While I understand the arguments for a “total return” approach, I also appreciate the behavioral reasons why living off income while keeping your ownership stake is desirable. The analogy I fall back on is owning an investment property that produces rental income. If you are reliably getting rent checks that increase with inflation, you can sit back calmly and let the market value fluctuate. The problem is that buy only things with the highest yields only increases the chance that those yields will drop. Therefore, I am trying to reach some sort of balance between the two approaches.

A quick and dirty way to see how much income (dividends and interest) your portfolio is generating is to take the “TTM Yield” or “12 Mo. Yield” from Morningstar (linked below). Trailing 12 Month Yield is the sum of a fund’s total trailing 12-month interest and dividend payments divided by the last month’s ending share price (NAV) plus any capital gains distributed over the same period. SEC yield is another alternative, but I like TTM because it is based on actual distributions (SEC vs. TTM yield article).

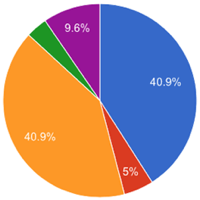

Below is a close approximation of my most recent portfolio update. I have changed my asset allocation slightly to 65% stocks and 35% bonds because I believe that will be my permanent allocation upon early retirement.

| Asset Class / Fund | % of Portfolio | Trailing 12-Month Yield (Taken 4/19/17) | Yield Contribution |

| US Total Stock Vanguard Total Stock Market Fund (VTI, VTSAX) |

25% | 1.88% | 0.47% |

| US Small Value Vanguard Small-Cap Value ETF (VBR) |

5% | 1.83% | 0.09% |

| International Total Stock Vanguard Total International Stock Market Fund (VXUS, VTIAX) |

25% | 2.75% | 0.69% |

| Emerging Markets Vanguard Emerging Markets ETF (VWO) |

5% | 2.31% | 0.12% |

| US Real Estate Vanguard REIT Index Fund (VNQ, VGSLX) |

6% | 4.42% | 0.27% |

| Intermediate-Term High Quality Bonds Vanguard Intermediate-Term Tax-Exempt Fund (VWIUX) |

17% | 2.87% | 0.49% |

| Inflation-Linked Treasury Bonds Vanguard Inflation-Protected Securities Fund (VAIPX) |

17% | 2.20% | 0.37% |

| Totals | 100% | 2.50% |

The total weighted 12-month yield on this portfolio has historically varied between 2% and 2.5%. This time, it was on the higher end of 2.50% mostly because inflation has picked up and thus the TIPS fund started to yield more. If I had a $1,000,000 portfolio balance today, a 2.5% yield means that it would have generated $25,000 in interest and dividends over the last 12 months. (The muni bond interest in my portfolio is exempt from federal income taxes.)

For comparison, the Vanguard LifeStrategy Moderate Growth Fund (VSMGX) is a low-cost, passive 60/40 fund that has a trailing 12-month yield of 2.12%. The Vanguard Wellington Fund is a low-cost active 65/35 fund that has a trailing 12-month yield of 2.55%. Numbers taken 4/19/2017.

These income yield numbers are significantly lower than the 4% withdrawal rate often quoted for 65-year-old retirees with 30-year spending horizons, and is even lower than the 3% withdrawal rate that I usually use as a rough benchmark. If I use 3%, my theoretical income would cover my projected annual expenses. If I used the actual numbers above, I am close but still short. Most people won’t want to use this number because it is a very small number. However, I like it for the following reasons:

- Tracking dividends and interest income is less stressful than tracking market price movements.

- Dividend yields adjust roughly for stock market valuations (if prices are high, dividend yield is probably down).

- Bond yields adjust roughly for interest rates (low interest rates now, probably low bond returns in future).

- With 2/3rds of my portfolio in stocks, I have confidence that over time the income will increase with inflation.

I will admit that planning on spending only 2% is most likely too conservative. Consider that if all your portfolio did was keep up with inflation each year (0% real returns), you could still spend 2% a year for 50 years. But as an aspiring early retiree with hopefully 40+ years ahead of me, I like having safe numbers given the volatility of stock returns and the associated sequence of returns risk.

It has been a while, so here is a 2016 First Quarter update on my investment portfolio holdings. This includes tax-deferred accounts like 401ks, IRAs, and taxable brokerage holdings, but excludes things like our primary home and cash reserves (emergency fund). The purpose of this portfolio is to create enough income to cover household expenses.

It has been a while, so here is a 2016 First Quarter update on my investment portfolio holdings. This includes tax-deferred accounts like 401ks, IRAs, and taxable brokerage holdings, but excludes things like our primary home and cash reserves (emergency fund). The purpose of this portfolio is to create enough income to cover household expenses.

I like the idea of living off dividend and interest income. Who doesn’t? The problem is that you can’t just buy stocks with the highest dividend yields and junk bonds with the highest interest rates without giving up something in return. There are many bad investments lurking out there for desperate retirees looking only at income. My goal is to generate reliable portfolio income by not reaching too far for yield.

I like the idea of living off dividend and interest income. Who doesn’t? The problem is that you can’t just buy stocks with the highest dividend yields and junk bonds with the highest interest rates without giving up something in return. There are many bad investments lurking out there for desperate retirees looking only at income. My goal is to generate reliable portfolio income by not reaching too far for yield.

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)