If you got in on the free iPod shuffle offer or the $24 ex24.com referral bonus offer, be aware that as of 9/30 ex24.com has changed their commission schedule so that it actually costs money to sell your share of stock. Before it was free. I already sold my 1 share of Costco for a slight profit, so I’m good. Just a heads up. Here is a link to the new ex24.com fee schedule. So if you want to unload now is a good time!

Delta and Northwest Airlines File For Bankruptcy

Well, it happened. Delta Air and Northwest Air both filed for Chapter 11 Bankruptcy. Check out the 1-Year charts for Delta [DAL] and Northwest [NWAC]. This is going to be bad for current and future pensioners. United already broke its promise to workers and left them with about 60% of their expected retirement money. I have relatives in the airline industry and they needed to hear this like they needed a hole in the head. How would you like to hear that your 401k got chopped by a 1/3rd? And of course taxpayers will be footing the bill through the Pension Benefit Guaranty Corp. (PBGC). Delta’s pensions are already underfunded by $10.6 billion. Sheesh.

[Read more…]

More on Capital One 360 Prime Rate Trust and Loan-Participation Funds

First, I’d just like to say just because I’m talking about a certain stock or bond doesn’t mean I’m recommending it or going to go out and buy tomorrow. I love learning about new areas of investing, and right now my focus is on increasing the yield on my cash funds for short-term time horizons. Accordingly, I’ve been reading the articles I mentioned in my previous post on ING Prime Rate Trust. First let’s break this down a bit to my level of understanding.

What’s going on? Corporations need money for their operations. Each corporation is given a credit rating by a company like Moody’s, sort of like the Equifax for businesses, as to how credit-worthy they are. Obviously, the higher the risk for default, the higher the interest rates they are charged. Banks loan money to these corporations, and one type of loan is called a floating-rate loan, in which the rate adjusts like an adjustable rate mortage with an index rate, like the LIBOR. Then loan-participation funds like ING Prime Rate Trust (PPR) invest in a diversified portfolio of these loans, focusing on those with less than investment-grade credit ratings.

[Read more…]

Higher Yields with Closed-End ETFs?

I was catching up with my magazine reading when I came across this article in the August 2005 issue of Kiplinger’s Personal Finance* – ‘Big Yields, Not-so-big Risks’. It introduced me to these closed-end loan funds, that trade like stocks, which invest in low-grade bank loans and produce dividend yields of about 6%. Let’s focus one of their examples, ING Prime Cap Trust (symbol: PPR). This fund caught my eye for obvious reasons.

It currently offers a yield of 6.60%, and is actually trading below it’s Net Asset Value. It has a really high annual expense ratio of 3.17%, but that seems to be the norm for these types of funds. What I really need to gauge is how much risk I am taking on for that appetizing extra yield.

[Read more…]

Capital One 360 Mutual Funds Brief Review (Verdict: Not Good)

Did you know that Capital One 360 sells mutual funds? Dubbed the 360 Investment Account, I guess they are trying some cross-selling of their 360 Savings Account. I don’t own any of them, but a visitor asked about them, so I decided to take a look since I was interested myself. Reminder – I’m not a financial professional.

It seems like they run 9 no-load mutual funds, covering some but not all asset classes like Large Cap, Mid Cap, Small Cap, International, and Bonds. You can only buy them from Capital One 360. You can also buy a mix of the funds in 3 basket portfolios – Conservative, Moderate, or Aggressive. You must already have a savings account with them to open an investment account. I found the information from the website pretty sparse, so I delved into the prospectus and also gave them a call at 1-866-BUY-FUND. I was surprised by what I found:

[Read more…]

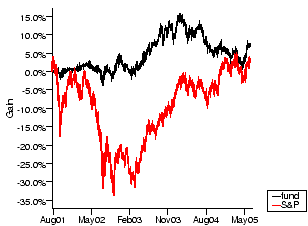

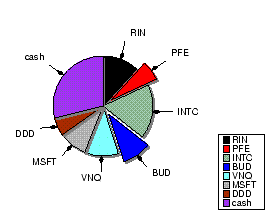

MMBPM Stock Portfolio Check-In

I’m not the type of person to obsessively check stock quotes throughout the day, but I think I’d like to start documenting my stock performance periodically. I last did this two months ago for my MyMoneyBlog Play Money portfolio (tracked at OpenPortfolios), in my post MMBPM beats the S&P 500! (*by pure luck). Since then, I haven’t made any trades, although I have been doing more and more reading into ETFs. I’m really considering selling all my stocks and rebuilding my portfolio with ETFs instead, but I don’t think I’m ready yet. Anyways, here’s my current snapshot:

[Read more…]

How to Beat the Market?

