A satoshi, or “sat” for short, is the smallest unit of the cryptocurrency bitcoin. “Stacking Sats” is a popular term for gradually accumulating bitcoin by purchasing small amounts of bitcoin at a time. (100 million sats = 1 bitcoin.) The idea is that you should be excited about adding any amount to your stack, focusing on that forward progress instead of the current market price.

If only it would be as trendy for folks to “stack VOO” or “stack VTI”. A low-cost S&P 500 or US Total Market index ETF is a tax-efficient way to build up your ownership of a share of excellent American businesses. Unfortunately, there is always something shinier next to this vanilla product. Factor ETFs, themed ETFs, sector ETFs, and so on. John Rekenthaler of Morningstar has an interesting series of articles comparing the long-term returns of various alternatives to Vanguard index funds. See Vanguard’s Other Index-Fund Invention.

Even way back in 1992, Vanguard started offering “Value” and “Growth” index funds, essentially splitting the US stock market into two halves based on price/book ratios. Essentially, these were the first variation on the plain S&P 500 index fund. You might think one was better than other. (Most academics would have guessed Value would win.) So what happened over the next 20 years? Not very much! (Plus Growth won slightly.)

Of course, I would not be surprised at all to see Value squeak out a slight win over Growth after another 10 or 20 years. One is always going to be winning slightly, but take a step back and you can argue they are effectively tied. Why not just own the S&P 500 index fund and get the average?

(Quick reminder: The Rule of 72 says that 10% annualized means your money will double every 7.2 years. That means $10,000 will have doubled three times in about 21 years. $10k doubled to $20k, then doubled to $40k, then doubled to $80k!)

What if you rebalanced regularly between Value and Growth? If you rebalanced between the two funds every single month, your annual return would have increased by 0.10%. If you rebalanced between the two funds only once every 5 years, your annual return would have increased by 0.28%. But really, who rebalances only once every 5 years? In view, these numbers are still low enough to be in the noise range, and the extra return is not dependable.

What if you bought a low-cost actively-managed fund from Vanguard instead? Due much to Vanguard’s extremely low costs on their active funds, some actively-managed funds did do better, but others did worse. If you chose to buy the funds with the highest trailing returns, or the best Sharpe ratios, or the most popular funds (most assets), all that Ivy League brainpower and decades of investing experience would have still lagged behind a simple index fund portfolio. Only with the power to see the future would you have picked the index-beating funds.

As the saying goes, don’t let the pursuit of perfect be the enemy of the good. As someone sitting on a relatively big pile of VTI after 15+ years of stacking it share by share, I am certainly relieved that I didn’t get too distracted by all of the other shiny objects out there. Instead of remembering your highest portfolio value ever from your monthly statement, remember the number of shares of VTI or VOO that you own. Every $200 saved = 1 share of VTI. But in the end, as long as you get excited about stacking something of high-quality with long-term productive value, you’ll likely end up in a good place.

Inside various financial forums, I am seeing the “anyone else worried?” 😓 posts as most portfolios are down double-digits. For a retiree with a $1 million portfolio, seeing $100,000 or $200,000 of value evaporate is understandably stressful. However, much of this is because you are comparing to your portfolio’s all-time high, or high-water mark, which is a relatively arbitrary number. Just because at one moment in time, there were a few willing buyers of your assets for a given price doesn’t mean you should anchor yourself to that number.

Inside various financial forums, I am seeing the “anyone else worried?” 😓 posts as most portfolios are down double-digits. For a retiree with a $1 million portfolio, seeing $100,000 or $200,000 of value evaporate is understandably stressful. However, much of this is because you are comparing to your portfolio’s all-time high, or high-water mark, which is a relatively arbitrary number. Just because at one moment in time, there were a few willing buyers of your assets for a given price doesn’t mean you should anchor yourself to that number.

