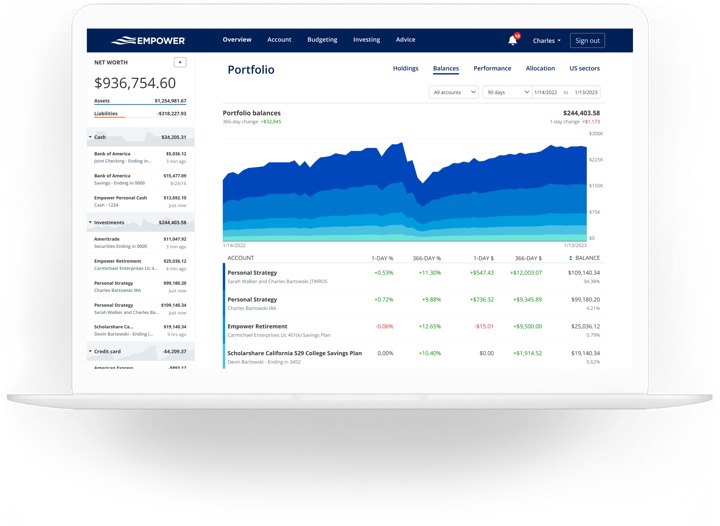

If you’ve looked at your portfolio and wondered exactly how much US stocks have outperformed the rest of the world, Charlie Bilello shares in his July 4th post USA! USA! USA!:

Over the last 16 years, US stocks have gained 502% vs. 104% for International stocks and 65% for Emerging Markets. This is by far the longest cycle of US outperformance that we’ve ever seen.

Will the gap continue to grow? I still don’t know, which is why I will continue to hedge my bets. Sometimes you shell out for insurance and it doesn’t pay out a claim. That doesn’t necessarily mean you should complain. I’m satisfied with my portfolio performance over the last 16 years. I couldn’t predict what happened, and I can’t predict how the next 16 years will go. I’d happily take another 16 years of the same, even if it means lagging the S&P 500 by a lot.

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)