Charles Munger is probably best known as the Vice Chairman of Berkshire Hathaway and longstanding investing partner of Warren Buffett. However, he has also been the CEO and/or Chairman of the Board of multiple other companies. This means there many additional sources of knowledge and wisdom beyond just BRK shareholder letters. I recently discovered this huge 1,000 page compilation (PDF) of everything Munger, including annual letters from Blue Chip Stamps, Wesco, and Daily Journal as well as his op-ed contributions and transcripts of speeches. Found at ValueWalk, the PDF includes links to most of the individual sources inside as well. Thanks to all the folks that worked hard to preserve this material.

Charles Munger is probably best known as the Vice Chairman of Berkshire Hathaway and longstanding investing partner of Warren Buffett. However, he has also been the CEO and/or Chairman of the Board of multiple other companies. This means there many additional sources of knowledge and wisdom beyond just BRK shareholder letters. I recently discovered this huge 1,000 page compilation (PDF) of everything Munger, including annual letters from Blue Chip Stamps, Wesco, and Daily Journal as well as his op-ed contributions and transcripts of speeches. Found at ValueWalk, the PDF includes links to most of the individual sources inside as well. Thanks to all the folks that worked hard to preserve this material.

There was no table of contents, so I started making a list of all the goodies inside:

Annual Shareholder Letters and Meeting Transcripts

- Blue Chip Stamps, Annual Shareholder Letters, 1978-1982. Blue Chip Stamps was merged into Berkshire Hathaway in 1983.

- Wesco Financial Corporation, Annual Shareholder Letters and/or Meeting Notes, 1983-2010. Wesco Financial was officially merged into Berkshire Hathaway in 2011.

- Q&A sesssion with Charlie Munger July 1st, 2011. An event paid for by Charlie Munger after the Wesco merger.

- Daily Journal Corporation Annual Meeting Notes and/or Transcript, 2013-2018.

Speech Transcripts, Op-Eds, Interviews, Etc.

- Opinion Pieces, 1984.

- Speech by Charlie Munger to the Harvard School, 1986.

- Resignation of Mutual Savings from US League of Savings Institutions, May 30, 1989.

- A Lesson On Elementary, Worldly Wisdom As It Relates To Investment Management & Business, 1995.

- Practical Thought about Practical Thought?, 1996.

- Investment Practices of Leading Charitable Foundations, 1998.

- Foundation Financial Officers Group Master’s Class, 1999.

- A Perverse Use of Antitrust Law, 2000.

- Philanthropy Round Table, 2000

- Optimism Has No Place in Accounting, 2002

- The Great Financial Scandal of 2003

- Herb Kay Undergraduate Lecture at the University of California, Santa Barbara Economics Department, 2003.

- Munger speech at University of California, Santa Barbara, 2004.

- The Pyschology of Human Misjudgment,

- Charlie Munger – USC Commencement Speech 2007

- Sacrificing To Restore Market Confidence, 2009.

- Basically, It’s Over. A parable about how one nation came to financial ruin, 2009.

- Wantmore, Tweakmore, Totalscum, and the Tragedy of Boneheadia: A Parody about the Great Recession, 2011.

- A Conversation with Charlie Munger and Michigan Ross Dean Scott DeRue, 2017.

- Charlie Munger, Unplugged, 2019.

- Foreword to the Chinese Edition of Poor Charlie’s Almanack: The Wit and Wisdom of Charles T. Munger (by Louis Li).

This should keep me busy for a while!

