Have you been unsuccessfully searching Netflix for a 72-minute documentary about index funds? Well, your wait is finally over. Game of Thrones, watch your back! 🙂

Have you been unsuccessfully searching Netflix for a 72-minute documentary about index funds? Well, your wait is finally over. Game of Thrones, watch your back! 🙂

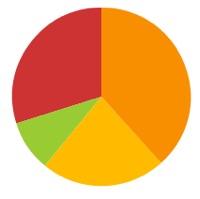

Also adapted from a book of the same title, Index Funds: The 12-Step Recovery Program for Active Investors systematically attacks the various reasons that people approach individual stock-picking and/or paying for actively-managed mutual funds. For example, there is the idea of picking an all-star manager, the idea of market timing, and the idea of picking individual stocks.

I would warn that content is targeted more towards investors with some experience and less towards novices. They apparently also recognized that the material can be rather dense, and thus also broke it up into 12 parts. Here is Part 1:

Both the book and film were created by Mark Hebner of Index Fund Advisors (IFA), a fee-only wealth management firm that offers mutual funds from Dimensional Fund Advisors (DFA). Found via co-producer Robin Powell. As the book promotes the purchase of DFA funds, which can only be bought through affiliated advisors such as IFA, the material can be seen as self-promotional. However, having read the original book 10 years ago, I did not feel that the content was overly self-promotional. If you focus on the academic research by Nobel Laureates and historical data presented, there is a lot of useful knowledge to be gained.

If you’re interested in more detail, you can buy a physical copy for $8 at Amazon, a Kindle eBook version for $3, or you can navigate through all the content online at IFA.com for free.

Here are some helpful resources on owning only bonds of the highest credit quality as part of your portfolio asset allocation.

Here are some helpful resources on owning only bonds of the highest credit quality as part of your portfolio asset allocation.

This is becoming a recurring theme around here, but I came across an interesting tidbit in this

This is becoming a recurring theme around here, but I came across an interesting tidbit in this

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)