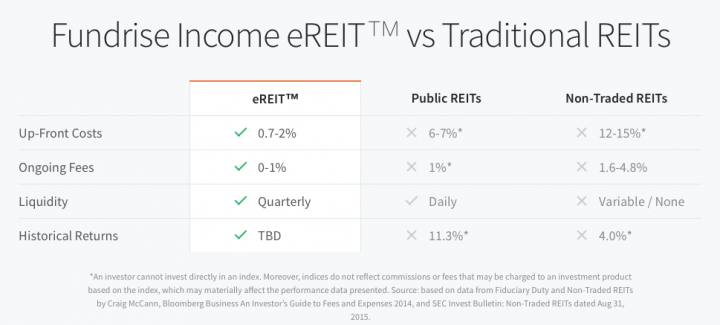

I’ve been putting some side money into crowdfunded real-estate investments – see here and here – and I have decided to test out the quarterly liquidity window of my Fundrise eREIT investment (review). An important difference between most of these private real estate investments and publicly-listed REIT is liquidity. On most any given weekday, I can sell my public REIT (i.e. VNQ) for a price that an open market deems fair and within few days I will have cash in hand.

The Fundrise Income eREITs are private REITs that take advantage of new crowdfunding regulations open to all investors (not just accredited investors). The intended time horizon of this investment at least 5 years, but they also advertise “quarterly liquidity” as a feature (see below). I was interested to see how this feature worked, as many of the other asset-backed loans in which I am invested could take a year or longer to get my money back. I decided to test out this “emergency hatch”.

The rules. You are allowed to make a redemption request once per quarter. For the full details on Fundrise quarterly redemption plans, please see the section of each eREIT Offering Circular titled, “Description of Our Common Shares—Quarterly Redemption Plan” at this link. It’s pretty dense, and I will only highlight this table which includes the “early withdrawal penalty” imposed if you redeem your shares within 5 years.

In other words, if I redeem now after one year, I will pay a 3% penalty on the current net asset value (NAV). The NAV itself is a complex calculation of the underlying assets that I believe is only updated to investors once a quarter.

Note that you are not guaranteed to have liquidity of all your shares. If too many shareholders request liquidity at the same time, that might force them to sell assets at large discounts and harm other shareholders. Here is an excerpt from the Offering Circular:

Q: Will there be any limits on my ability to redeem my shares?

A: Yes. While we designed our redemption plan to allow shareholders to request redemptions on a quarterly basis, we need to impose limitations on the total amount of net redemptions per calendar quarter in order to maintain sufficient sources of liquidity to satisfy redemption requests without impacting our ability to invest in commercial real estate assets and maximize investor returns.

In the event our Manager determines, in its sole discretion, that we do not have sufficient funds available to redeem all of the common shares for which redemption requests have been submitted in any given month or calendar quarter, as applicable, such pending requests will be honored on a pro rata basis. […]

Redemption Process. The process of requesting a quarterly redemption was straightforward. Here’s a step-by-step rundown:

- Contact Fundrise support and request a redemption (3/6 in my case). You need to make this request at least 15 days prior to the end of the applicable quarter.

- They asked the reason for my redemption, and I told them. You don’t need to supply a reason, they just wanted feedback.

- They sent over the official redemption form, which I was able to read and complete online. I received an e-mail confirmation of my redemption request.

- At the end of the quarter (3/31 in my case), I received another e-mail confirmation that my redemption request was processed.

- 12 days after the end of the quarter (4/12 in my case), I received another e-mail confirmation that the funds were being transferred to my bank account.

Complete Investment Timeline. Here’s a summary of cashflows from beginning to end.

- December 29, 2015. Invested $2,000 into Fundrise Income eREIT (200 shares x $10 a share).

- Held for 15 months. Received 5 quarterly income distributions on a timely basis in April, July, October 2016 and January, April 2017. Total of $234.79.

- Early March 2017. Requested redemption of all 200 shares as of the end of quarter 3/31/17.

- April 12, 2017. Received $1,908 in principal back. 100% of NAV would have been $1967.

Screenshot:

So I invested $2,000 and after 471 days I collected a total of $2,142.79 for a total gain of 7.14%. The annualized return works out to 5.49%. That’s not amazing but not bad considering that I am bailing out of a 5+ year investment after only a year. I’m confident that my returns would have been better if I waited out the full 5 years as real estate ownership investments take time to work out. (Traditional non-traded REITs are infamous for having huge penalties for early withdrawals where you get back less than 90 cents on the dollar.)

Hopefully this post answers some questions about the liquidity of Fundrise eREITs. I received my money, as requested, in about a month. If instant/daily liquidity is important to you, I would still stick with publicly-traded REITs.

Bottom line. The Fundrise Income eREITs are meant as long-term investments with time horizons of at least 5 years. However, they advertise the availability of limited quarterly liquidity. I tested out this liquidity feature and was able to cash out subject to a 3% discount from net asset value. It worked as promised, howewer I would not recommend using this option unless necessary as it will impair your overall return. Fundrise does warn you that in an extreme event with depressed prices, this liquidity window may be closed for the benefit of long-term investors. You can sign-up and learn about currently-available Fundrise eREITs here.

We’ve all been told that past performance is no guarantee of future returns, but it’s still hard to buy an investment that has been performing poorly. We need to remember the historical power of diversification and that even though something may look horrible now, good news may be just around the corner.

We’ve all been told that past performance is no guarantee of future returns, but it’s still hard to buy an investment that has been performing poorly. We need to remember the historical power of diversification and that even though something may look horrible now, good news may be just around the corner.

Updated. Automated portfolio management services like

Updated. Automated portfolio management services like

As we stand today in early 2017, the performance of the US stock market since 2009 has been pretty impressive with only a few minor hiccups. I am not calling a market drop, but the best time to prepare is before an emergency or crisis occurs. Humans have a well-documented

As we stand today in early 2017, the performance of the US stock market since 2009 has been pretty impressive with only a few minor hiccups. I am not calling a market drop, but the best time to prepare is before an emergency or crisis occurs. Humans have a well-documented

Do you recommend

Do you recommend

Fidelity Investments has a few different bonuses if you transfer a certain levels of new assets over to them. These are handy if you want to move money out of an old 401(k) plan or are looking to try out a new broker. Besides a cash deposit, you can also do an in-kind transfer and move over your existing investments without incurring any capital gains. Please note that for some you must register soon by March 31st, 2017. You can register now and still have 60 days to move over assets.

Fidelity Investments has a few different bonuses if you transfer a certain levels of new assets over to them. These are handy if you want to move money out of an old 401(k) plan or are looking to try out a new broker. Besides a cash deposit, you can also do an in-kind transfer and move over your existing investments without incurring any capital gains. Please note that for some you must register soon by March 31st, 2017. You can register now and still have 60 days to move over assets.

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)