Inflation (and thus I Bonds) 🚀🚀🚀! Savings I Bonds are a unique, low-risk investment backed by the US Treasury that pay out a variable interest rate linked to inflation. With a holding period from 12 months to 30 years, you could own them as an alternative to bank certificates of deposit (they are liquid after 12 months) or bonds in your portfolio.

Inflation (and thus I Bonds) 🚀🚀🚀! Savings I Bonds are a unique, low-risk investment backed by the US Treasury that pay out a variable interest rate linked to inflation. With a holding period from 12 months to 30 years, you could own them as an alternative to bank certificates of deposit (they are liquid after 12 months) or bonds in your portfolio.

Here’s my quarterly update on my current investment holdings as of 4/8/22, including our 401k/403b/IRAs and taxable brokerage accounts but excluding a side portfolio of self-directed investments. Following the concept of

Here’s my quarterly update on my current investment holdings as of 4/8/22, including our 401k/403b/IRAs and taxable brokerage accounts but excluding a side portfolio of self-directed investments. Following the concept of

The official IRA contribution deadline for Tax Year 2021 is April 15th, 2022. However, I choose to use April 15th as the informal deadline for my same-year IRA contributions (Tax Year 2022). By around April 1st, I have usually finished filing my income taxes and thus have handled any expected tax bills. I also have the first quarter of dividends arrive in my brokerage accounts, so I also have funds ready to re-invest. The optimal time would actually be make my contributions on January 1st, but sometimes we just have to settle for “good enough”.

The official IRA contribution deadline for Tax Year 2021 is April 15th, 2022. However, I choose to use April 15th as the informal deadline for my same-year IRA contributions (Tax Year 2022). By around April 1st, I have usually finished filing my income taxes and thus have handled any expected tax bills. I also have the first quarter of dividends arrive in my brokerage accounts, so I also have funds ready to re-invest. The optimal time would actually be make my contributions on January 1st, but sometimes we just have to settle for “good enough”.

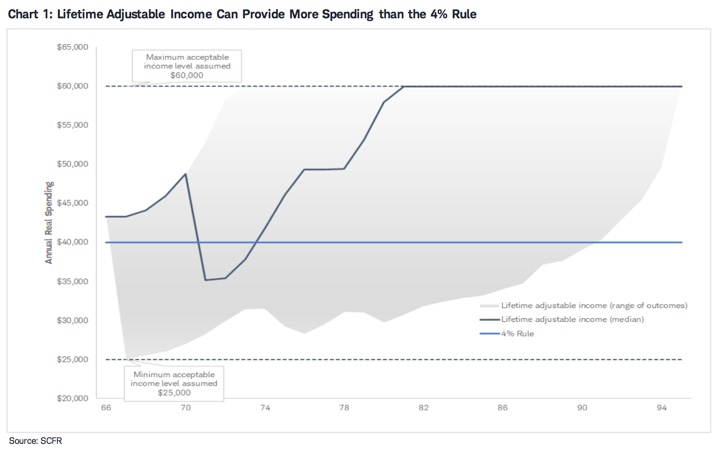

One of the perpetual debates in retirement planning circles is withdrawal rates, AKA how much monthly income can you take from a portfolio. Once you nail down a withdrawal rate and retirement spending target, then you get Your Number – how much you need to have saved to retire (after backing out Social Security and other income streams). It’s common to start with the static 4% rule, but that rule also includes some drawbacks. An alternative is a flexible withdrawal rule that adjusts based on market returns. When your portfolio grows, you can spend a little more. If it shrinks, you cut back a little. Sounds reasonable, right?

One of the perpetual debates in retirement planning circles is withdrawal rates, AKA how much monthly income can you take from a portfolio. Once you nail down a withdrawal rate and retirement spending target, then you get Your Number – how much you need to have saved to retire (after backing out Social Security and other income streams). It’s common to start with the static 4% rule, but that rule also includes some drawbacks. An alternative is a flexible withdrawal rule that adjusts based on market returns. When your portfolio grows, you can spend a little more. If it shrinks, you cut back a little. Sounds reasonable, right?

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)