It was very telling that the first chapter of Richer, Wiser, Happier: How the World’s Greatest Investors Win in Markets and Life by William Green was a profile of Mohnish Pabrai. In other words, not Warren Buffett! If you aren’t a student of value investing, then you probably have never even heard of him before. He is best known for a being a “clone” investor.

“I’m a shameless copycat,” he says. “Everything in my life is cloned.… I have no original ideas.” Consciously, systematically, and with irrepressible delight, he has mined the minds of Buffett, Munger, and others not only for investment wisdom but for insights on how to manage his business, avoid mistakes, build his brand, give away money, approach relationships, structure his time, and construct a happy life.

That descriptor always seemed a bit derogatory, but after reading more about Pabrai in this book, I grew quite a lot of appreciation and respect for his approach. If you also like collecting outside wisdom (especially about investing) and incorporating into your life, you will likely enjoy this book as well. Green is an excellent writer and journalist that has managed to interview over 40 of the world’s greatest investors (many of which I’d never heard of until now), and this became the most heavily-highlighted book in my Kindle. Here are a fraction of them:

Mohnish Pabrai

Rule 1: Clone like crazy. Rule 2: Hang out with people who are better than you. Rule 3: Treat life as a game, not as a survival contest or a battle to the death. Rule 4: Be in alignment with who you are; don’t do what you don’t want to do or what’s not right for you. Rule 5: Live by an inner scorecard; don’t worry about what others think of you; don’t be defined by external validation.

Cloning Buffett, who once showed him the blank pages of his little black diary, Pabrai keeps his calendar virtually empty so he can spend most of his time reading and studying companies. On a typical day at the office, he schedules a grand total of zero meetings and zero phone calls. One of his favorite quotes is from the philosopher Blaise Pascal: “All of humanity’s problems stem from man’s inability to sit quietly in a room alone.” […] He says it helps that his investment staff consists of a single person: him. “The moment you have people on your team, they’re going to want to act and do things, and then you’re hosed.”

John Templeton

To his credit, Templeton was especially demanding of himself. Take his attitude toward saving and spending. “After my education, I had absolutely no money and neither did my bride,” he told me. “So we deliberately saved fifty cents out of every dollar we earned.”

Distrustful of debt, he always paid cash for his cars and homes. He also claimed that his wartime bet was the only time he ever borrowed money to invest. During the Great Depression he’d seen how easy it was for overextended people to come undone, and he regarded fiscal discipline as a moral virtue.

Howard Marks

“Look, luck is not enough,” he says. “But equally, intelligence is not enough, hard work is not enough, and even perseverance is not necessarily enough. You need some combination of all four.

He plans to work indefinitely because he finds it intellectually rewarding, not because he has an “unquenchable” thirst for money or status. He recalls his Japanese studies professor explaining a Buddhist teaching that “you have to break the chain of getting and wanting”—an aimless cycle of craving that leads inevitably to suffering.

Irving Kahn

Kahn became Graham’s teaching assistant at Columbia in the 1920s, and they remained friends for decades. I wanted to know what he’d learned from Graham that had helped him to prosper during his eighty-six years in the financial markets. Kahn’s answer: “Investing is about preserving more than anything. That must be your first thought, not looking for large gains. If you achieve only reasonable returns and suffer minimal losses, you will become a wealthy man and will surpass any gambler friends you may have. This is also a good way to cure your sleeping problems.”

Just think for a moment about those basic ingredients that helped to make for a richly rewarding life. Family, health, challenging and useful work, which involved serving his clients well by compounding their savings conservatively over decades. And learning—particularly from Graham, an investment prophet who, Kahn said, “taught me how to study companies and succeed through research as opposed to luck or happenstance.”

Joel Greenblatt

This raises an obvious but crucial question: Do you know how to value a business? There’s nothing admirable or shameful about your response. But you and I need to answer this question honestly, since self-delusion is a costly habit in extreme sports such as skydiving and stock picking. “It’s a very small fraction of people that can value businesses—and if you can’t do that, I don’t think you should be investing on your own,” says Greenblatt. “How can you invest intelligently if you can’t figure out what something is worth?”

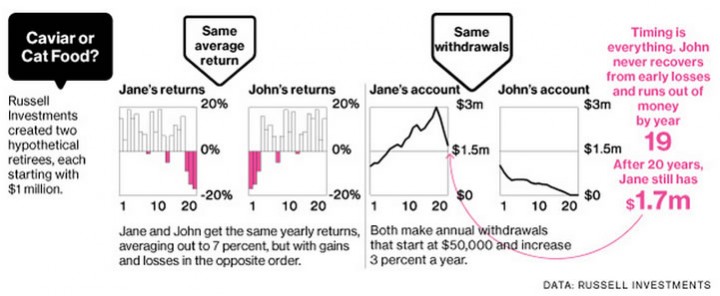

These experiences have led him to an important revelation: “For most individuals, the best strategy is not the one that’s going to get you the highest return.” Rather, the ideal is “a good strategy that you can stick with” even “in bad times.”

