Here’s another Charles T. Munger interview (last one for a while, I promise!) for those of you that share a peculiar fondness for hearing someone encourage rationality, patience, and self-discipline. After the Daily Journal 2019 annual meeting, Munger did a 30-minute interview with Becky Quick of CNBC. (See similar Buffett CNBC interview.) I guess they forgave Munger’s jabs at Jim Cramer, as they posted the entire interview online along with a full transcript.

I’m going to be honest, I didn’t get as many gems out of this interview as some of his other stuff. Here was my favorite part.

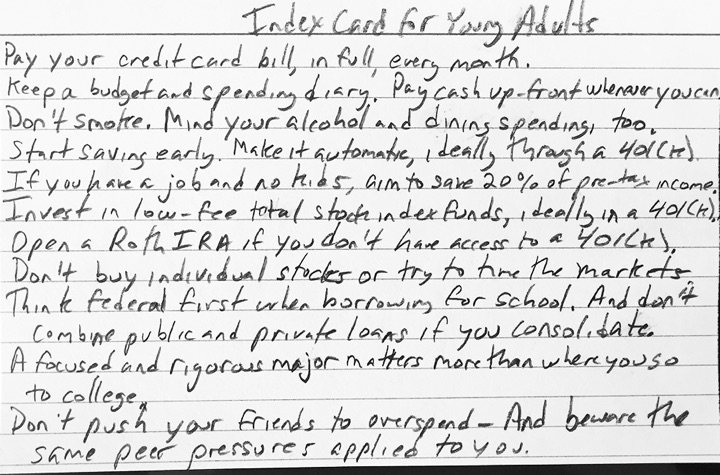

The secrets to life can also fit on an index card? As Munger noted earlier, “If it’s trite, it’s right”. We’ve seen personal finance advice fit on an index card, so why not life advice as well?

BECKY QUICK: Charlie, so many of the people who come here come because they’re looking for advice not on business or investments as much as they’re looking for just advice on life. There were a lot of questions today, people trying to figure out what the secret to life is, to a long and happy life. And– and I just wonder, if you were–

CHARLIE MUNGER: Now that is easy, because it’s so simple.

BECKY QUICK: What is it?

CHARLIE MUNGER: You don’t have a lot of envy, you don’t have a lot of resentment, you don’t overspend your income, you stay cheerful in spite of your troubles. You deal with reliable people and you do what you’re supposed to do. And all these simple rules work so well to make your life better. And they’re so trite.

BECKY QUICK: How old were you when you figured this out?

CHARLIE MUNGER: About seven. I could tell that some of my older people were a little bonkers. I’ve always been able to recognize that other people were a little bonkers. And it helped me because there’s so much irrationality in the world. And I’ve been thinking about it for a long time, its causes and its preventions, and so forth, that I– sure it’s helped me.

