Credit Card Debt

In the past, I have taken money from credit cards at 0% APR and placed it into online savings accounts, bank CDs, or savings bonds that earn 4-5% interest (much less recently), and keeping the difference as profit. I even put together a series of step-by-step posts on how to make money off of credit cards in this way.

However, given the current lack of great no fee 0% APR balance transfer offers, I am no longer playing this “game” and have just paid off my last 0% offer for now. This makes the net worth chart a bit funny, but it should clear up next month.

Retirement and Brokerage accounts

Our total investment portfolio increased by a few thousand dollars since last month. DW’s 401k was already maxed out at $16,500. I made another $1,000 contribution to my Solo 401k, for a total of $16,500 contributed in 2009 as well. (I forgot the limit was $16,500 and not $15,500 last month…) This makes us done with our goal of maxing out both our 401k salary contributions for 2009.

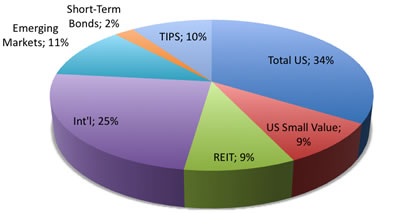

I am starting to build up too much cash, and have started investing for retirement in a taxable brokerage account as well. In the interest of tax efficiency, I’ll have to move around some investments in order to keep bonds in the tax-advantaged IRAs/401k and the “extra” stocks in taxable. I expect to finish investing $20,000 this week.

Taking that additional 20k into account, our total retirement portfolio is now $211,095, or on an estimated after-tax basis, $170,047. At a 4% withdrawal rate, this would provide $567 per month in tax-free retirement income, which brings me to 23% of my long-term goal of $2,500 per month.

Cash Savings and Emergency Funds

We keep a year’s worth of expenses in our emergency fund. Another $10,000 is earmarked for upcoming home improvement projects that I keep putting off (minor roof repair and solar water heating).

Home Value

I am no longer using any internet home valuation tools to track home value. Some people have suggested using my tax assessed value, but I also think that is too high. I simply picked what I felt is a conservative number based on recent comparables, $480,000, and keep it for at least 6 months if not a year. (Currently on month 2 out of 6.) For the most part I am concerned about mortgage payoff, which I still plan to accomplish in 20 years at most.

You can view previous net worth updates here.

Meet Bill and Jan. They are my imaginary couple that loves putting their personal finances on auto-pilot. They don’t worry about bill due dates, they never visit the bank, and only check their balances online once a month if there are no e-mail alerts sent to them. (Apparently they also don’t have lips or eyes, so it works well for them…) Let’s take a look at how they do it!

Meet Bill and Jan. They are my imaginary couple that loves putting their personal finances on auto-pilot. They don’t worry about bill due dates, they never visit the bank, and only check their balances online once a month if there are no e-mail alerts sent to them. (Apparently they also don’t have lips or eyes, so it works well for them…) Let’s take a look at how they do it!

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)