Charlie Munger

Munger often preaches about the importance of avoiding behavior with marginal upside and devastating downside. He once observed, “Three things ruin people: drugs, liquor, and leverage.”

Asked for career advice, he opines: “You have to play in a game where you’ve got some unusual talents. If you’re five foot one, you don’t want to play basketball against some guy who’s eight foot three. It’s just too hard. So you’ve got to figure out a game where you have an advantage, and it has to be something that you’re deeply interested in.”

Survivorship bias! I would say that one of the dangers of this book is that it may make you want to be a stock picker. All of the people profiled are probably have a net worth of over $50 million if not much more. Many made a few bold bets, and they paid off big. I want an oceanfront house in Newport Beach, my own private jet, and a vintage car to drive across Asia too!

The rewards for investing intelligently are so extravagant that the business attracts many brilliant minds.

Beating the market means being different. Can you make “unconventional bets that the crowd would consider foolish”? Are you a good fit for the “bizarrely lucrative discipline of sitting alone in a room and occasionally buying a mispriced stock”? Do you have enough humility to make a good judgment, mixed with the self-confidence to bet big when you think you have an edge?

Even if you think you do, survivorship bias reminds us that there are many, many highly-intelligent, hard-working people who tried their best to apply these concepts, but did not succeed. They are missing from the pages of this book, and you’ll never read their stories.

The true goal is independence. The good news is that you don’t need be a great stock picker. Even if you just invest in low-cost index funds and can stick with it, you can do quite well and still achieve the ability to be independent and become in control of your time on Earth.

Buffett said, “If you’re even a slightly above average investor who spends less than you earn, over a lifetime you cannot help but get very wealthy.”

Howard Marks: “Most people should index most of their money.”

The pattern is clear. In their own ways, Greenblatt, Buffett, Bogle, Danoff, and Miller have all been seekers of simplicity. The rest of us should follow suit. We each need a simple and consistent investment strategy that works well over time—one that we understand and believe in strongly enough that we’ll adhere to it faithfully through good times and bad.

“You build capital and then you can do whatever you want because you’re independent.” For many of the most successful investors I’ve interviewed, that freedom to construct a life that aligns authentically with their passions and peculiarities may be the single greatest luxury that money can buy.

p.s. Here is a list of the people profiled in this book; I can’t guarantee I got all of them but it’s definitely close. A good source for additional research.

- Sir John Templeton

- Irving Kahn

- Bill Ruane

- Marty Whitman

- Jack Bogle

- Charlie Munger

- Ed Thorp

- Howard Marks

- Joel Greenblatt

- Bill Miller

- Mohnish Pabrai

- Tom Gayner

- Guy Spier

- Fred Martin

- Ken Shubin Stein

- Matthew McLennan

- Jeffrey Gundlach

- Francis Chou

- Thyra Zerhusen

- Thomas Russo

- Chuck Akre

- Li Lu

- Peter Lynch

- Pat Dorsey

- Michael Price

- Mason Hawkins

- Bill Ackman

- Jeff Vinik

- Mario Gabelli

- Laura Geritz

- Brian McMahon

- Henry Ellenbogen

- Donald Yacktman

- Bill Nygren

- Paul Lountzis

- Jason Karp

- Will Danoff

- François Rochon

- John Spears

- Joel Tillinghast

- Qais Zakaria

- Nick Sleep

- Paul Isaac

- Mike Zapata

- Paul Yablon

- Whitney Tilson

- François-Marie Wojcik

- Sarah Ketterer

- Christopher Davis

- Raamdeo Agrawal

- Arnold Van Den Berg

- Mariko Gordon

- Jean-Marie Eveillard

- Guy Spier

Here’s my monthly roundup of the best interest rates on cash as of July 2021, roughly sorted from shortest to longest maturities. You will find lesser-known opportunities to earn 3% APY and higher while still keeping your principal FDIC-insured or equivalent. Check out my

Here’s my monthly roundup of the best interest rates on cash as of July 2021, roughly sorted from shortest to longest maturities. You will find lesser-known opportunities to earn 3% APY and higher while still keeping your principal FDIC-insured or equivalent. Check out my

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)