When creating financial statements, there are “generally accepted accounting principles” (GAAP) so that all companies follow the same standardized set of rules. After reading 100+ books on personal finance, you could also create what I would call “generally accepted personal finance principles” (GAPFP?), as organized into a flowchart below by u/atlasvoid in the r/personalfinance subreddit. Hat tip to the NYT article So You Saved a Little Money This Past Year. Now What?. (Click to see full version. Might be hard to read on mobile.)

When creating financial statements, there are “generally accepted accounting principles” (GAAP) so that all companies follow the same standardized set of rules. After reading 100+ books on personal finance, you could also create what I would call “generally accepted personal finance principles” (GAPFP?), as organized into a flowchart below by u/atlasvoid in the r/personalfinance subreddit. Hat tip to the NYT article So You Saved a Little Money This Past Year. Now What?. (Click to see full version. Might be hard to read on mobile.)

There are also additional versions for Canada, Australia, European Union, Ireland, New Zealand, and the United Kingdom.

I view this as the next step up in detail from personal advice on a 3×5 index card, while still trying to maximize the amount useful information in the given space. You might have some minor quibbles with the ordering or want to add some exceptions, but it still provides a good place to start additional research.

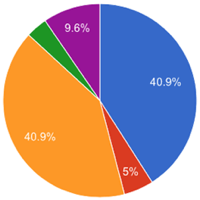

When talking about constructing an investment portfolio, you’ll often hear about diversification and buying low-correlation or non-correlated assets.

When talking about constructing an investment portfolio, you’ll often hear about diversification and buying low-correlation or non-correlated assets.

Here’s my monthly roundup of the best interest rates on cash as of February 2021, roughly sorted from shortest to longest maturities. I track these rates because I keep 12 months of expenses as a cash cushion and there are many lesser-known opportunities to improve your yield while still being FDIC-insured or equivalent. Check out my

Here’s my monthly roundup of the best interest rates on cash as of February 2021, roughly sorted from shortest to longest maturities. I track these rates because I keep 12 months of expenses as a cash cushion and there are many lesser-known opportunities to improve your yield while still being FDIC-insured or equivalent. Check out my

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)