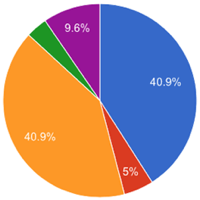

Have an individual stock idea brewing the in the back of your mind? Perhaps the recent LendingClub drama has you itching to buy a few shares of LC at under $5 a share? Above is an interesting chart that shows the distribution of total returns for individual stocks when compared to the S&P 500 index (1989-2015). It was created by Longboard Asset Management, found via Abnormal Returns.

We analyzed 14,455 active stocks between 1989 and 2015, identifying the best performing stocks on both an annualized return and total return basis. Looking at total returns of individual stocks, 1,120 stocks (7.7% of all active stocks) outperformed the S&P 500 Index by at least 500% during their lifetimes. Likewise, 976 stocks (6.8% of all active stocks) lagged the S&P 500 by at least 500%. The remaining 12,404 stocks performed above, at or below the same level as the S&P 500.

I felt that this chart shows you the psychological risks of investing in individual stocks. I’ve been dipping my toes back into individual stock investing with a very small portion of my portfolio. My general idea is to invest in some high-quality, dividend-earning stocks and thus being able to earn those dividends without paying the expense ratio of an ETF. I’d also avoid some tax-efficiency issues if I am able to hold them for very long periods as opposed to a dividend ETF that keeps changing the components of their underlying index. Here’s one of my inspirations. In other words: Buy good stocks, hold them forever.

But as the chart above shows, some of your picks will do great, and some will do horribly. Some people will tell you about their “ten-baggers” and neglect to mention the losers, while the final math will show you lagging the index. As active investors, Longboard concludes that you should focus on avoiding the underperforming assets. But I’d be wary of being so careful about avoiding losers that they miss out on the winners. (The winners often look like losers at some point… can you say Apple?)

Even if you just plan on make a few trades here and here, individual stock investing is a mental sport that takes self-discipline and a calm rationality. Very few people have the characteristics needed, even when managing their own money with no management fee drag. Charlie Munger has his own take, but also admits that only a small percentage can add value:

I think a select few – a small percentage of the investment managers – can deliver value added. But I don’t think brilliance alone is enough to do it. I think that you have to have a little of this discipline of calling your shots and loading up – if you want to maximize your chances of becoming one who provides above average real returns for clients over the long pull.

[…] I think it’s hard to provide a lot of value added to the investment management client, but it’s not impossible.

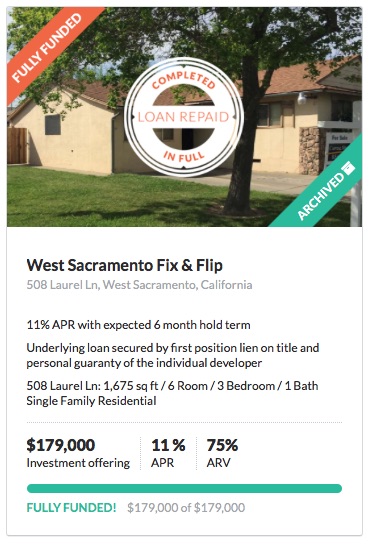

My first investment into real estate crowdfunding has completed. In April 2015, I invested $5,000 into a fix-and-flip loan at the site

My first investment into real estate crowdfunding has completed. In April 2015, I invested $5,000 into a fix-and-flip loan at the site

I like the idea of living off dividend and interest income. Who doesn’t? The problem is that you can’t just buy stocks with the absolute highest dividend yields and junk bonds with the highest interest rates without giving up something in return. There are many bad investments lurking out there for desperate retirees looking only at income. My goal is to generate reliable portfolio income by not reaching too far for yield.

I like the idea of living off dividend and interest income. Who doesn’t? The problem is that you can’t just buy stocks with the absolute highest dividend yields and junk bonds with the highest interest rates without giving up something in return. There are many bad investments lurking out there for desperate retirees looking only at income. My goal is to generate reliable portfolio income by not reaching too far for yield. It has been a while, so here is a 2016 First Quarter update on my investment portfolio holdings. This includes tax-deferred accounts like 401ks, IRAs, and taxable brokerage holdings, but excludes things like our primary home and cash reserves (emergency fund). The purpose of this portfolio is to create enough income to cover household expenses.

It has been a while, so here is a 2016 First Quarter update on my investment portfolio holdings. This includes tax-deferred accounts like 401ks, IRAs, and taxable brokerage holdings, but excludes things like our primary home and cash reserves (emergency fund). The purpose of this portfolio is to create enough income to cover household expenses.

If you’re a basketball fan, you may have read this

If you’re a basketball fan, you may have read this

Morningstar is holding a free online event this Saturday, April 2nd called the

Morningstar is holding a free online event this Saturday, April 2nd called the  The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)