The entire Jim Cramer interview with Jon Stewart last night are now up on TheDailyShow.com. It’s split up into a few parts, here is the first one:

It was kind of fun to see Cramer squirm a little bit (deny everything!), but I think most experienced investors would find very little surprising out of it. Making fun of CNBC and Cramer is like shooting fish in a barrel. Cramer should have known they would dig up this video of him mocking the SEC. I’m surprised he showed up at all. He definitely took one for the CNBC team.

Even Stewart admits Cramer isn’t the real problem, which is that the purpose of 99% of the financial industry is not to make you rich. It’s too extract money from you, while you think they might make you rich. From brokers to hedge funds to bloated 401(k) plans. Cramer was worth millions before starting Mad Money, guess where that money came from? And CNBC is part of that machine. Hopefully more people realized it after tonight.

CNBC is financial porn. It’s air-brushed to look better than reality, and is scripted for your entertainment. Do people really want to watch responsible reporting on CNBC? Invest in index funds. Don’t trade too much. Don’t look at the Dow ticker every five minutes. I’m not so sure that would sell. Still, will TDS kill Mad Money like they nuked Crossfire? That would be impressive.

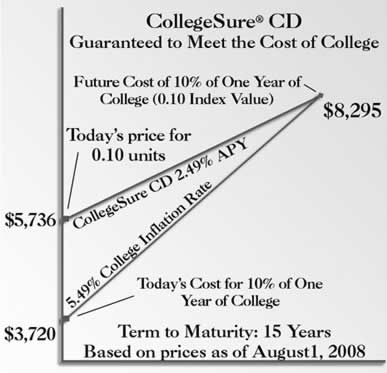

But especially in times of low interest rates, people start to look for just a bit more yield. Even SmartMoney magazine has gotten caught up in the act. Check out their cover this month.

But especially in times of low interest rates, people start to look for just a bit more yield. Even SmartMoney magazine has gotten caught up in the act. Check out their cover this month.

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)