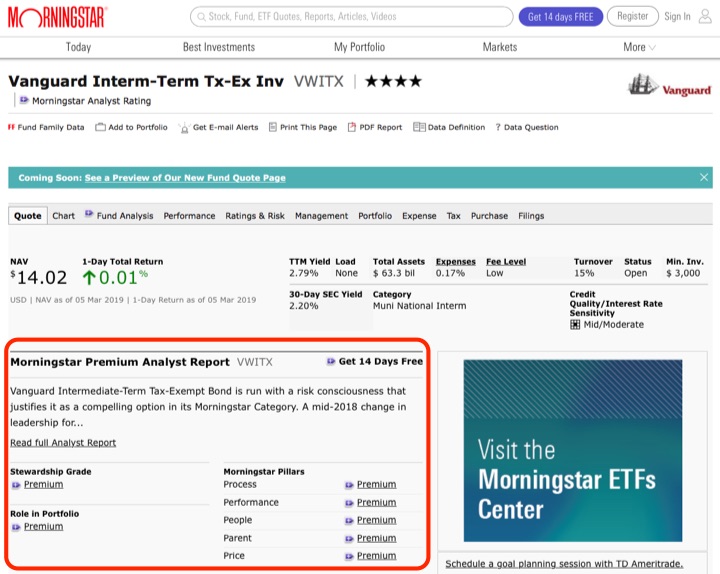

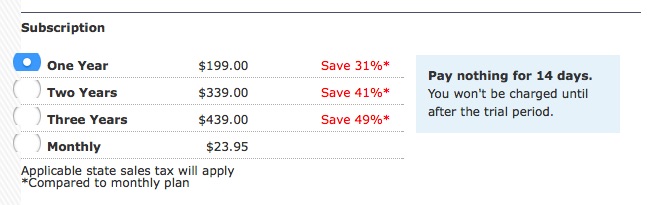

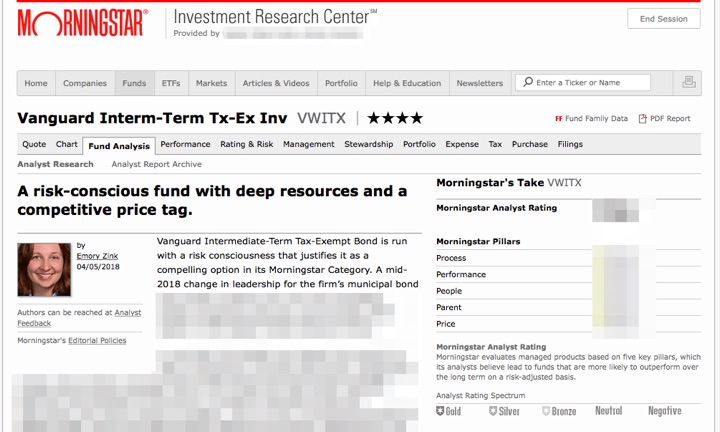

Updated 2019. Let’s say you are a DIY investor and doing some research on some mutual funds. You decide to learn more about the Vanguard Intermediate-Term Tax-Exempt Fund. You pull up the Morningstar quote pages (ticker

Updated 2019. Let’s say you are a DIY investor and doing some research on some mutual funds. You decide to learn more about the Vanguard Intermediate-Term Tax-Exempt Fund. You pull up the Morningstar quote pages (ticker

Here’s my monthly roundup of the best interest rates on cash for March 2019, roughly sorted from shortest to longest maturities. Check out my

Here’s my monthly roundup of the best interest rates on cash for March 2019, roughly sorted from shortest to longest maturities. Check out my  T. Rowe Price has an article

T. Rowe Price has an article

Berkshire Hathaway (BRK) has released its

Berkshire Hathaway (BRK) has released its

Individual Retirement Arrangements (IRAs) are way to save money towards retirement that also saves on taxes. For 2019, the annual contribution limit for either Traditional or Roth IRAs increased to $6,000 (it is roughly indexed to inflation). The additional catch-up contribution allowed for those age 50+ stays at $1,000 (for a total of $7,000). You can’t contribute more than your taxable compensation for the year, although a spouse can contribute with no income if the other person has enough income.

Individual Retirement Arrangements (IRAs) are way to save money towards retirement that also saves on taxes. For 2019, the annual contribution limit for either Traditional or Roth IRAs increased to $6,000 (it is roughly indexed to inflation). The additional catch-up contribution allowed for those age 50+ stays at $1,000 (for a total of $7,000). You can’t contribute more than your taxable compensation for the year, although a spouse can contribute with no income if the other person has enough income.

Employer-based retirement plans like the 401(k), 403(b), and Thrift Savings Plan are not perfect, but they are often the best available option to save money in a tax-advantaged manner. For 2019, the employee elective deferral (contribution) limit for these plans increased to $19,000 (it is indexed to inflation). The additional catch-up contribution allowed for those age 50+ stays at $6,000 (for a total of $25,000).

Employer-based retirement plans like the 401(k), 403(b), and Thrift Savings Plan are not perfect, but they are often the best available option to save money in a tax-advantaged manner. For 2019, the employee elective deferral (contribution) limit for these plans increased to $19,000 (it is indexed to inflation). The additional catch-up contribution allowed for those age 50+ stays at $6,000 (for a total of $25,000).

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)