Allan Roth is one of the financial planners whose independent opinions I have come to respect, and he shares seven takeaways from 40 years of financial planning. Financial Planning is an industry trade magazine targeted at (obviously) professional financial planners, but many of the articles are quite useful for DIY investors as well.

Allan Roth is one of the financial planners whose independent opinions I have come to respect, and he shares seven takeaways from 40 years of financial planning. Financial Planning is an industry trade magazine targeted at (obviously) professional financial planners, but many of the articles are quite useful for DIY investors as well.

Read the article first, but here are my personal interpretations of his lessons (not his words):

- A solid income and frugality both matter, but either one is not enough. He’s advised a high-income doctor with a net worth smaller than an emergency fund, and a 10X millionaire who is still afraid to spend their money. Both needed help.

- Many people overestimate their ability to handle real-world risk. He has seen firsthand how clients answer the theoretical, as compared to how they later react during a real-world market crisis. Same idea as how paper trading is not real trading.

- Indexing and low fees = higher returns. Some things take time to work out, especially when billions are spent on marketing against it.

- You can’t predict the future. Other people can’t predict the future. Market cap indexing means that you will own the winners, many of which will be companies that don’t even exist today. Own bonds for safety, and accept whatever yield there is. You can’t predict rates either. The problem is that someone will always get it right any given time, and they’ll be loud about it.

- The CFP designation doesn’t mean much (good or bad). CFP wants to be the gold standard for a professional financial planners, but they don’t do enough to put the clients first. It just means they have a minimum level of education, 2 years of industry experience, and chose to pay the annual dues that year. You could be a great planner without being a CFP, or a bad planner with multiple complaints and still be a CFP.

- Financial planners provide the greatest value in: “real planning, improving tax-efficiency, behavioral coaching, and insurance analysis.” That means this stuff is harder and often benefits from an outside perspective. Note that this list excludes stock-picking and market-timing.

Here’s my monthly roundup of the best interest rates on cash for November 2020, roughly sorted from shortest to longest maturities. I track these rates because I keep 12 months of expenses as a cash cushion and also invest in longer-term CDs (often at lesser-known credit unions) when they yield more than bonds. Check out my

Here’s my monthly roundup of the best interest rates on cash for November 2020, roughly sorted from shortest to longest maturities. I track these rates because I keep 12 months of expenses as a cash cushion and also invest in longer-term CDs (often at lesser-known credit unions) when they yield more than bonds. Check out my

Investment research firm Morningstar has released their annual 529 College Savings Plans

Investment research firm Morningstar has released their annual 529 College Savings Plans

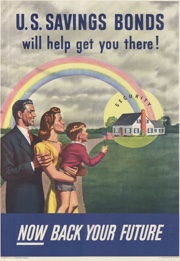

Savings I Bonds are a unique, low-risk investment backed by the US Treasury that pay out a variable interest rate linked to inflation. With a holding period from 12 months to 30 years, you could own them as an alternative to bank certificates of deposit (they are liquid after 12 months) or bonds in your portfolio.

Savings I Bonds are a unique, low-risk investment backed by the US Treasury that pay out a variable interest rate linked to inflation. With a holding period from 12 months to 30 years, you could own them as an alternative to bank certificates of deposit (they are liquid after 12 months) or bonds in your portfolio.  If you can’t tell by now, I enjoy participating in various

If you can’t tell by now, I enjoy participating in various

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)