Don’t worry, I haven’t turned into some financial “advisor”. I was researching ETFs for my 401k roll-over, and came across this article from RadicalGuides: Turning Taxes to Your Advantage. As you know, I’m a index fund (or ETF I guess) guy. I think it is really hard for an mutual fund with active management to beat the market indices over time, and is really hard to pick ahead of time which ones will do so. So is the writer of this article, but he/she points out a possible new way of using ETFs to make tax-loss selling legal and profitable. Sound confusing? It did to me too, I ended up making up a simple example to wrap my head around it. I’m not 100% sure it is right, please let me know if I am wrong!

[Read more…]

Turning the Costco & ShareBuilder offer $50/$75 Opening Bonus into $1000+

I’m really not the hugest fan of ShareBuilder, but it seems to be pretty successful. Right now, in partnership with Costco, they are offering a $50 bonus and 10% rebate on transaction fees to Gold/Business Members, and a $75 bonus and 25% fee rebate to Executive Members that open up a new account and make one transaction (trade). Make sure you use the promo code ‘COSTCOEP50’ or ‘COSTCOEP75’ to get this promotion.

I’m going to open up an account, but not as my main brokerage account. Since this is free money, I’m going to put it in something fun and risky! Here’s my plan:

1. Go to the ShareBuilder website and apply. Be sure to enter the correct promotional code in the blank.

2. Deposit $50 of my own money (to make the 1st trade).

3. Pick the Basic Plan with no monthly maintance fees and $4 trade.

4. Buy $46 of any stock or ETF. $4 will go towards the trade.

5. Wait the 4-6 weeks for my $50 bonus.

6. Withdraw my $50 bonus. Net cost to me: nothing!

7. Don’t touch the account or make any more trades for 20-30 years. Hopefully they last that long.

Why? This is free money, they don’t even run a credit check when you open the account. If you want to sell a stock, they charge $15.95. That cuts into the bonus so much it’s not worth the effort just to get some bonus money. On the other hand, why not invest in something with a high potential return and take advantage of their lack of maintenance fees?

Emerging Markets are an asset class that invests in the performance of the world’s major emerging markets, including South Korea, South Africa, China, Taiwan, India, Russia, Brazil, and over 200 others. It is characterized as being risky, but with a high overall average annual return over time of about 17%! Of course, it is very volatile in the meantime. You should not put a lot of your portfolio in this stuff.

But with free money, why not? $46, invested at an 17% average rate, over 20 years, is $1062! Over 30 years, it’s $5109! Yes, inflation will devalue the final amount, and you’ll pay capital gains when you finally sell, but it’s not bad for 10 minutes and loaning out $50 for a month. I think Sharebuilder automatically reinvests dividends, but not sure, I’ll have to check again.

Now you could to this ‘plan’ with any volatile stock, but I like the index since it’s very very very unlikely to go completely belly-up, unlike some random pharmaceutical company. Thoughts welcome! I haven’t made the trade yet, I’ve opened the account and am waiting for it to fund.

Is anyone else getting investment spam?

Every morning I check my e-mail, I get more and more spam related to hot stock picks and get-rich investment ideas. I get very few ads for Viagra, other male enhancement products, or even pirated Microsoft softare. Is anyone else getting this? My e-mail address is public, so I guess it could be harvested by a robot, but it just feels so targeted. And what is it with spammers and poor spelling and grammar skills? Like I’m going to buy a stock with “promsing asdn specualtive future”…

MMBPM beats the S&P 500! (*by pure luck)

I was tinkering around with my stock portfolio MMBPM again and cleaned up some more transactions. I think it’s all correct now, complete with stock splits and commissions. Check it out (as of 6/17/05):

MMBPM beats the S&P 500! (*by pure luck)

I was tinkering around with my stock portfolio MMBPM again and cleaned up some more transactions. I think it’s all correct now, complete with stock splits and commissions. Check it out (as of 6/17/05):

MyMoneyBlog Play Money now moved to OpenPortfolios.com

My stock portfolio, previously named the MyMoneyBlog Play Money (MMBPM) fund, is now moved here at OpenPortfolios.com. Previously, I was keeping track of it at a separate blog space, MMBPM, but that was getting a bit dry as I haven’t been doing nearly as much trading for fun as I thought I might. OpenPortfolios.com is run (partly? mostly?) by my friend Stephen of IRA-Cam, and offers to help host your investment accounts, keep track of its performance, and also share it with others (ergo the “open” part). Check it out, it’s cool!

This way, I can see the performance versus difference indices whenever I want. It took me a while to input all my previous trades, but I’m done! I’m happy to see I’m still in the black, barely.

I want to type more, but I’m pooped. Jury Duty stinks. More later.

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)