Mercury Magazines offers free subscriptions if you fill out their professional profile. If you provide accurate information, they will present trade publications that are applicable to your field, which is partially how they fund these offers. I have also read that sometimes magazines will offer deep discounts in order to improve their circulation numbers (which in turns make them able to charge advertisers more money). Availability will go in and out of stock.

Mercury Magazines offers free subscriptions if you fill out their professional profile. If you provide accurate information, they will present trade publications that are applicable to your field, which is partially how they fund these offers. I have also read that sometimes magazines will offer deep discounts in order to improve their circulation numbers (which in turns make them able to charge advertisers more money). Availability will go in and out of stock.

- Money (2 years)

- Time

- Fortune (2 years)

- Autoweek (1 year)

- Health

- House Beautiful (1 year)

- Men’s Health (1 year)

- Veranda (1-year)

Thanks to reader Hannah and SD. In my experience, this company is legit and I have gotten free magazines from them in the past. You should not have to enter a credit card (consider using an alias and temporary email as well). You will get a renewal “bill” when the subscription ends, but you can either ignore it or send it back with “cancel” written on the invoice. I would just make sure you actually want to read them, otherwise it’s a lot of wasted paper that piles up.

Andrews Federal Credit Union has a few

Andrews Federal Credit Union has a few  The benefit of “old-school” desktop tax software is that it doesn’t require your Social Security Number and financial details to be stored in the “cloud”, a fancy word for a third-party server where it can be copied or hacked. Here’s a limited-time deal on H&R Block Tax Software 2018 (PC/Mac download or physical CD).

The benefit of “old-school” desktop tax software is that it doesn’t require your Social Security Number and financial details to be stored in the “cloud”, a fancy word for a third-party server where it can be copied or hacked. Here’s a limited-time deal on H&R Block Tax Software 2018 (PC/Mac download or physical CD).

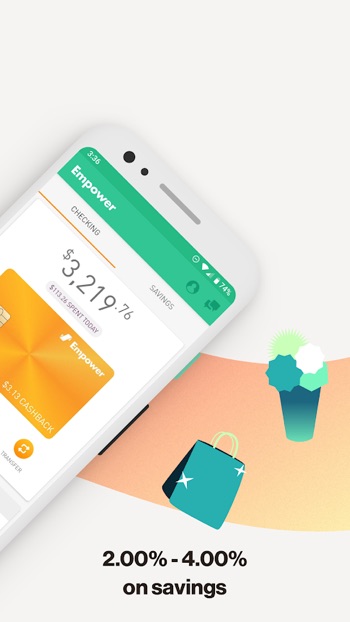

Here’s my monthly roundup of the best interest rates on cash for February 2019, roughly sorted from shortest to longest maturities. Check out my

Here’s my monthly roundup of the best interest rates on cash for February 2019, roughly sorted from shortest to longest maturities. Check out my  The

The

The benefit of “old-school” desktop tax software is that it doesn’t require your Social Security Number and financial details to be stored in the “cloud” at at time when everything is being hacked. Here’s a limited-time deal on TurboTax 2018 that includes a $10 Amazon gift card. That brings it down to an effective net price of $29.99 for TurboTax Deluxe Fed/State and $44.99 for Premier Fed/State. Found via

The benefit of “old-school” desktop tax software is that it doesn’t require your Social Security Number and financial details to be stored in the “cloud” at at time when everything is being hacked. Here’s a limited-time deal on TurboTax 2018 that includes a $10 Amazon gift card. That brings it down to an effective net price of $29.99 for TurboTax Deluxe Fed/State and $44.99 for Premier Fed/State. Found via

ETA (Executive Travel App) is an app that scans your calendar to automatically suggest travel options (hotels, flights, Uber) based on your calendar and personal travel preferences.

ETA (Executive Travel App) is an app that scans your calendar to automatically suggest travel options (hotels, flights, Uber) based on your calendar and personal travel preferences. The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)