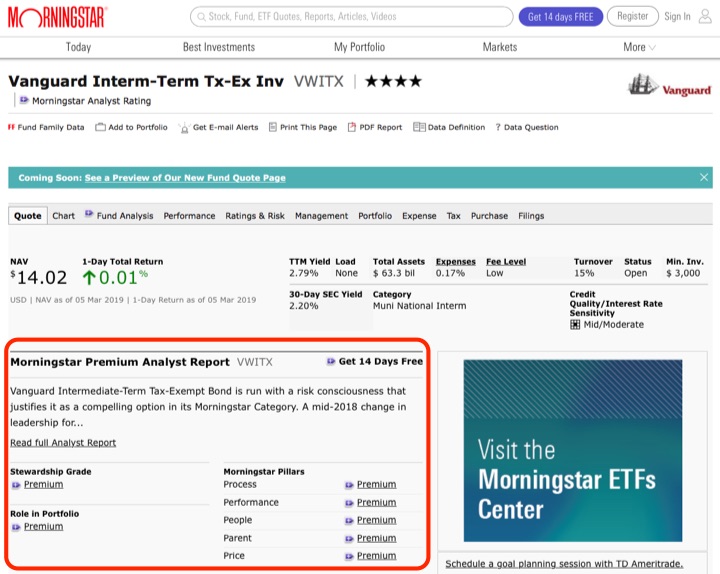

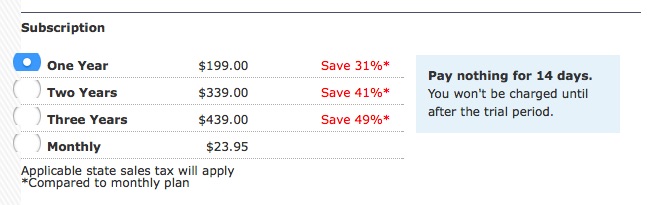

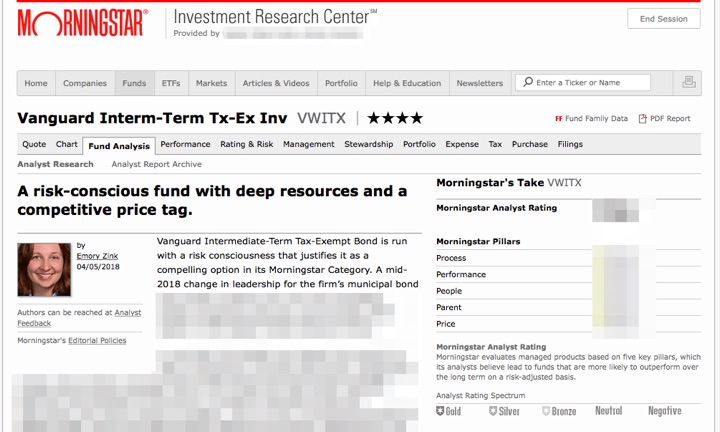

Updated 2019. Let’s say you are a DIY investor and doing some research on some mutual funds. You decide to learn more about the Vanguard Intermediate-Term Tax-Exempt Fund. You pull up the Morningstar quote pages (ticker

DiscountMags.com is running their

DiscountMags.com is running their  The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)