The wealth management group Del Monte published a whitepaper on Solo 401k plans, calling it the “financial industry’s best kept secret” and a “powerful and underutilized” retirement plan for self-employed business owners. The 4-page PDF does a good job at summarizing the benefits of a Solo 401k, aka Self-Employed 401k. Perhaps most importantly, the Solo 401k allows the maximum annual tax-sheltered contribution (or ties for the max) for all income levels and ages.

The wealth management group Del Monte published a whitepaper on Solo 401k plans, calling it the “financial industry’s best kept secret” and a “powerful and underutilized” retirement plan for self-employed business owners. The 4-page PDF does a good job at summarizing the benefits of a Solo 401k, aka Self-Employed 401k. Perhaps most importantly, the Solo 401k allows the maximum annual tax-sheltered contribution (or ties for the max) for all income levels and ages.

Here’a a quick benefit comparison against the SEP-IRA and SIMPLE IRA:

The key difference is the Solo 401k allows an $18,000 salary deferral at any income (i.e. if you make $18k or under, you can put aside all of it) for 2017 and then adds on a profit-sharing component. In addition, Solo 401ks a larger additional “catch-up” contributions at age 50.

I’ve had a Self-Employed 401k through Fidelity for several years, and I have been quite happy with it. The paperwork has been minimal, although you must start filing IRS Form 5500-EZ once your asset exceed $250,000 or face significant penalties. (It’s one page long.) It has been quite flexible – I am able to purchase mutual funds, ETFs, individual stocks, CDs, and individual Treasury and TIPS bonds. There is no annual fee and I’ve only had to pay trade commissions. Fidelity also accepts rollovers from outside IRAs and 401k plans.

Vanguard, Schwab, and TD Ameritrade also offer cheap in-house Solo 401k plans that work well for low-cost DIY investors. There are now several independent providers with “custom” 401k plans which can offer features like 401k loans the ability to invest in alternative asset classes (precious metals, tax liens, real estate, private equity, etc.) at additional cost. Vanguard and TD Ameritrade offer a Roth option; Fidelity and Schwab are only available with “traditional” pre-tax contributions.

Another option to consider is the Solo Defined-Benefit Plan, or “Solo Pension”. The annual maintenance fees are higher and the IRA requirements are significantly more complex, but you can make much larger amounts of tax-deferred contributions (dependent on age and income). The most affordable option appears to be the Schwab Defined-Benefit Plan. If anyone has any experience with this plan, I’d like to hear about it and would be open to a guest post.

One of the early books that impacted my investing philosophy was

One of the early books that impacted my investing philosophy was

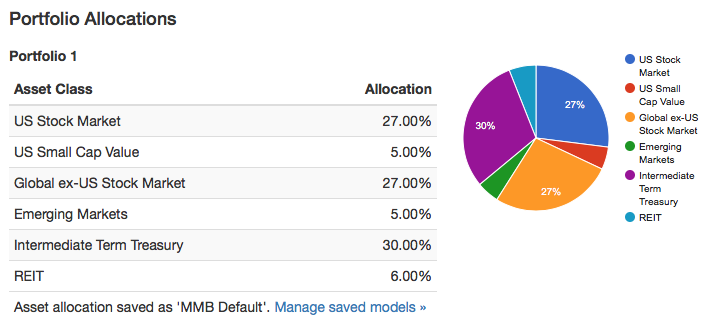

Here’s another neat (and free!) portfolio analysis tool –

Here’s another neat (and free!) portfolio analysis tool –

If you haven’t gotten a dose of Jack Bogle wisdom recently, check out this

If you haven’t gotten a dose of Jack Bogle wisdom recently, check out this

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)