Vanguard is making a

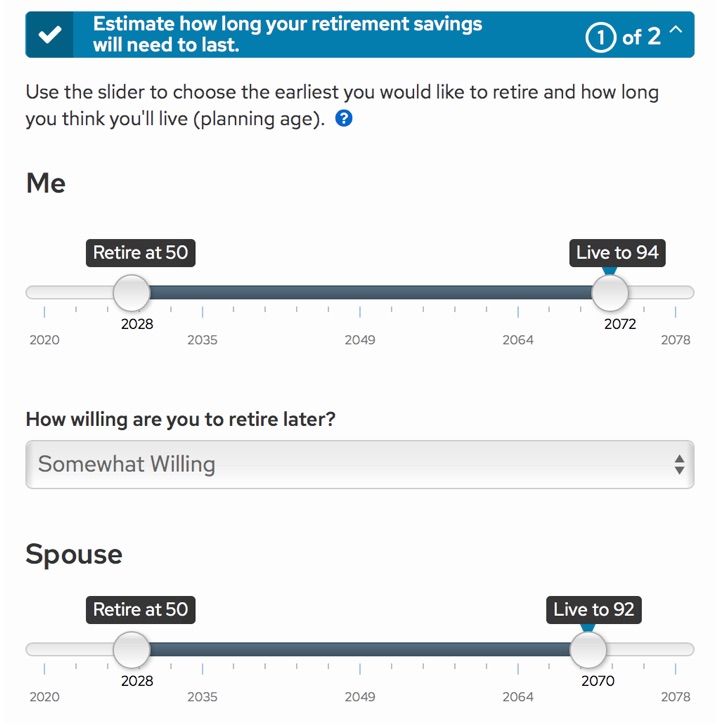

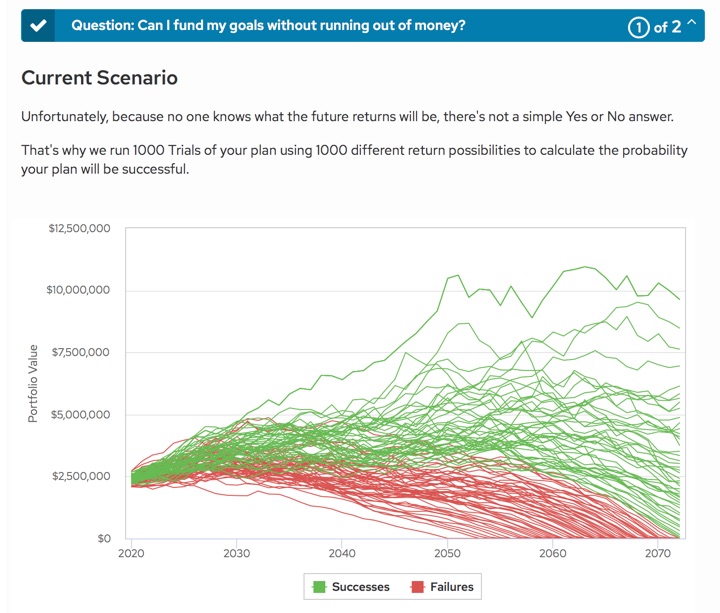

Vanguard is making a  Schwab has rolled out a new digital financial planning tool called

Schwab has rolled out a new digital financial planning tool called

Financial institutions increasingly want all of your money under one roof. Brokerage firms and robo-advisors are adding savings accounts and debit cards. Banks want to let you trade stocks. If you have built up some sizeable assets, you can make extra money when they decide to pay you to move over your assets. Try them out, see if you like them, and move again if you need to.

Financial institutions increasingly want all of your money under one roof. Brokerage firms and robo-advisors are adding savings accounts and debit cards. Banks want to let you trade stocks. If you have built up some sizeable assets, you can make extra money when they decide to pay you to move over your assets. Try them out, see if you like them, and move again if you need to.

The CFA Institute Research Foundation publishes some short finance ebooks on Amazon Kindle that qualify as continuing education credits for Chartered Financial Analysts (CFAs), a type of investment professional certification.

The CFA Institute Research Foundation publishes some short finance ebooks on Amazon Kindle that qualify as continuing education credits for Chartered Financial Analysts (CFAs), a type of investment professional certification.

Like many folks, I recently enjoyed the excellent musical Hamilton for the first time on Disney+. I’m a bit embarrassed to say it was also very educational (yes, I know its not 100% historically accurate). I never really thought about how precarious and up-for-debate everything was during the beginning of this country. If Hamilton never survived the war or wasn’t as persuasive, would there be a federal Treasury? I feel like the creator of this

Like many folks, I recently enjoyed the excellent musical Hamilton for the first time on Disney+. I’m a bit embarrassed to say it was also very educational (yes, I know its not 100% historically accurate). I never really thought about how precarious and up-for-debate everything was during the beginning of this country. If Hamilton never survived the war or wasn’t as persuasive, would there be a federal Treasury? I feel like the creator of this

The third book in the “Investing for Adults” series by William Bernstein is

The third book in the “Investing for Adults” series by William Bernstein is  The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)