When talking about constructing an investment portfolio, you’ll often hear about diversification and buying low-correlation or non-correlated assets.

When talking about constructing an investment portfolio, you’ll often hear about diversification and buying low-correlation or non-correlated assets.

- A positive correlation means that the assets tended to move in the same direction. A value of 1 is perfect positive correlation.

- A negative correlation means that they tended to move in opposite directions. A value of -1 is perfect negative correlation.

- A zero correlation means that they had no relationship.

Morningstar recently released its 2021 Diversification Landscape Report (free download with e-mail) which includes a lot of great information about the correlations between key asset classes from 2001-2020, including the March 2020 COVID-related market crash. I try not to look too finely at historical numbers, but noticing the overall historical trends can be helpful.

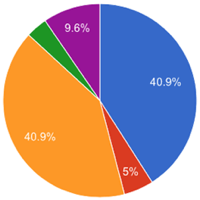

The lower the correlation between asset classes (the less they move in the same direction), the greater the reduction in volatility you get by combining assets. As long as you combine asset classes with correlations below 1, you get some degree of volatility reduction. This M* chart from the paper helps you visualize this:

This handy M* table shows how the 5-year correlations between the total US stock market and other major asset classes have changed over the four separate periods of 2001-2005, 2006-2010, 2011-2015, and 2016-2020:

Some quick takeaways:

- The best portfolio diversifiers for US stocks has consistently been US Treasury bonds. Short-term, medium-term, long-term Treasuries all have consistently negative correlations to US stocks. (There is some problem with the shading in the chart that doesn’t quite match the numbers.)

- International developed country stocks, Emerging Markets stocks, and US REITs have high correlations with US stocks (which is somewhat expected), but the correlation is still below 1 (roughly 0.80 or so) such that it still offers a little diversification benefit over time.

- High-yield “junk” bonds are highly-correlated with US stocks. They are just as highly-correlated as international and emerging market stocks, so watch out if you are chasing higher yield with riskier bonds.

- Gold has been a pretty good and consistent diversifier as well, but only on par with cash (T-bills) not as good as US Treasuries. You just need to believe that the long-term return of gold is high enough to warrant inclusion. These days, gold actually looks better to me than in the past because I figure it will match inflation, and that’s actually better than most cash and bonds right now. Also see: Gold as a Hedge Against Bonds During Low Interest Rates

As an extension of

As an extension of

The WSJ article

The WSJ article

Here’s my monthly roundup of the best interest rates on cash as of April 2021, roughly sorted from shortest to longest maturities. There are many lesser-known opportunities to improve your yield while keeping your principal “safe” (FDIC-insured or equivalent). Check out my

Here’s my monthly roundup of the best interest rates on cash as of April 2021, roughly sorted from shortest to longest maturities. There are many lesser-known opportunities to improve your yield while keeping your principal “safe” (FDIC-insured or equivalent). Check out my  This

This  Although I’m still decades away from Social Security, I see a constant stream of articles about the “best” time to start taking benefits. Often, you are told to delay claiming until age 70, as you will receive a more valuable, inflation-adjusted, government-guaranteed payout for the rest of your life. But if you have a spouse, it may be better for one of them to claim as early as possible, at age 62. There are many calculators out there – here is one

Although I’m still decades away from Social Security, I see a constant stream of articles about the “best” time to start taking benefits. Often, you are told to delay claiming until age 70, as you will receive a more valuable, inflation-adjusted, government-guaranteed payout for the rest of your life. But if you have a spouse, it may be better for one of them to claim as early as possible, at age 62. There are many calculators out there – here is one

Perhaps it is because I somehow ended up buying $5,000 in gold coins a couple weeks ago, but I’ve been doing some reading about gold again. The stock market is at higher and higher valuations, while the Fed promises that interest rates will stay low for a long time. The real yield on TIPS remains negative, meaning that it is highly unlikely that any high-quality investment-grade bonds will beat inflation over the next decade. Is there really no alternative?

Perhaps it is because I somehow ended up buying $5,000 in gold coins a couple weeks ago, but I’ve been doing some reading about gold again. The stock market is at higher and higher valuations, while the Fed promises that interest rates will stay low for a long time. The real yield on TIPS remains negative, meaning that it is highly unlikely that any high-quality investment-grade bonds will beat inflation over the next decade. Is there really no alternative?

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)